Get the free DONOR ADVISED FUNDS GUIDE SHEET EXPLANATION5 Things to Know About Donor-Advised Fund...

Show details

Donor Advised Fund Change Form

Current Donor Contact Information

Check here if contact information does not changeCheck here if new contact information and fill in below

Last nameFirst name

Fund named

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor advised funds guide

Edit your donor advised funds guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor advised funds guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

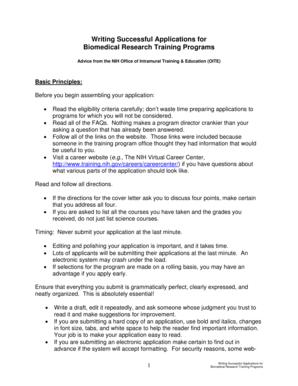

How to edit donor advised funds guide online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donor advised funds guide. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor advised funds guide

How to fill out donor advised funds guide

01

Research different donor advised fund providers and choose the one that best suits your needs.

02

Complete the application form provided by the chosen donor advised fund provider.

03

Provide all the necessary personal information, such as your name, address, and contact details.

04

Specify the type of fund you want to establish, whether it's a donor advised fund or a specific fund for a particular cause.

05

Determine the initial contribution amount and decide how often you want to contribute to the fund.

06

Designate any additional advisors or successors who will have decision-making authority over the fund after your passing.

07

Review and sign the agreement or contract provided by the donor advised fund provider.

08

Make the initial contribution to the fund as specified in the agreement.

09

Start recommending grants or distributions from your donor advised fund to eligible charities.

10

Keep track of your contributions, grants, and fund balance to ensure proper management and reporting.

Who needs donor advised funds guide?

01

Anyone who wants to make a significant impact through charitable giving

02

Individuals or families who want to establish a long-term philanthropic legacy

03

High-net-worth individuals who are looking for tax-efficient ways to support charitable causes

04

Businesses or corporations seeking to manage their corporate giving initiatives

05

Foundations or trusts that want to streamline their grantmaking process

06

Financial advisors or wealth managers who assist clients in strategic charitable planning

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find donor advised funds guide?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the donor advised funds guide in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in donor advised funds guide?

The editing procedure is simple with pdfFiller. Open your donor advised funds guide in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete donor advised funds guide on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your donor advised funds guide, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is donor advised funds guide?

A donor advised funds guide is a comprehensive resource that provides information on how donor advised funds operate, including their structure, rules, and tax implications for donors.

Who is required to file donor advised funds guide?

Organizations that manage donor advised funds are typically required to file reports detailing the fund activities and compliance with IRS regulations.

How to fill out donor advised funds guide?

To fill out a donor advised funds guide, one should gather all required financial information, include details about contributions and distributions, and ensure compliance with IRS guidelines before submitting the report.

What is the purpose of donor advised funds guide?

The purpose of a donor advised funds guide is to ensure transparency and compliance in the management of donor advised funds, as well as to educate donors on best practices for making charitable contributions.

What information must be reported on donor advised funds guide?

Information that must be reported includes the total contributions made to the fund, grants distributed, administrative expenses, and the fund's investment performance.

Fill out your donor advised funds guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Advised Funds Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.