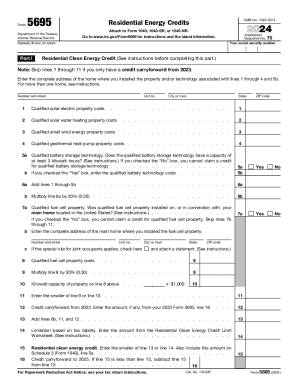

IRS Form 5695 2013 free printable template

Show details

19e f If you claimed window expenses on your Form 5695 for 2006 2007 2009 2010 2011 2012 or 2013 enter the amount from the Window Expense Worksheet see instructions otherwise enter -0-. 19f g Subtract line 19f from line 19e. If zero or less enter -0-. 19g Add lines 19a 19b 19c and 19h. Form Department of the Treasury Internal Revenue Service OMB No. 1545-0074 Residential Energy Credits Information about Form 5695 and its separate instructions is...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Form 5695

Edit your IRS Form 5695 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Form 5695 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Form 5695 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Form 5695. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 5695 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Form 5695

How to fill out IRS Form 5695

01

Download IRS Form 5695 from the IRS website or obtain a physical copy.

02

Read the instructions carefully to understand the eligibility for the tax credits.

03

Fill out the top section with your personal information, including your name and Social Security number.

04

Complete Part I for the Residential Energy Efficient Property Credit or Part II for the Nonbusiness Energy Property Credit, depending on the type of credit you are claiming.

05

Enter the costs for qualifying energy-efficient improvements in their respective sections.

06

Calculate the credit amount based on the instructions provided on the form.

07

Transfer the credit amount to your tax return as indicated.

Who needs IRS Form 5695?

01

Homeowners who have made qualifying energy-efficient improvements to their primary or secondary residences.

02

Individuals claiming the Residential Energy Efficient Property Credit or the Nonbusiness Energy Property Credit.

03

Taxpayers who purchased energy-efficient equipment or made qualified improvements during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Who files Form 5695?

You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit.

How to enter Form 5695?

How to Fill Out IRS Form 5695 Step 1 - Calculate The Total Cost Of Your Solar Power System. Step 2 - Add Additional Energy-Efficient Improvements. Step 3 - Calculate The Tax Credit Value. Step 4 - Enter Your Tax Credit Value. Step 5 - Calculate Your Tax Liability. Step 6 - Calculate The Maximum Tax Credit You Can Claim.

How to enter Form 5695?

How to Fill Out IRS Form 5695 Step 1 - Calculate The Total Cost Of Your Solar Power System. Step 2 - Add Additional Energy-Efficient Improvements. Step 3 - Calculate The Tax Credit Value. Step 4 - Enter Your Tax Credit Value. Step 5 - Calculate Your Tax Liability. Step 6 - Calculate The Maximum Tax Credit You Can Claim.

What is 5695?

Use Form 5695 to figure and take your residential energy credits. The residential energy credits are: The nonbusiness energy property credit, and. The residential energy efficient property credit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS Form 5695?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IRS Form 5695 and other forms. Find the template you need and change it using powerful tools.

How do I execute IRS Form 5695 online?

pdfFiller has made it simple to fill out and eSign IRS Form 5695. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the IRS Form 5695 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your IRS Form 5695 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is IRS Form 5695?

IRS Form 5695 is a tax form used to claim the Residential Energy Credits, which provide tax credits for residential energy-efficient improvements made to a taxpayer's home.

Who is required to file IRS Form 5695?

Taxpayers who made qualified energy-efficient improvements to their homes, or installed renewable energy systems, may be required to file IRS Form 5695 to claim the associated tax credits.

How to fill out IRS Form 5695?

To fill out IRS Form 5695, taxpayers must provide their personal information, report the costs of qualified energy improvements, and calculate the applicable tax credits based on the instructions provided on the form.

What is the purpose of IRS Form 5695?

The purpose of IRS Form 5695 is to allow taxpayers to claim tax credits for making energy-efficient improvements to their homes, encouraging investment in renewable energy and energy-saving technology.

What information must be reported on IRS Form 5695?

The information that must be reported on IRS Form 5695 includes the total cost of qualified energy improvements, details of the improvements made, and calculations for the tax credits being claimed.

Fill out your IRS Form 5695 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Form 5695 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.