Get the free Mutual fund Schemes in India - Franklin Templeton IndiaMutual fund Schemes in India ...

Show details

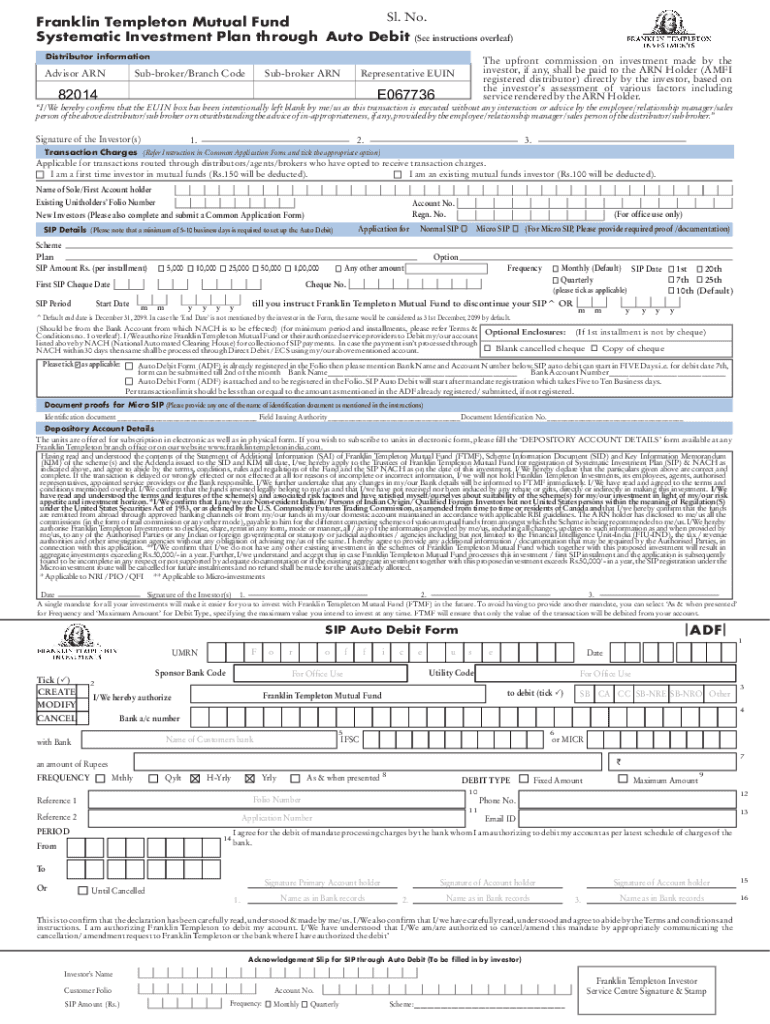

SL. No.

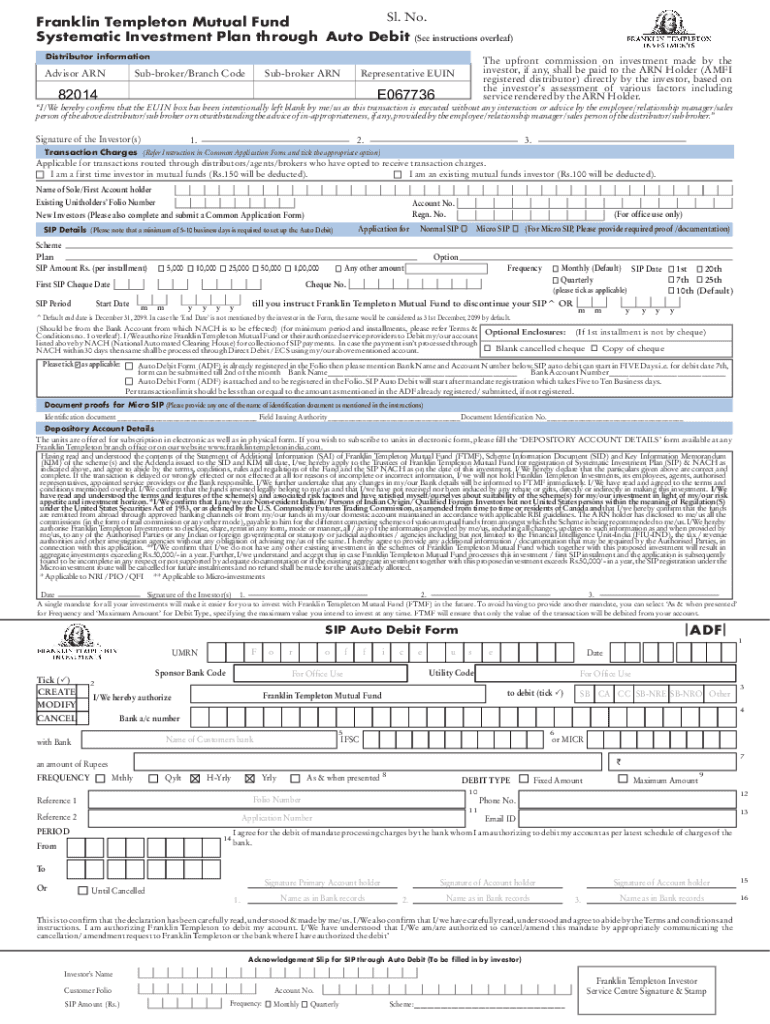

Franklin Templeton Mutual Fund

Systematic Investment Plan through Auto Debit (See instructions overleaf)

Distributor informationAdvisor ARNSubbroker/Branch CodeSubbroker Anthem upfront commission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund schemes in

Edit your mutual fund schemes in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund schemes in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual fund schemes in online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mutual fund schemes in. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund schemes in

How to fill out mutual fund schemes in

01

Start by understanding what mutual fund schemes are and how they work.

02

Research different mutual fund schemes available in the market and choose the one that aligns with your financial goals and risk tolerance.

03

Read the scheme documents carefully to understand the investment objective, asset allocation, fund manager details, and other important information.

04

Open a mutual fund account with a registered mutual fund distributor or through the online platform of a mutual fund company.

05

Fill out the application form provided by the mutual fund company or distributor.

06

Provide your personal details such as name, address, contact information, and PAN (Permanent Account Number) details.

07

Choose the investment amount and mode of investment (lump sum or SIP - Systematic Investment Plan).

08

Provide bank account details and authorize the mutual fund company to deduct money from your bank account for investments.

09

Review the application form for accuracy and ensure all necessary documents and proofs are attached.

10

Submit the completed application form along with the required documents to the mutual fund company or distributor.

11

Once the application is processed, you will receive a mutual fund account number and statement.

12

Keep track of your investments by reviewing the statements and regularly monitoring the performance of the mutual fund scheme.

13

Stay updated with any changes or updates from the mutual fund company and make informed decisions regarding your investments.

14

Seek guidance from a financial advisor if you are unsure about any aspect of filling out mutual fund schemes.

Who needs mutual fund schemes in?

01

Individuals looking to grow their wealth through diversified investments.

02

Investors who want professional management of their investments by experienced fund managers.

03

Long-term investors who can stay invested for a significant period to benefit from potential returns.

04

Individuals who want to invest in a variety of asset classes such as stocks, bonds, and commodities.

05

People who want to start investing with small amounts regularly (SIP)

06

Investors who want to enjoy the benefits of compounding and rupee cost averaging.

07

Individuals who want to save taxes by investing in tax-saving mutual fund schemes (ELSS).

08

Investors who want to diversify their portfolio and reduce risk by spreading investments across multiple securities.

09

Individuals who want easy accessibility to their investments and the flexibility to buy and sell units as per their convenience.

10

Investors who want transparency and regular reporting of their investments' performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in mutual fund schemes in without leaving Chrome?

mutual fund schemes in can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit mutual fund schemes in on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign mutual fund schemes in on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete mutual fund schemes in on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your mutual fund schemes in. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is mutual fund schemes in?

Mutual fund schemes are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of securities, such as stocks, bonds, or other financial instruments.

Who is required to file mutual fund schemes in?

Mutual fund companies and asset management firms are required to file mutual fund schemes with the regulatory authorities.

How to fill out mutual fund schemes in?

To fill out mutual fund schemes, one typically needs to provide specific details about the fund's investment objectives, risk factors, fees, and other relevant information as required by the regulatory body.

What is the purpose of mutual fund schemes in?

The purpose of mutual fund schemes is to provide investors with a professionally managed investment option that allows for diversification and access to a range of asset classes.

What information must be reported on mutual fund schemes in?

Information that must be reported typically includes fund objectives, investment strategies, fee structures, performance data, and financial statements.

Fill out your mutual fund schemes in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund Schemes In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.