Get the free Organizational Loan Commitment: - WordPress.com

Show details

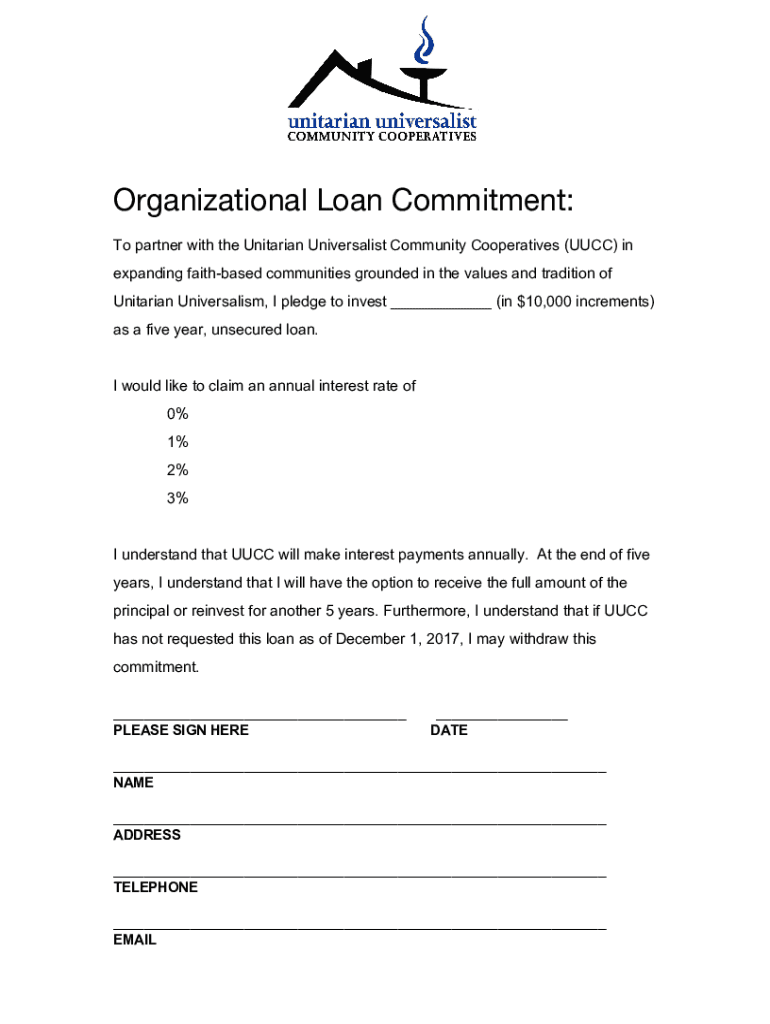

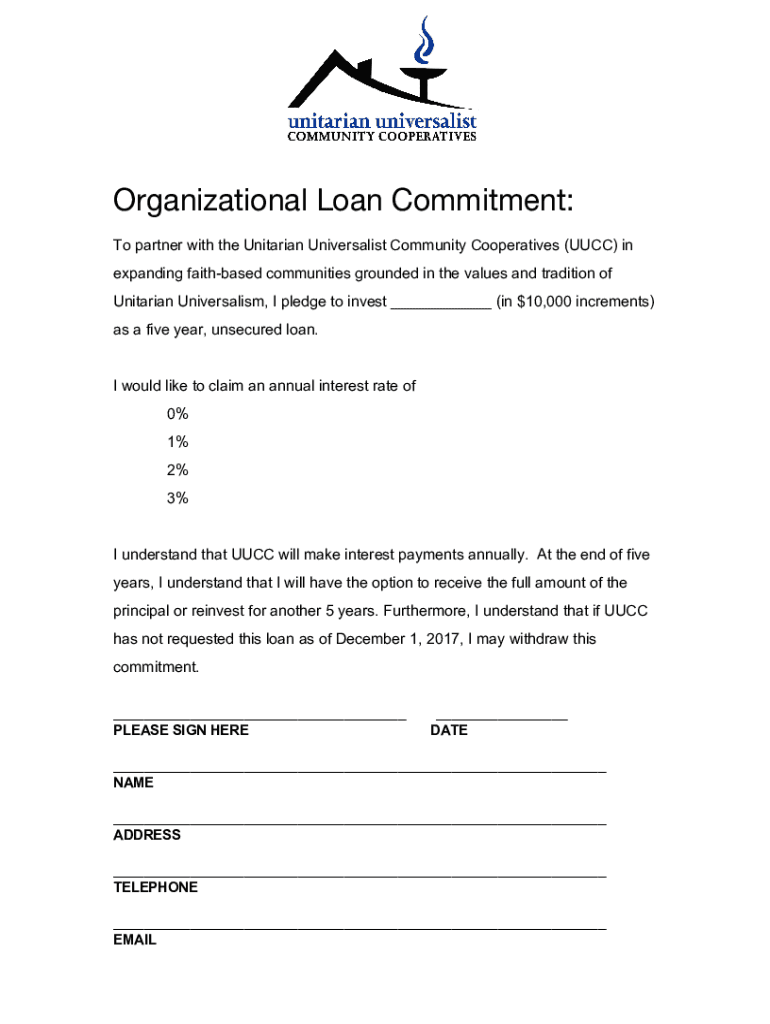

OrganizationalLoanCommitment: To partner with the Unitarian Universalist Community Cooperatives (UCC) in expanding faith based communities grounded in the values and tradition of Unitarian Universalism,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign organizational loan commitment

Edit your organizational loan commitment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your organizational loan commitment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing organizational loan commitment online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit organizational loan commitment. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out organizational loan commitment

How to fill out organizational loan commitment

01

Gather all the necessary documentation such as financial statements, business plan, and legal documents.

02

Review the loan application form and familiarize yourself with the requirements and instructions provided.

03

Fill out the loan application form accurately and completely, providing all the requested information.

04

Attach all the required documents to the loan application, ensuring they are properly organized and legible.

05

Double-check all the information provided and make sure it is consistent and accurate.

06

Review the terms and conditions of the loan commitment thoroughly before signing it.

07

Submit the filled-out loan commitment form and accompanying documents to the appropriate financial institution or lender.

08

Follow up with the lender to ensure the application is processed and to provide any additional information or documentation if required.

09

Await the lender's decision on the loan commitment and respond promptly to any requests for further information.

10

If the loan commitment is approved, review the terms and conditions once again before accepting it and proceed with necessary paperwork or actions as outlined.

Who needs organizational loan commitment?

01

Organizational loan commitments are usually required by businesses or organizations that are in need of financial assistance or funding.

02

Startups and small businesses often seek organizational loan commitments to finance their operations, purchase equipment or inventory, expand their facilities, or cover other expenses.

03

Established organizations may also require a loan commitment to support growth initiatives, fund mergers or acquisitions, or manage cash flow during periods of financial stress.

04

Additionally, non-profit organizations or government entities may seek loan commitments to support community development projects or public infrastructure improvements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit organizational loan commitment from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including organizational loan commitment, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the organizational loan commitment in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out organizational loan commitment using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign organizational loan commitment and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is organizational loan commitment?

An organizational loan commitment is a formal agreement between a lender and a borrower that outlines the terms and conditions under which the lender agrees to provide a loan to the borrower. It indicates the lender's intent to finance a specific amount of money for a designated purpose.

Who is required to file organizational loan commitment?

Organizations that have received or are seeking loans typically need to file an organizational loan commitment. This includes businesses, non-profits, and other entities looking to secure financing.

How to fill out organizational loan commitment?

To fill out an organizational loan commitment, one typically needs to provide accurate information such as the borrowing organization’s name, address, loan amount requested, purpose of the loan, terms of repayment, and any required signatures from authorized representatives.

What is the purpose of organizational loan commitment?

The purpose of an organizational loan commitment is to formalize the terms of the loan agreement between the lender and the borrower, ensuring both parties understand their obligations and providing a basis for the loan's disbursement and repayment.

What information must be reported on organizational loan commitment?

Key information that must be reported on an organizational loan commitment includes the loan amount, interest rate, repayment schedule, any collateral, the purpose of the loan, and the identities of the involved parties.

Fill out your organizational loan commitment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Organizational Loan Commitment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.