Get the free Gift Tax Limit 2021: How Much Can You Gift? - SmartAsset

Show details

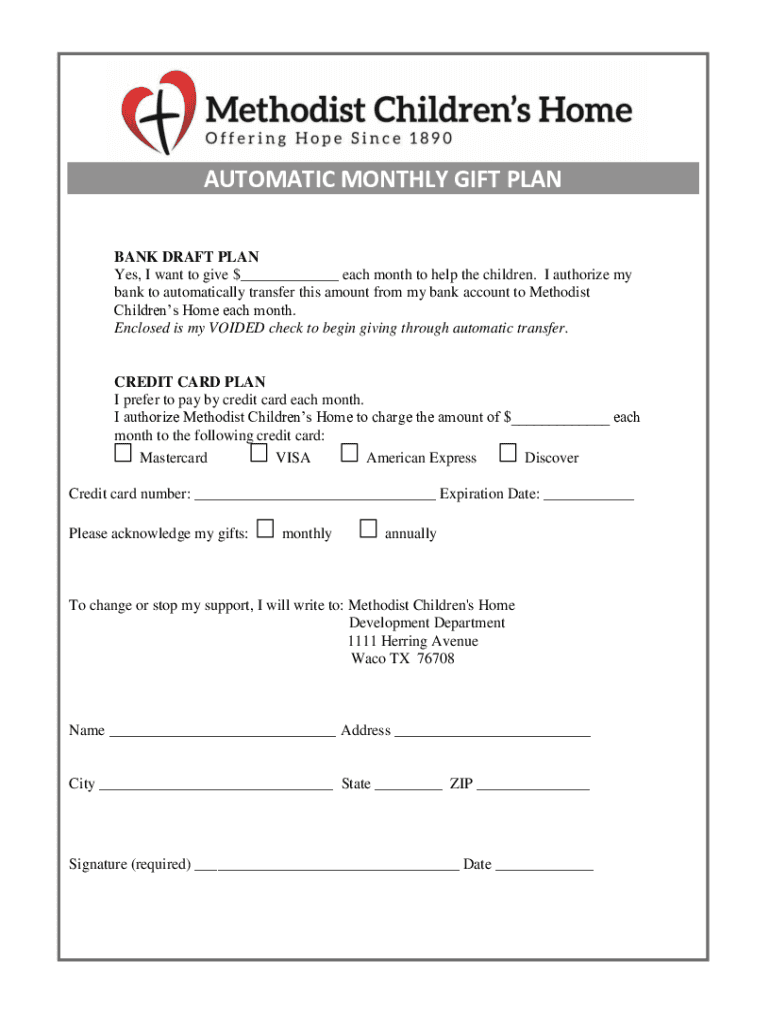

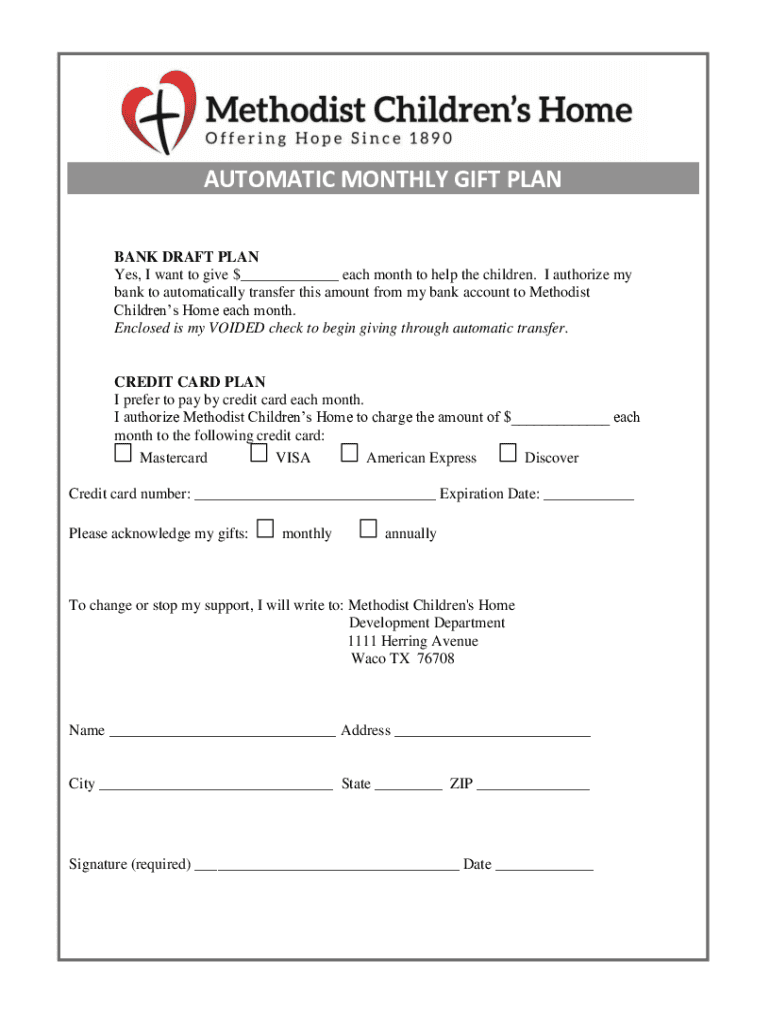

AUTOMATIC MONTHLY GIFT PLAN BANK DRAFT PLAN Yes, I want to give $ each month to help the children. I authorize my bank to automatically transfer this amount from my bank account to Methodist Children's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift tax limit 2021

Edit your gift tax limit 2021 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift tax limit 2021 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift tax limit 2021 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift tax limit 2021. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift tax limit 2021

How to fill out gift tax limit 2021

01

To fill out the gift tax limit for 2021, follow these steps:

02

Determine the current gift tax limit for the year, which is $15,000 per recipient.

03

Calculate the total value of the gifts you have given to each recipient throughout the year.

04

If the total value exceeds the annual gift tax limit, you may need to file a gift tax return (Form 709) with the IRS.

05

Obtain Form 709 from the IRS website or consult a tax professional for assistance in completing the form.

06

Fill out the necessary information on the form, including your personal details, the recipient's details, and the value of the gift.

07

Attach any additional documentation, if required, such as appraisals or valuations of the gifted assets.

08

Double-check the accuracy of the information provided and make sure all required fields are completed.

09

Sign and date the form before sending it to the appropriate IRS address as mentioned in the instructions.

10

Retain a copy of the completed form and supporting documents for your records.

11

If you are unsure about the gift tax laws or have complex gifting situations, it is advisable to consult with a tax professional for guidance.

Who needs gift tax limit 2021?

01

Various individuals may need to be aware of and adhere to the gift tax limit for 2021, including:

02

- Individuals who plan to gift money or assets to others and want to remain within the tax-exempt limit.

03

- Parents or grandparents who wish to provide financial support to their children or grandchildren.

04

- Individuals who plan to make sizable donations or gifts to charities.

05

- Estate planners or professionals who deal with wealth transfer strategies.

06

- Business owners who want to gift shares or ownership interests to their family members or partners.

07

- Trustees or executors of trusts who may need to make distributions to beneficiaries as gifts.

08

- Individuals who anticipate receiving significant gifts and want to understand the tax implications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift tax limit 2021 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign gift tax limit 2021 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit gift tax limit 2021 online?

The editing procedure is simple with pdfFiller. Open your gift tax limit 2021 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out gift tax limit 2021 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your gift tax limit 2021, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is gift tax limit how?

The gift tax limit refers to the maximum amount an individual can give as a gift without incurring gift tax. As of 2023, the annual exclusion amount is $17,000 per recipient.

Who is required to file gift tax limit how?

Individuals who give gifts that exceed the annual exclusion limit of $17,000 must file a gift tax return (Form 709) to report the excess amount.

How to fill out gift tax limit how?

To fill out the gift tax return, you need to complete IRS Form 709, providing details on the gifts given, their fair market value, and the recipient's information.

What is the purpose of gift tax limit how?

The purpose of the gift tax limit is to prevent individuals from avoiding estate taxes by giving away their assets while they are still alive.

What information must be reported on gift tax limit how?

The reported information includes the donor's details, recipient's details, description of the gifts, the dates they were given, and their fair market values.

Fill out your gift tax limit 2021 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Tax Limit 2021 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.