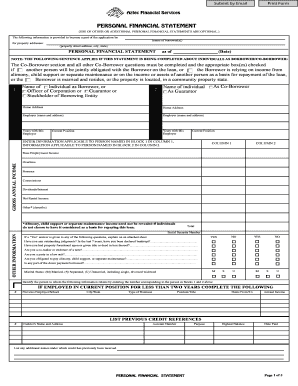

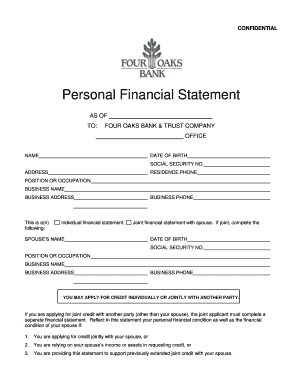

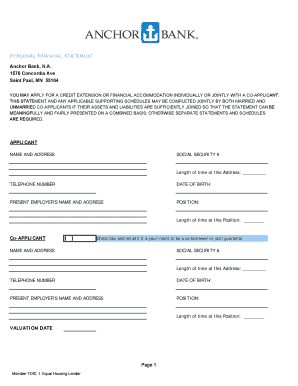

Fillable Personal Financial Statement

What is fillable personal financial statement?

A fillable personal financial statement is a document that allows individuals to provide detailed information about their financial status. It includes information such as income, expenses, assets, and liabilities. The fillable format enables users to easily input their data directly into the document.

What are the types of fillable personal financial statement?

There are several types of fillable personal financial statements available, including: - Individual financial statement - Joint financial statement - Business financial statement - Non-profit financial statement - Real estate financial statement Each type is designed to cater to different financial situations and requirements.

How to complete fillable personal financial statement

Completing a fillable personal financial statement is a straightforward process. Here are the steps to follow: 1. Open the fillable personal financial statement template. 2. Input your personal details, such as name, contact information, and social security number. 3. Provide accurate information about your income from various sources. 4. List your monthly expenses, including rent/mortgage, utilities, and debt payments. 5. Detail your assets, such as cash, investments, and real estate. 6. Disclose any liabilities you have, such as loans, credit card debt, or mortgages. 7. Review the completed form for accuracy and make any necessary adjustments. 8. Save and/or print the completed fillable personal financial statement for your records or sharing purposes.

With pdfFiller, you can easily create, edit, and share fillable personal financial statements online. pdfFiller offers a wide range of templates and powerful editing tools, making it the perfect solution for managing your financial documents.