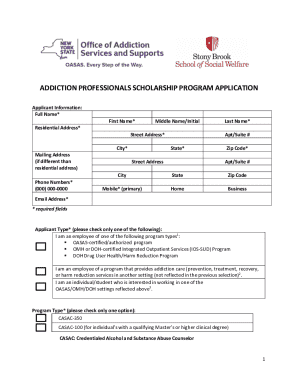

Get the free YOUR DEPOSIT OF $100 IS DUE NOW IF YOU WOULD LIKE ...

Show details

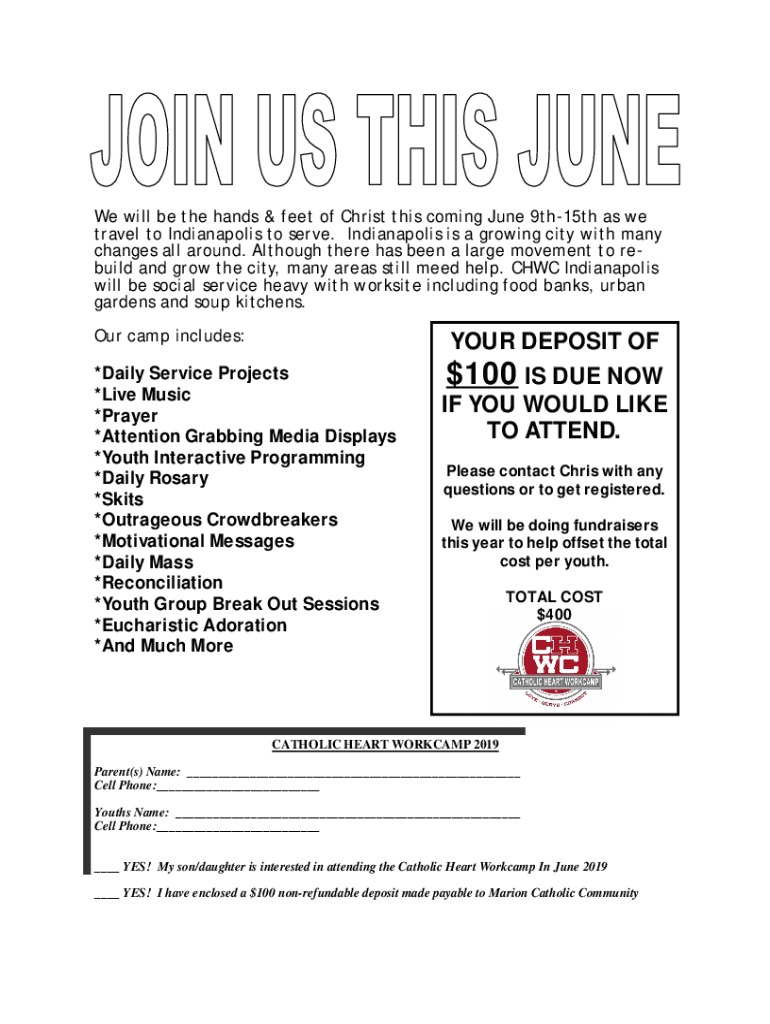

We will be the hands & feet of Christ this coming June 9th15th as we travel to Indianapolis to serve. Indianapolis is a growing city with many changes all around. Although there has been a large movement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your deposit of 100

Edit your your deposit of 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your deposit of 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your deposit of 100 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit your deposit of 100. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your deposit of 100

How to fill out your deposit of 100

01

Start by gathering all the necessary information and documents required to open a deposit account.

02

Choose a financial institution or bank where you want to open your deposit account. It should be a reputable and reliable institution.

03

Visit the chosen bank or financial institution in person or access their online platform if available.

04

Fill out the required application form for opening a deposit account. Provide accurate and up-to-date personal information, including your full name, address, contact details, and identification documents.

05

Specify the deposit amount as 100 units of your currency.

06

Select the term or duration for which you want to keep your deposit. It could be a few months or several years. Make sure to consider the interest rates and benefits associated with different term options.

07

Provide any additional details or instructions required by the bank or financial institution. This may include choosing the type of deposit account, specifying joint or individual ownership, and selecting any additional features or services.

08

Review the terms and conditions of the deposit account carefully. Understand the interest rates, withdrawal procedures, penalties for early termination, and any other relevant policies.

09

Sign the application form and submit it along with the required documents to the bank or financial institution. Keep a copy of the application form and any receipts or acknowledgment provided by the institution.

10

Wait for the confirmation and account opening process to complete. Once done, you will receive the details of your deposit account, including the account number, terms, and any other relevant information.

11

Make the deposit of 100 units of your currency into the newly opened account. Follow the instructions provided by the bank or financial institution for depositing funds.

12

Keep track of your deposit and any subsequent transactions or changes related to your account.

13

Monitor the interest earned and any applicable fees or charges associated with the deposit. Ensure timely payments and adherence to the terms of the deposit account.

14

Consider reviewing and adjusting your deposit strategy periodically based on your financial goals and market conditions.

15

If needed, seek assistance or advice from a financial advisor or banking professional to optimize the benefits of your deposit.

Who needs your deposit of 100?

01

Anyone who wants to save their money and earn interest on it can benefit from a deposit of 100. Whether you are an individual looking to secure your funds, small business or organization wanting to grow your savings, or even a student trying to start building a financial foundation, a deposit of 100 can serve as a starting point. It allows you to establish a relationship with a financial institution, explore different investment options, and gradually increase your savings over time. By depositing 100, you demonstrate financial responsibility and take a step towards achieving your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit your deposit of 100 online?

With pdfFiller, it's easy to make changes. Open your your deposit of 100 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit your deposit of 100 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your your deposit of 100, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the your deposit of 100 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign your deposit of 100. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is your deposit of 100?

The deposit of 100 refers to an amount of money that is paid as an initial payment or security, often required in various transactions, contracts, or financial agreements.

Who is required to file your deposit of 100?

Typically, individuals or entities engaging in certain financial transactions or agreements may be required to file a deposit of 100. This could include businesses filing with regulatory agencies or individuals applying for loans.

How to fill out your deposit of 100?

To fill out your deposit of 100, provide your personal or business information, the amount of the deposit, the purpose of the deposit, and any required documentation that needs to accompany the form.

What is the purpose of your deposit of 100?

The purpose of your deposit of 100 is to secure a commitment for a service or contract, demonstrate good faith in a transaction, or fulfill a requirement for participation in a certain process, such as bidding or leasing.

What information must be reported on your deposit of 100?

Information typically required includes the depositor's name, contact information, the amount of the deposit, the purpose, date of the deposit, and any relevant identification or account numbers.

Fill out your your deposit of 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Deposit Of 100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.