2013 Federal Tax Forms

What is 2013 federal tax forms?

2013 federal tax forms are official documents that individuals use to report their income, deductions, and tax payments to the Internal Revenue Service (IRS) in the United States. These forms are specifically designed for the tax year 2013 and are used to determine the amount of taxes owed or the refund to be received. They are an essential part of the annual tax filing process for individuals and businesses alike.

What are the types of 2013 federal tax forms?

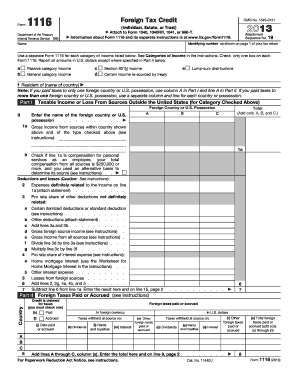

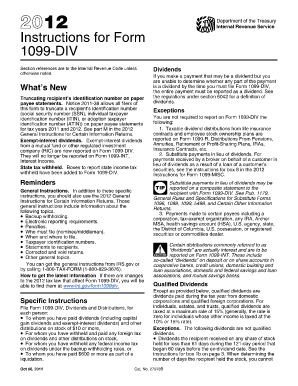

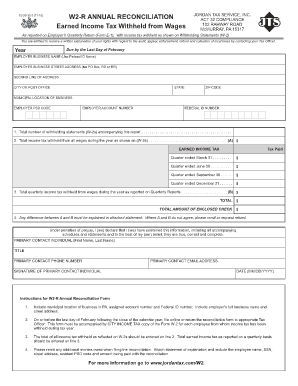

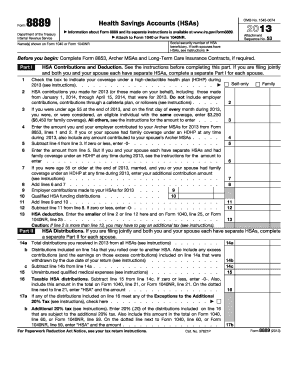

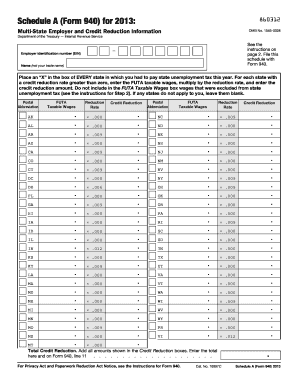

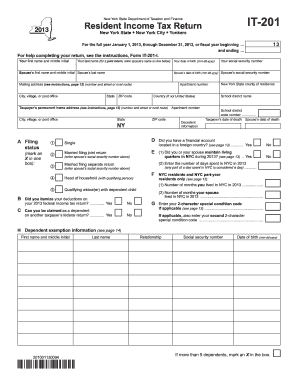

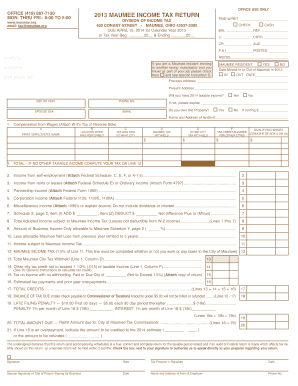

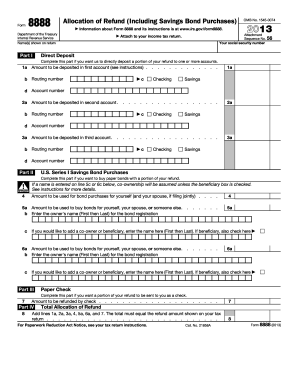

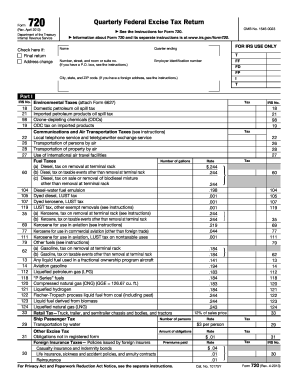

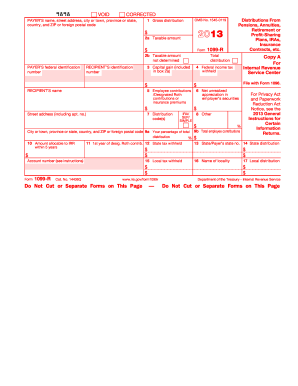

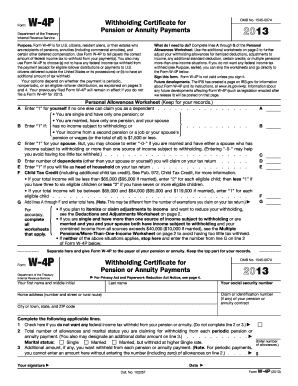

There are several types of 2013 federal tax forms, each serving a different purpose. The most common ones include: 1. Form 1040: This is the main tax form used by individuals to report their income, deductions, and tax liabilities. 2. Form 1040A: A simplified version of Form 1040, suitable for individuals with less complex tax situations. 3. Form 1040EZ: The simplest tax form, designed for individuals with very basic tax situations. 4. Form 1099 series: Various forms used to report different types of income, such as interest, dividends, and self-employment earnings. 5. Form W-2: The form employers use to report their employees' wages and taxes withheld. These are just a few examples, and there are other forms and schedules that may be applicable depending on an individual's specific circumstances.

How to complete 2013 federal tax forms

Completing 2013 federal tax forms may seem daunting, but with the right resources and guidance, it can be done successfully. Here are some steps to help you complete your tax forms: 1. Gather all necessary documents: This includes your income statements, receipts, and any other relevant financial documents. 2. Choose the appropriate form: Determine which form is best suited to your tax situation (e.g., Form 1040, 1040A, or 1040EZ). 3. Fill in your personal information: Provide your name, address, Social Security number, and other requested details. 4. Report your income: Carefully enter all sources of income, including wages, investments, and any other taxable income. 5. Deductions and credits: Take advantage of any deductions or credits you qualify for, reducing your taxable income. 6. Calculate your tax liability: Use the tax tables or online tools to determine the amount of tax you owe. 7. Review and double-check: Ensure all information is accurate and complete before submitting your forms. Remember, if you have any doubts or concerns, it's always a good idea to seek professional assistance from a tax advisor or accountant. They can help ensure accuracy and maximize your deductions and credits.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.