Get the free Property Taxes and Utilities - Burnaby

Show details

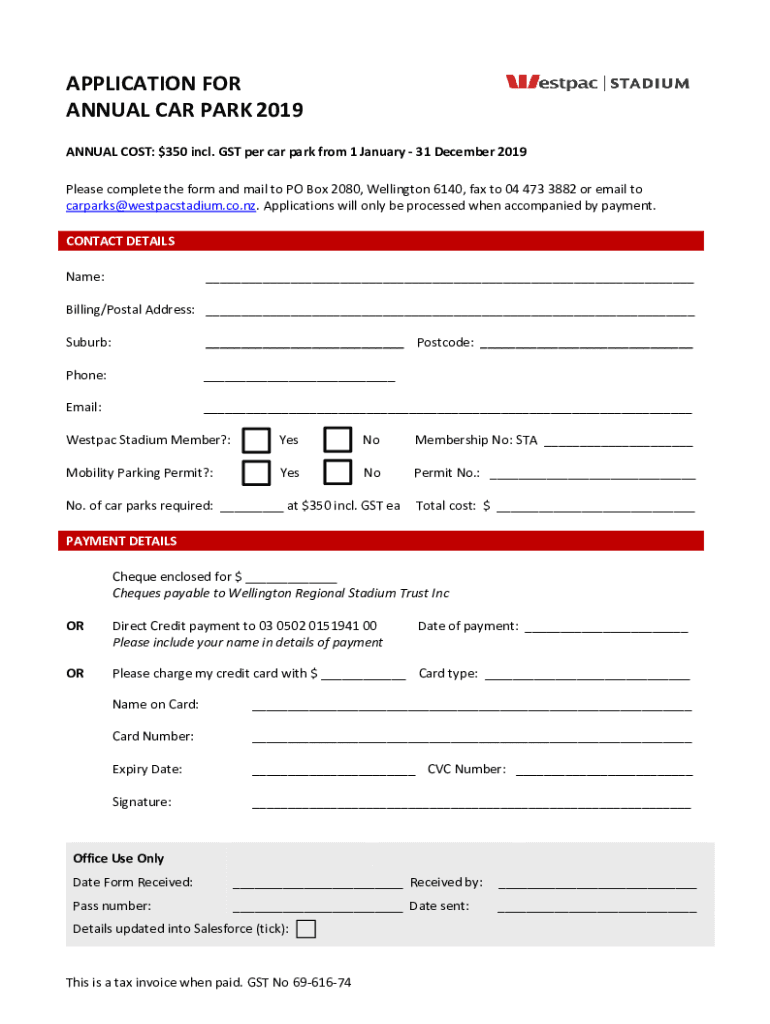

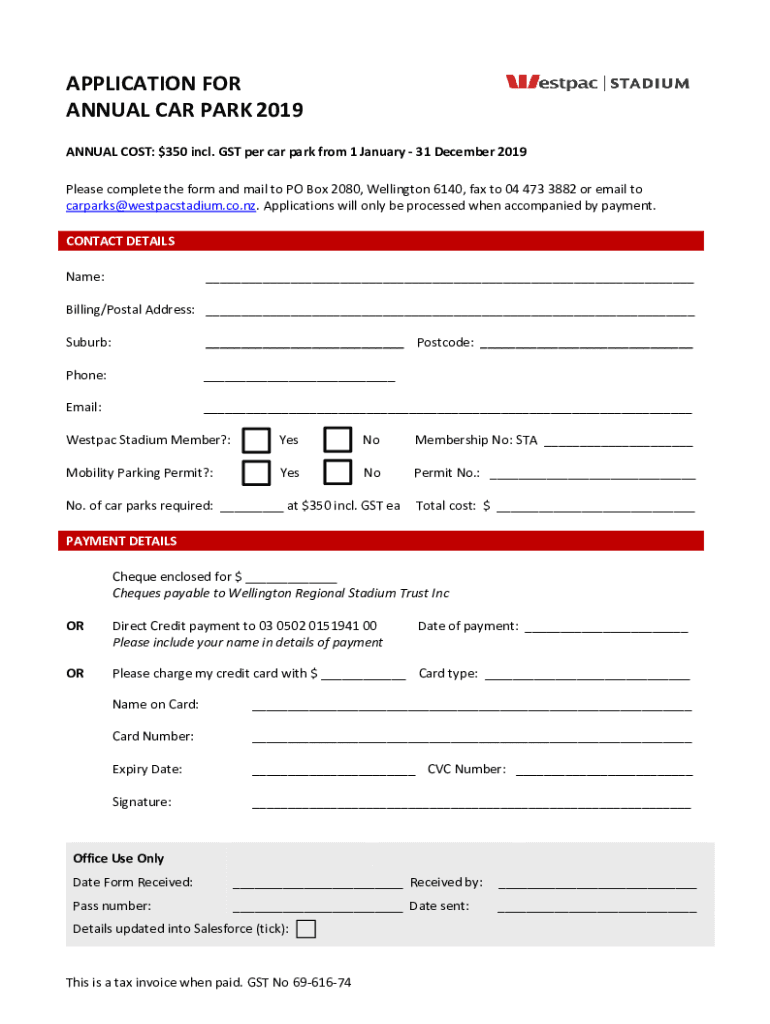

APPLICATION FOR ANNUAL CAR PARK 2019 ANNUAL COST: $350 incl. GST per car park from 1 January 31 December 2019 Please complete the form and mail to PO Box 2080, Wellington 6140, fax to 04 473 3882

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property taxes and utilities

Edit your property taxes and utilities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property taxes and utilities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property taxes and utilities online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property taxes and utilities. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property taxes and utilities

How to fill out property taxes and utilities

01

Gather all necessary documents and forms, such as property tax forms and utility bills.

02

Begin by filling out the property tax form with your personal information, including your name, address, and contact details.

03

Provide accurate and up-to-date information about your property, such as its assessed value and any improvements you have made.

04

Calculate the amount of property tax owed based on the applicable tax rate and any exemptions or deductions you qualify for.

05

Double-check all the information you provided to ensure it is correct and complete.

06

Attach any required supporting documents, such as proof of residency or income.

07

Submit the completed property tax form and payment by the specified deadline.

08

To fill out utilities, gather all utility bills for the property, such as water, electricity, and gas bills.

09

Check if the utility company provides a specific form for reporting usage or if you can provide the information directly on the bill.

10

Fill out the utility form or provide the necessary information, such as meter readings, usage periods, and account details.

11

Calculate the total amount of the utility bills and any applicable taxes or fees.

12

Double-check all the information to ensure accuracy.

13

Submit the completed utility form and payment by the specified deadline.

Who needs property taxes and utilities?

01

Property taxes and utilities are important for anyone who owns or rents property.

02

Homeowners need property taxes to fulfill their financial obligations to the government and maintain the functioning of public services.

03

Renters may indirectly contribute to property taxes through their rent payments, as landlords often include property tax expenses in rental rates.

04

Both homeowners and renters need utilities to access essential services like water, electricity, and gas for their daily living needs.

05

Utilities are necessary to ensure a comfortable and functional living environment.

06

Business owners and commercial property owners also require property taxes and utilities to operate their businesses and provide services.

07

In summary, property taxes and utilities are essential for property owners, renters, and businesses to meet financial obligations and access essential services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute property taxes and utilities online?

Filling out and eSigning property taxes and utilities is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit property taxes and utilities in Chrome?

Install the pdfFiller Google Chrome Extension to edit property taxes and utilities and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out property taxes and utilities on an Android device?

Use the pdfFiller mobile app to complete your property taxes and utilities on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is property taxes and utilities?

Property taxes are taxes imposed by local governments on real estate properties, based on their value, to fund public services. Utilities refer to essential services such as water, electricity, and gas that households and businesses require.

Who is required to file property taxes and utilities?

Property owners, including individual homeowners and businesses, are required to file property taxes. The utilities may not require a formal filing, but customers must pay for the utilities they consume.

How to fill out property taxes and utilities?

To fill out property taxes, property owners need to complete a property tax return form provided by their local tax authority, reporting the property's assessed value and any applicable deductions. Utilities typically do not require a filing but involve setting up an account and providing necessary details to the service provider.

What is the purpose of property taxes and utilities?

The purpose of property taxes is to generate revenue for local governments to finance public services such as education, infrastructure, and public safety. Utilities provide essential services necessary for daily living.

What information must be reported on property taxes and utilities?

Property taxes require reporting of the property's assessed value, property type, and any exemptions. For utilities, customers typically provide their contact information, service address, and utility usage if required.

Fill out your property taxes and utilities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Taxes And Utilities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.