Get the free End-of-Year Giving and Donor Statements for 2020Giving

Show details

CREDIT CARD FORM: MONTHLY OR ANNUAL CONTRIBUTOR Yes! I would like to help ensure Advantages future with a monthly donation of (circle one): $10 (Candlelight)$15 (Lantern light)OTHER: $ monthly.$20

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign end-of-year giving and donor

Edit your end-of-year giving and donor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your end-of-year giving and donor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit end-of-year giving and donor online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit end-of-year giving and donor. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out end-of-year giving and donor

How to fill out end-of-year giving and donor

01

Determine the purpose of your end-of-year giving. Decide which causes or organizations you want to support.

02

Research the organizations or causes. Make sure they are reputable and aligned with your values.

03

Set a budget for your end-of-year giving. Determine how much you can afford to donate.

04

Decide on the donation method. You can donate online, by check, or through a giving platform.

05

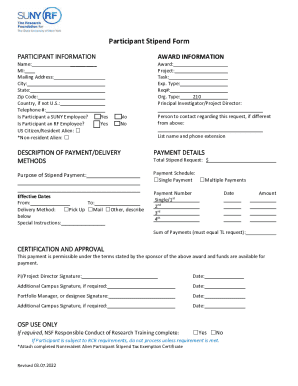

Fill out the necessary donation forms. Provide your contact information, donation amount, and any additional details requested.

06

Review and double-check your donation information before submitting.

07

Complete the donation process. Follow the instructions provided by the organization or giving platform.

08

Keep a record of your donations for tax purposes. Obtain a receipt or confirmation of your donation.

09

Consider setting up recurring donations for ongoing support beyond the end of the year.

10

Share your end-of-year giving experience with others. Encourage friends and family to join in supporting meaningful causes.

Who needs end-of-year giving and donor?

01

Nonprofit organizations rely on end-of-year giving and donors to sustain their programs and services.

02

Individuals or families in need often benefit from end-of-year giving as it can provide crucial support during the holiday season.

03

Community projects, educational institutions, and healthcare organizations may also need end-of-year giving and donors to fund their initiatives.

04

Supporting these entities through end-of-year giving ensures that important programs are maintained and individuals in need receive assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit end-of-year giving and donor from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your end-of-year giving and donor into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute end-of-year giving and donor online?

pdfFiller has made it easy to fill out and sign end-of-year giving and donor. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out end-of-year giving and donor on an Android device?

Use the pdfFiller app for Android to finish your end-of-year giving and donor. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is end-of-year giving and donor?

End-of-year giving refers to charitable donations made by individuals or organizations at the close of the calendar year, often to maximize tax benefits. A donor is an individual or entity that makes these contributions.

Who is required to file end-of-year giving and donor?

Individuals and organizations that have made charitable contributions during the year may be required to report these donations for tax purposes, especially if they intend to claim deductions on their tax returns.

How to fill out end-of-year giving and donor?

To fill out the end-of-year giving and donor forms, one must gather all relevant documentation such as receipts, the value of items donated, and complete the appropriate tax forms (like IRS Form 1040) where charitable contributions are reported.

What is the purpose of end-of-year giving and donor?

The purpose is to encourage charitable contributions, provide tax incentives for donors, and support nonprofit organizations in their missions by uplifting community services and initiatives through increased funding.

What information must be reported on end-of-year giving and donor?

Donors must report the amount donated, the date of the donation, the name of the charitable organization, and any applicable receipts or documentation to support the deduction.

Fill out your end-of-year giving and donor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

End-Of-Year Giving And Donor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.