Get the free In-Kind Gifts: How to Acknowledge and Recognize Them ...In-Kind Gifts: How to Acknow...

Show details

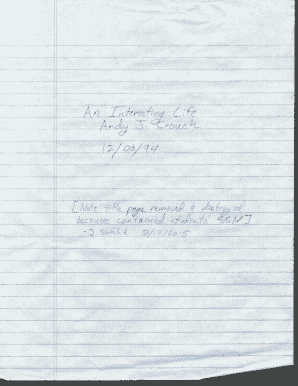

INKING DONATION FORM Thank you for your support! Please provide the following information so that we may process your donation. DONATION INFORMATION SPONSORED WALK LOCATION (CITY, STATE): FAIR MARKET

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-kind gifts how to

Edit your in-kind gifts how to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind gifts how to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in-kind gifts how to online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit in-kind gifts how to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-kind gifts how to

How to fill out in-kind gifts how to

01

To fill out in-kind gifts, follow these steps:

02

Start by gathering all the necessary information and documentation related to the in-kind gift. This includes the description of the gift, its estimated value, and any relevant receipts or proof of ownership.

03

Determine the purpose or use of the in-kind gift. This can help ensure that it is properly allocated and utilized by the intended recipient.

04

Identify the recipient of the in-kind gift. It could be an individual, organization, or specific program.

05

Record the details of the in-kind gift in the appropriate documentation, such as an in-kind gift form or a donation receipt. Make sure to include accurate information about the donor and recipient, description of the gift, and its estimated value.

06

If required, consult with legal or accounting professionals to ensure compliance with any applicable tax regulations or reporting requirements.

07

Submit the completed in-kind gift documentation to the relevant party or organization.

08

Keep a copy of the documentation for your records and for future reference, especially for tax or audit purposes.

Who needs in-kind gifts how to?

01

In-kind gifts can be beneficial for various individuals and organizations, including:

02

- Non-profit organizations, charities, and foundations: In-kind gifts can provide necessary resources, such as food, clothing, or supplies, to support their operations or assist those in need.

03

- Schools, colleges, and educational institutions: In-kind gifts of books, equipment, or educational materials can enhance learning opportunities and benefit students and educators.

04

- Community centers or shelters: In-kind gifts like blankets, toiletries, or kitchen supplies can help support the well-being of individuals facing difficulties or homelessness.

05

- Disaster relief organizations: In-kind gifts of food, water, medical supplies, or temporary shelter can be critical in emergency situations.

06

- Individuals or families in need: In-kind gifts can provide essential items, such as food, clothing, or household goods, to those experiencing financial hardship or personal challenges.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my in-kind gifts how to in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your in-kind gifts how to right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete in-kind gifts how to on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your in-kind gifts how to by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit in-kind gifts how to on an Android device?

The pdfFiller app for Android allows you to edit PDF files like in-kind gifts how to. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is in-kind gifts how to?

In-kind gifts refer to non-cash donations that can be tangible goods, services, or property given to an organization or individual. The process typically involves assessing the value of the items donated and ensuring proper documentation is maintained.

Who is required to file in-kind gifts how to?

Individuals or organizations that receive in-kind gifts and are subject to tax reporting requirements, such as non-profits and charities, are generally required to file information about these donations.

How to fill out in-kind gifts how to?

To fill out in-kind gifts reports, one must identify the nature of the gift, its fair market value, the donor's information, and the purpose of the donation. This information is often recorded on specific forms required by tax authorities.

What is the purpose of in-kind gifts how to?

The purpose of in-kind gifts is to provide valuable resources to organizations in a form other than cash, facilitating support for their missions and activities while potentially maximizing tax benefits for donors.

What information must be reported on in-kind gifts how to?

The information that must be reported includes the description of the gift, the recipient's name, the donor's name, the fair market value of the gift, and the date of the donation.

Fill out your in-kind gifts how to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Kind Gifts How To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.