Get the free Accounting Practice Sales - #1 in Accounting and Tax Practice ...

Show details

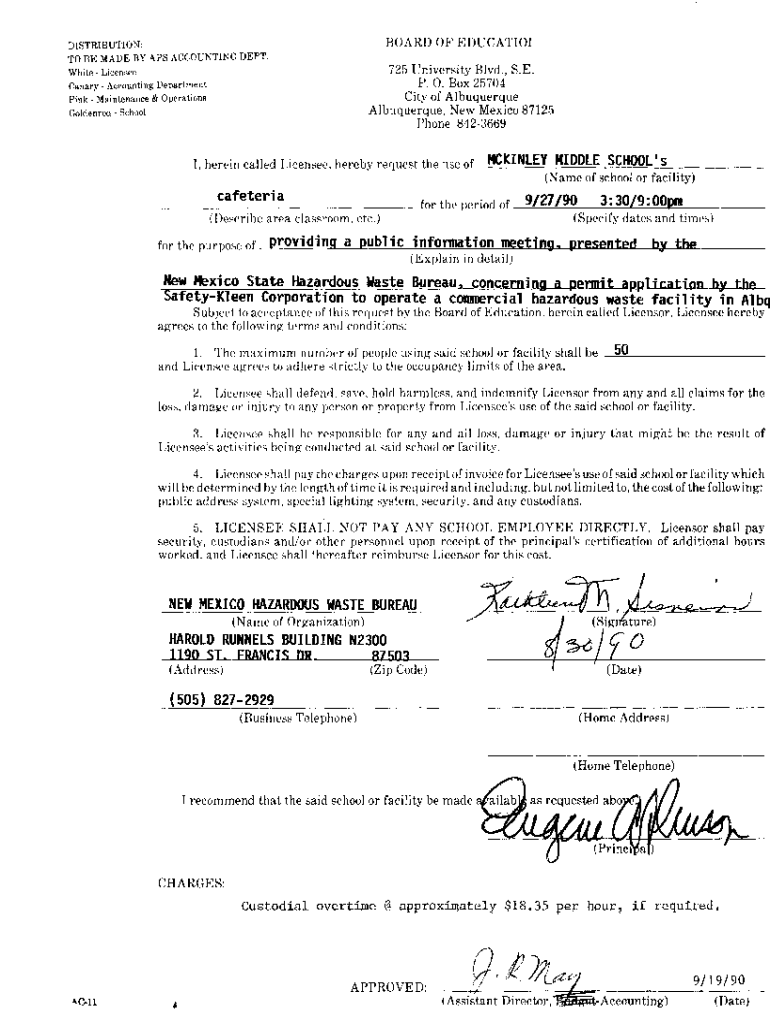

BOARD OF EDUCATI01DISTRIBUTION: TO BE MADE BY APS ACCOUNTING DEPT. White Licensee Canary Accounting Department Pink Maintenance & Operations Goldenrod School725 University Blvd., S.E. P. 0. Box 25704

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting practice sales

Edit your accounting practice sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting practice sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting practice sales online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounting practice sales. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting practice sales

How to fill out accounting practice sales

01

To fill out accounting practice sales, you can follow these steps:

02

Gather all the necessary financial documents and records related to the sales.

03

Determine the value of your accounting practice by considering factors such as revenue, client base, assets, and goodwill.

04

Prepare a comprehensive sales agreement that outlines the terms and conditions of the sale, including the purchase price, payment terms, and any additional agreements or warranties.

05

Advertise the sale of your accounting practice through various channels, such as online platforms, professional networks, or industry associations.

06

Screen potential buyers by evaluating their financial capability, experience, and compatibility with your existing clients and employees.

07

Conduct negotiations with interested buyers and address any concerns or questions they may have about the sale.

08

Once you have found a suitable buyer, finalize the sales agreement and ensure all necessary legal and financial documentation is completed.

09

Transfer ownership of the accounting practice to the buyer, including the transfer of client contracts, licenses, and any intellectual property rights.

10

Notify your clients and employees about the transfer of ownership and ensure a smooth transition for all parties involved.

11

Evaluate the success of the sale and assess any lessons learned for future reference.

Who needs accounting practice sales?

01

Various individuals or entities may have a need for accounting practice sales, including:

02

- Accounting firm owners who are looking to retire or exit the industry.

03

- Accounting practitioners who are planning to merge their practice with another firm.

04

- Investors or entrepreneurs who want to acquire an established accounting practice as a business opportunity.

05

- Professionals in the accounting industry who are seeking growth or expansion through acquisition.

06

- Banks or financial institutions that specialize in providing financing or loans for accounting practice acquisitions.

07

- Consultants or advisors who assist clients in buying or selling accounting practices.

08

- Job seekers who are interested in working for an accounting firm that has recently undergone a change in ownership.

09

- Accounting students or researchers who are studying the dynamics and trends in the accounting practice sales market.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit accounting practice sales from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including accounting practice sales, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find accounting practice sales?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific accounting practice sales and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out accounting practice sales on an Android device?

Complete accounting practice sales and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is accounting practice sales?

Accounting practice sales refer to the process of buying or selling a business that offers accounting services. This includes the transfer of clients, goodwill, and often the physical or intellectual property of the accounting practice.

Who is required to file accounting practice sales?

Typically, individuals or firms engaging in the sale or transfer of an accounting practice are required to file accounting practice sales. This includes both the seller and the buyer as part of the regulatory compliance.

How to fill out accounting practice sales?

To fill out accounting practice sales, parties must provide pertinent information including business details, valuation of the practice, client lists, and any associated liabilities. It's crucial to follow the specific guidelines set by the relevant accounting regulatory authority.

What is the purpose of accounting practice sales?

The purpose of accounting practice sales is to facilitate the transfer of business ownership, ensuring that clients receive continuity of services while the seller can monetize their practice. It also allows a buyer to establish or expand their clientele.

What information must be reported on accounting practice sales?

Information that must be reported on accounting practice sales typically includes details of the parties involved, a description of the practice, financial statements, client demographics, and any liabilities associated with the practice.

Fill out your accounting practice sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Practice Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.