CO DoR 104 2013 free printable template

Show details

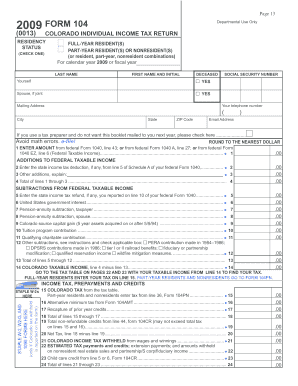

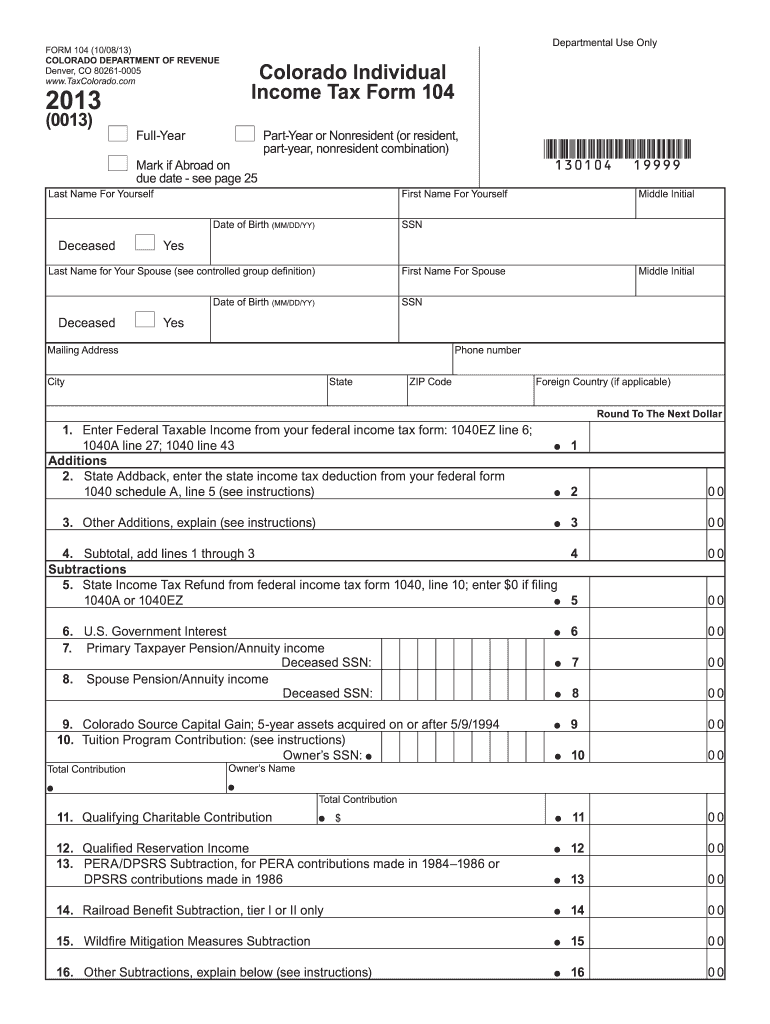

FORM 104 (10/08/13) COLORADO DEPARTMENT OF REVENUE Denver, CO 80261-0005 www.TaxColorado.com 2013 Departmental Use Only Colorado Individual Income Tax Form 104 (0013) Full-Year Part-Year or Nonresident

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

Instructions and Help about CO DoR 104

How to edit CO DoR 104

To edit CO DoR 104, access a digital version through platforms supportive of document modifications, such as pdfFiller. Utilize the editing tools to input the necessary changes while ensuring that the information remains accurate and up to date.

How to fill out CO DoR 104

To fill out CO DoR 104, follow these steps:

01

Download the form from an official state resource.

02

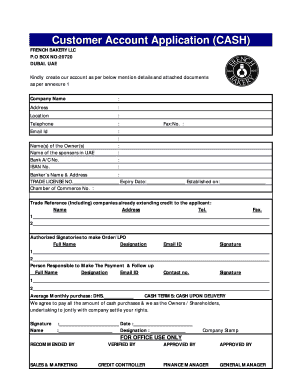

Provide your business’s name and address in the designated fields.

03

Indicate the type of payment details as required.

04

Sign and date the form once all necessary fields are filled.

About CO DoR previous version

What is CO DoR 104?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR previous version

What is CO DoR 104?

CO DoR 104 is a state-level tax form utilized in Colorado for the purpose of reporting specific payments made to individuals or entities. This form helps ensure compliance with state tax laws and provides the necessary documentation for tax filings.

What is the purpose of this form?

The purpose of CO DoR 104 is to report payments made for services rendered or goods purchased that exceed the threshold established by the state. This form is essential for the accurate reporting of financial transactions and for fulfilling state tax obligations.

Who needs the form?

Businesses and organizations in Colorado that make certain payments, such as contractor or vendor payments exceeding the stipulated amounts, need to complete CO DoR 104. This includes both for-profit and non-profit organizations.

When am I exempt from filling out this form?

You may be exempt from filling out CO DoR 104 if you are making payments below the reporting threshold or if the payment is made to an entity that is not subject to Colorado state tax. Additionally, payments made for goods that are not taxable do not require this form.

Components of the form

CO DoR 104 primarily contains sections that require details about the payer, payee, amounts paid, and the nature of the transactions. The structured format ensures all relevant information is captured for tax purposes.

Due date

The due date for submitting CO DoR 104 typically aligns with the annual tax reporting deadlines established by the state. It is crucial to confirm the specific submission dates during the tax year, as they may vary.

What are the penalties for not issuing the form?

Failing to issue CO DoR 104 when required can result in penalties imposed by the state of Colorado. These penalties may include monetary fines and interest on any unpaid taxes derived from the transactions that were not reported.

What information do you need when you file the form?

When filing CO DoR 104, you will need the payer's and payee's identification information, including tax identification numbers, details of the payments made, and the total amounts. Ensure all information is accurate to avoid complications.

Is the form accompanied by other forms?

CO DoR 104 may need to be filed with other supplementary forms, depending on your tax situation. It is best practice to consult with a tax professional or review state guidelines to ensure all necessary documents are included.

Where do I send the form?

Once completed, CO DoR 104 should be submitted to the appropriate address designated by the Colorado Department of Revenue. Ensure that you send it to the correct office to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

pdf filler has allowed me to easily upload and edit pdf documents...as the technology improves it will be a standard use software for most users.

Where has PDFfiller been my whole life?!?! LOVE IT!

See what our users say