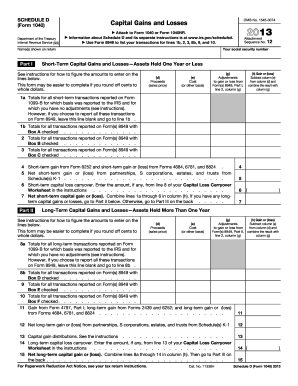

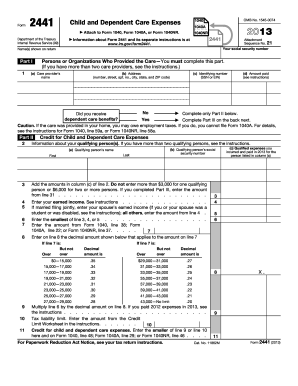

2013 Tax Form 1040

What is 2013 tax form 1040?

The 2013 tax form 1040 is the standard IRS form that individuals use to file their annual income tax return. It includes sections for reporting income, deductions, credits, and more to determine the final tax obligation or refund.

What are the types of 2013 tax form 1040?

In 2013, there were three main types of 1040 forms: 1040, 1040A, and 1040EZ. Each form had different eligibility requirements and levels of complexity. The 1040 form was the most comprehensive, while the 1040EZ was the simplest for taxpayers with straightforward income and deductions.

How to complete 2013 tax form 1040

Completing the 2013 tax form 1040 can seem daunting, but with the right preparation, it can be straightforward. Here are some steps to help you navigate the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.