Get the free Donor acknowledgments and filing IRS Forms 8282 and 8283 ...

Show details

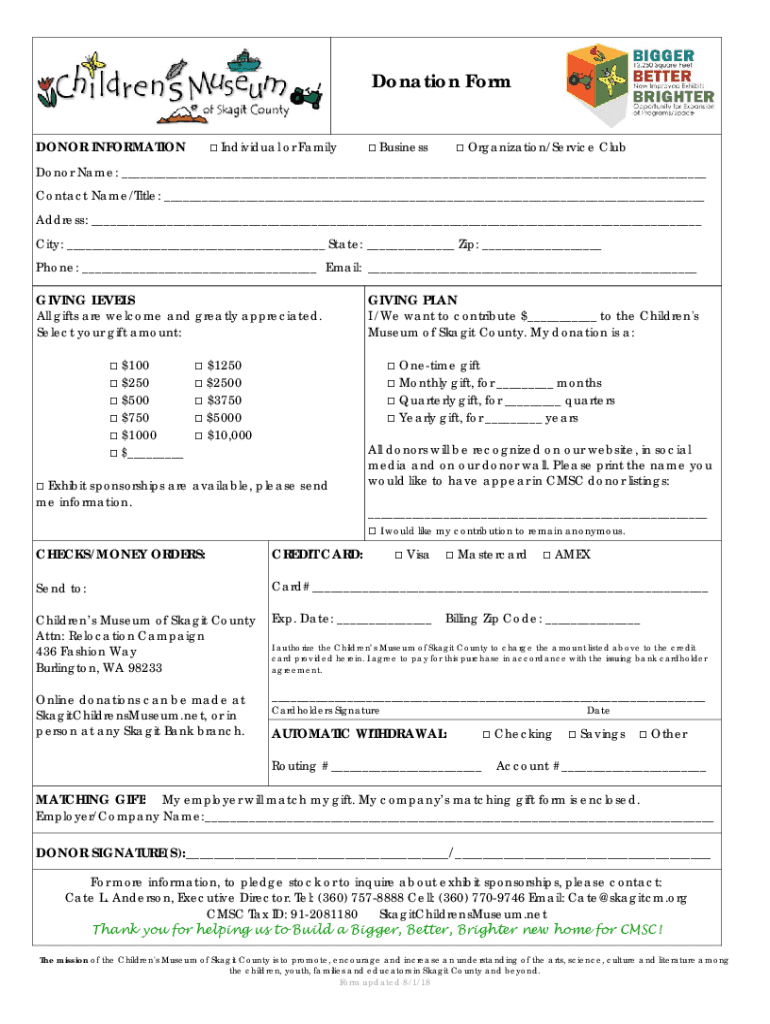

Donation Form DONOR INFORMATION Individual or Family Business Organization/Service Clubfoot Name: Contact Name/Title: Address: City: State: Zip: Phone: Email: GIVING Levels gifts are welcome and greatly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor acknowledgments and filing

Edit your donor acknowledgments and filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor acknowledgments and filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donor acknowledgments and filing online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donor acknowledgments and filing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor acknowledgments and filing

How to fill out donor acknowledgments and filing

01

To fill out donor acknowledgments and filing, follow these steps:

02

Start by gathering all necessary information, such as the donor's name, contact information, and donation details.

03

Create a template for the donor acknowledgment letter. This letter should include a thank-you message, the donation amount, and any tax-deductible information.

04

Personalize each donor acknowledgment letter by inputting the relevant information into the template.

05

Print and sign each personalized letter, or send them electronically if preferred.

06

Keep a copy of each donor acknowledgment letter for your records.

07

As for filing, organize the donor acknowledgment letters and any other related documentation, such as donation receipts, in a secure and easily accessible manner.

08

Depending on your organization and local regulations, you may need to file these documents with the appropriate authorities or keep them on file for reporting purposes.

09

Regularly review and update your filing system to ensure compliance and easy retrieval of donor acknowledgments and related documents.

Who needs donor acknowledgments and filing?

01

Any organization or individual that receives donations and wants to show appreciation to their donors should use donor acknowledgments and filing.

02

Additionally, nonprofit organizations and those who offer tax-deductible donation opportunities often need to provide donor acknowledgments and maintain proper filing for tax and legal purposes.

03

Donor acknowledgments help demonstrate gratitude towards donors and can potentially strengthen the relationship between the donor and the organization.

04

Filing ensures transparency, accountability, and adherence to legal requirements regarding donations received and tax-exempt status.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donor acknowledgments and filing in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your donor acknowledgments and filing along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit donor acknowledgments and filing on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing donor acknowledgments and filing.

How do I edit donor acknowledgments and filing on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share donor acknowledgments and filing on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is donor acknowledgments and filing?

Donor acknowledgments and filing refer to the process by which nonprofit organizations formally recognize contributions received from donors and report this information for tax purposes. It ensures transparency and accountability in fundraising.

Who is required to file donor acknowledgments and filing?

Nonprofit organizations that receive donations and intend to provide donors with a written acknowledgment for contributions are required to file donor acknowledgments and reporting documents, particularly those seeking tax-exempt status.

How to fill out donor acknowledgments and filing?

To fill out donor acknowledgments, organizations should include the donor's name, address, the amount of the contribution, date of the contribution, and a statement indicating whether any goods or services were exchanged for the donation.

What is the purpose of donor acknowledgments and filing?

The purpose of donor acknowledgments and filing is to provide donors with proof of their charitable contributions for tax deduction purposes and to maintain transparency in the financial dealings of nonprofit organizations.

What information must be reported on donor acknowledgments and filing?

Donor acknowledgments must report the donor's name, address, the amount donated, the date of the donation, and a description of any goods or services provided in exchange for the donation.

Fill out your donor acknowledgments and filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Acknowledgments And Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.