Get the free Auto loans key termsConsumer Financial Protection Bureau

Show details

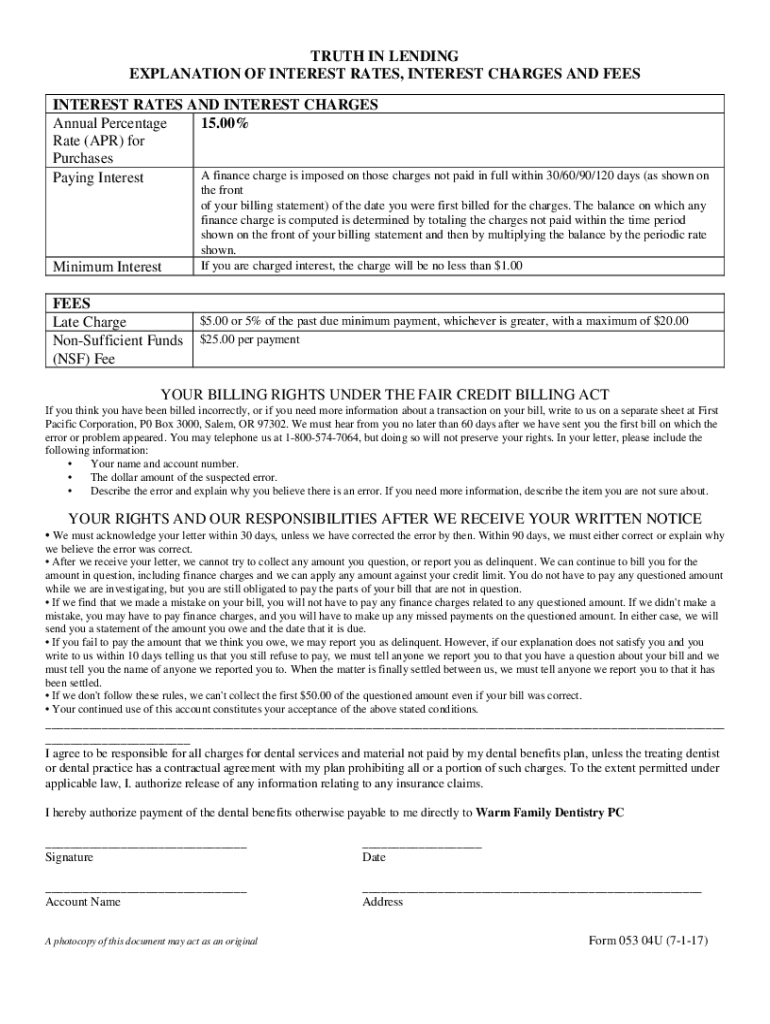

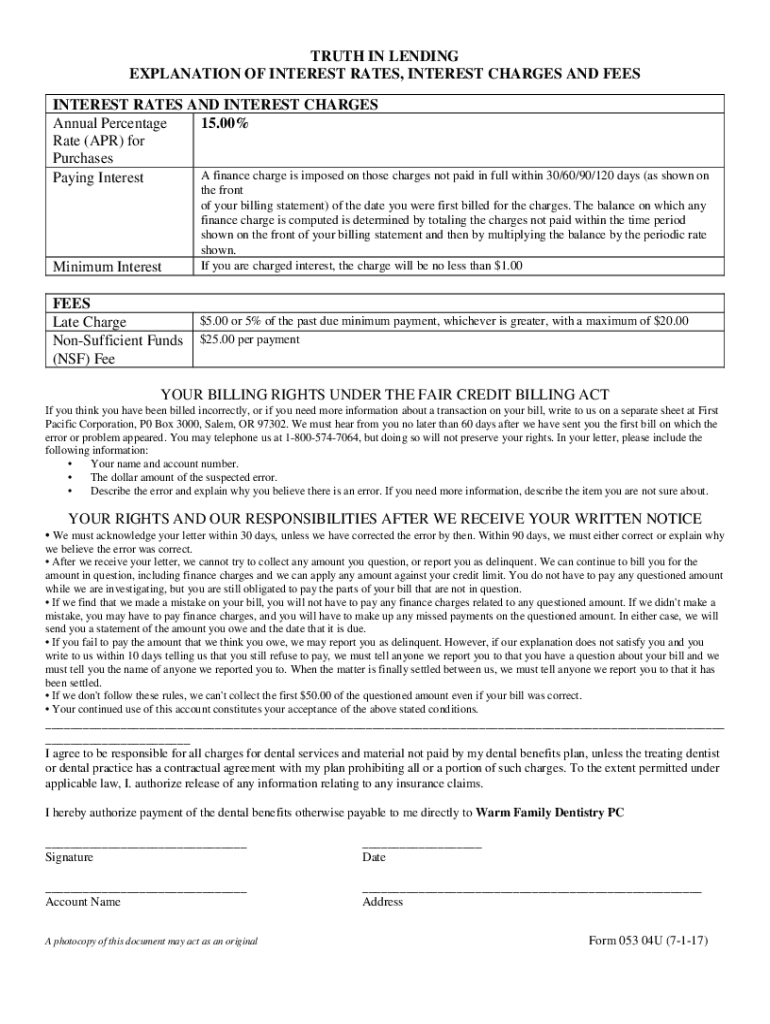

TRUTH IN LENDING

EXPLANATION OF INTEREST RATES, INTEREST CHARGES AND FEES

INTEREST RATES AND INTEREST CHARGES

Annual Percentage

15.00%

Rate (APR) for

Purchases

A finance charge is imposed on those

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auto loans key termsconsumer

Edit your auto loans key termsconsumer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auto loans key termsconsumer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit auto loans key termsconsumer online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit auto loans key termsconsumer. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auto loans key termsconsumer

How to fill out auto loans key termsconsumer

01

Start by gathering all the necessary documents such as proof of income, proof of identity, and proof of address.

02

Research and compare different auto loan options from various lenders to find the best terms and interest rates.

03

Determine the amount of loan you need and calculate the monthly payments you can afford.

04

Fill out the application form provided by the lender and provide accurate information about yourself, your employment, and your financial situation.

05

Review the key terms of the auto loan, including the interest rate, loan duration, and any additional fees or charges.

06

Make sure to carefully read and understand all the terms and conditions before signing the auto loan agreement.

07

Submit the completed application along with the required documents to the lender for review.

08

Wait for the lender's decision on your loan application. This may take some time for processing and approval.

09

If approved, carefully review the loan agreement once again before accepting the loan.

10

Sign the loan agreement if you are satisfied with the terms and conditions.

11

Follow any additional instructions provided by the lender, such as providing additional documentation or completing any remaining paperwork.

12

Once all the necessary steps are completed, the lender will disburse the funds for your auto loan.

13

Make sure to make timely monthly payments on the loan to avoid any penalties or negative impact on your credit score.

14

Keep track of your loan balance and remaining payments to ensure you stay on top of your financial obligations.

15

If you encounter any difficulties or have any questions during the loan term, contact the lender's customer service for assistance.

Who needs auto loans key termsconsumer?

01

Anyone who wants to purchase a car but does not have the necessary funds to do so outright can benefit from auto loans key termsconsumer. Whether you are buying a new or used car, auto loans provide a convenient financing option to help you afford the vehicle. This includes individuals who are purchasing a car for personal use, as well as small businesses or self-employed individuals who need a vehicle for work purposes. Auto loans can be beneficial for those who prefer to spread out the cost of the car over a period of time, rather than paying a big lump sum upfront. Additionally, auto loans can help individuals build or improve their credit history if they make timely payments on the loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete auto loans key termsconsumer online?

pdfFiller makes it easy to finish and sign auto loans key termsconsumer online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my auto loans key termsconsumer in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your auto loans key termsconsumer and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit auto loans key termsconsumer on an iOS device?

Create, edit, and share auto loans key termsconsumer from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is auto loans key terms consumer?

Auto loans key terms consumer refers to the essential terminology and conditions related to auto loans that consumers should understand before applying for or engaging in financing a vehicle.

Who is required to file auto loans key terms consumer?

Consumers who are applying for auto loans or engaging with financial institutions for vehicle financing are typically required to understand and acknowledge the key terms associated with their auto loans.

How to fill out auto loans key terms consumer?

To fill out the auto loans key terms consumer form, individuals should provide personal information, details regarding the loan amount, interest rate, duration of the loan, and any additional costs or terms associated with the financing.

What is the purpose of auto loans key terms consumer?

The purpose of auto loans key terms consumer is to inform borrowers of important loan conditions and help them understand their rights and obligations, enabling informed decision-making regarding financing a vehicle.

What information must be reported on auto loans key terms consumer?

The information that must be reported on auto loans key terms consumer includes the loan amount, interest rates, repayment schedule, fees, penalties, and other relevant terms and conditions.

Fill out your auto loans key termsconsumer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auto Loans Key Termsconsumer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.