Get the free 2017 12 31 Financial Statements - Hand in Hand Ministries

Show details

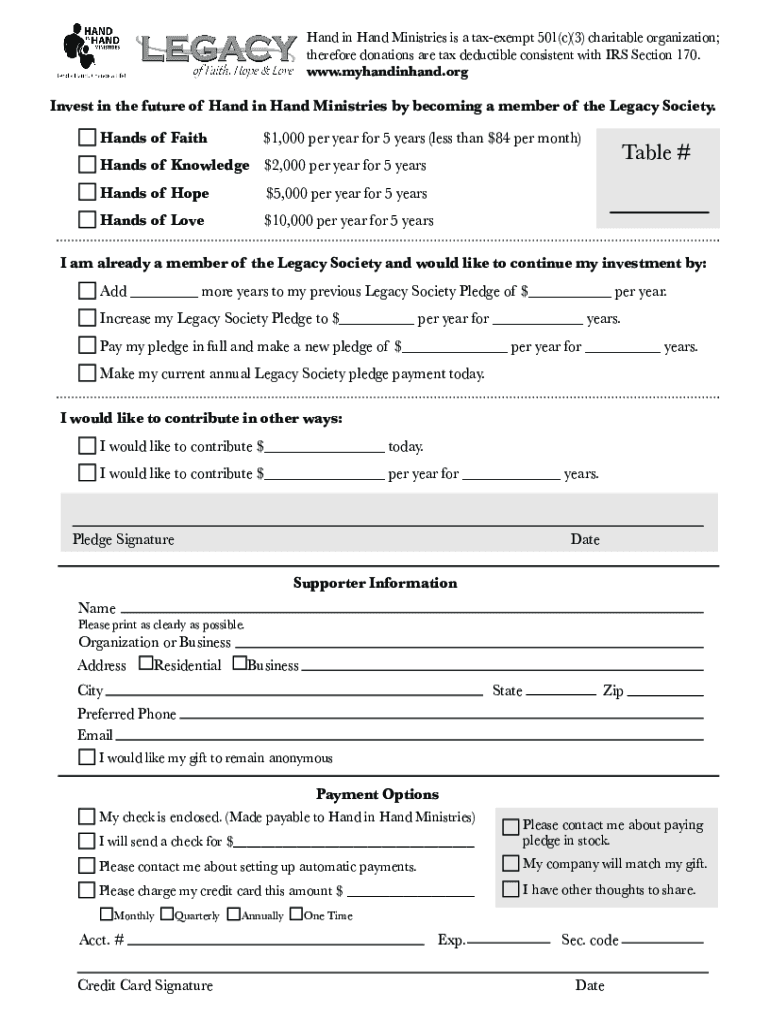

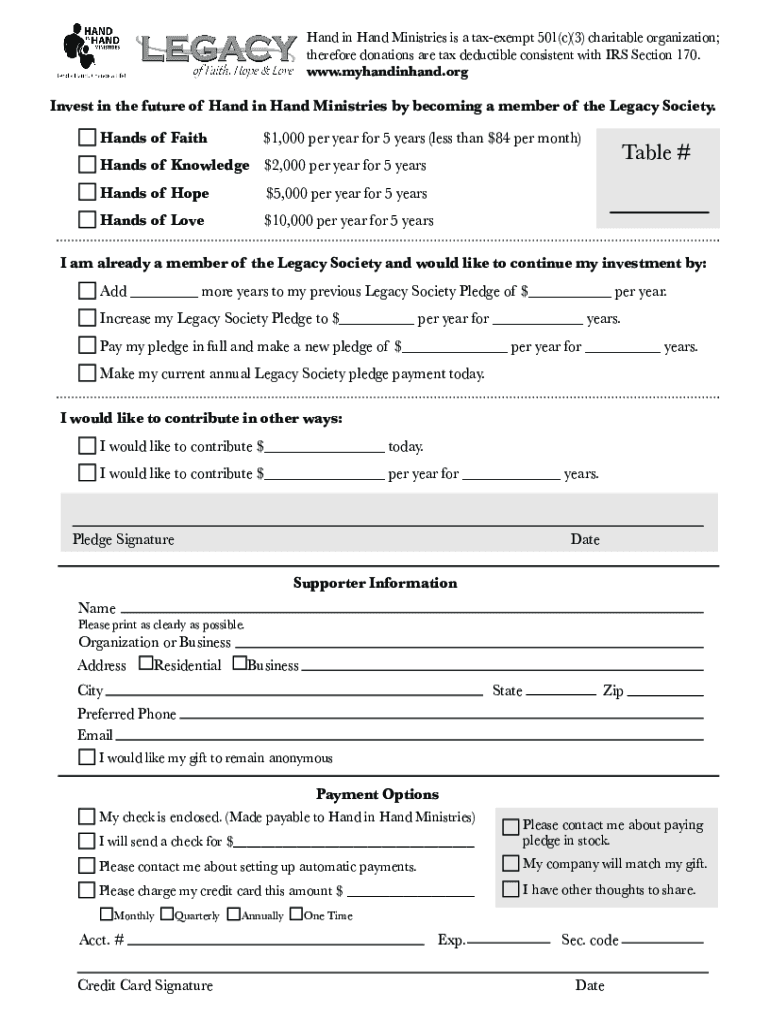

Hand in Hand Ministries is a tax-exempt 501(c)(3) charitable organization;

therefore donations are tax-deductible consistent with IRS Section 170.

www.myhandinhand.orgInvest in the future of Hand

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2017 12 31 financial

Edit your 2017 12 31 financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2017 12 31 financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2017 12 31 financial online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2017 12 31 financial. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2017 12 31 financial

How to fill out 2017 12 31 financial

01

Start by gathering all necessary financial documents for the year ending December 31, 2017. This may include bank statements, receipts, invoices, and any other relevant financial records.

02

Organize these documents in a systematic manner, ensuring that you have a clear record of all income and expenses for the year.

03

Review your financial documents to ensure accuracy and completeness. This may involve cross-checking figures, verifying calculations, and reconciling any discrepancies.

04

Use these financial records to prepare a balance sheet, income statement, and cash flow statement for the year ending December 31, 2017. These statements will provide a comprehensive snapshot of your financial position and performance during that period.

05

Ensure that all necessary adjustments, accruals, and provisions are appropriately accounted for in the financial statements.

06

Once the financial statements are prepared, review them for accuracy and ensure that they comply with relevant accounting standards and regulations.

07

If required, have the financial statements audited by a qualified accountant or accounting firm to provide an independent verification of your financial position and performance.

08

Finally, distribute the completed financial statements to relevant stakeholders, such as shareholders, investors, lenders, and regulatory authorities, as required by law or industry regulations.

Who needs 2017 12 31 financial?

01

Businesses and organizations of all sizes need the financial statements for the year ending December 31, 2017. This includes publicly-traded companies, privately-held companies, non-profit organizations, government agencies, and other entities.

02

Stakeholders such as investors, shareholders, lenders, creditors, and regulatory authorities often require these financial statements to assess the financial health and performance of the businesses or organizations they are associated with or monitoring.

03

Financial statements also serve as a crucial tool for management and decision-making purposes. They provide valuable insights into the financial position, profitability, and cash flow of a company, helping management make informed decisions and plan for the future.

04

Additionally, tax authorities may require these financial statements to ensure compliance with tax laws and regulations.

05

Furthermore, audited financial statements may be necessary for companies seeking external funding or planning for mergers and acquisitions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2017 12 31 financial online?

pdfFiller makes it easy to finish and sign 2017 12 31 financial online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit 2017 12 31 financial online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 2017 12 31 financial to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the 2017 12 31 financial form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign 2017 12 31 financial. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is 12 31 financial statements?

12 31 financial statements refer to the financial reports that are prepared as of December 31st of a fiscal year. They typically include the balance sheet, income statement, and cash flow statement, reflecting the company's financial position at the end of the year.

Who is required to file 12 31 financial statements?

Generally, businesses that operate as corporations, partnerships, or limited liability companies (LLCs) are required to file 12 31 financial statements, especially if they are publicly traded or must comply with regulatory bodies such as the IRS or SEC.

How to fill out 12 31 financial statements?

To fill out 12 31 financial statements, organizations must gather their financial data from the year-end, including revenues, expenses, assets, liabilities, and equity, then compile this information into structured reports following accounting principles and standards.

What is the purpose of 12 31 financial statements?

The purpose of 12 31 financial statements is to provide stakeholders, including investors and regulators, with a transparent overview of a company's financial health, performance, and cash flow, enabling informed decision-making.

What information must be reported on 12 31 financial statements?

12 31 financial statements must report key information such as total assets, total liabilities, shareholders' equity, revenues, expenses, net income, and cash flows from operating, investing, and financing activities.

Fill out your 2017 12 31 financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2017 12 31 Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.