Get the free TIEA agreement between Mauritius and GreenlandLegal ...

Show details

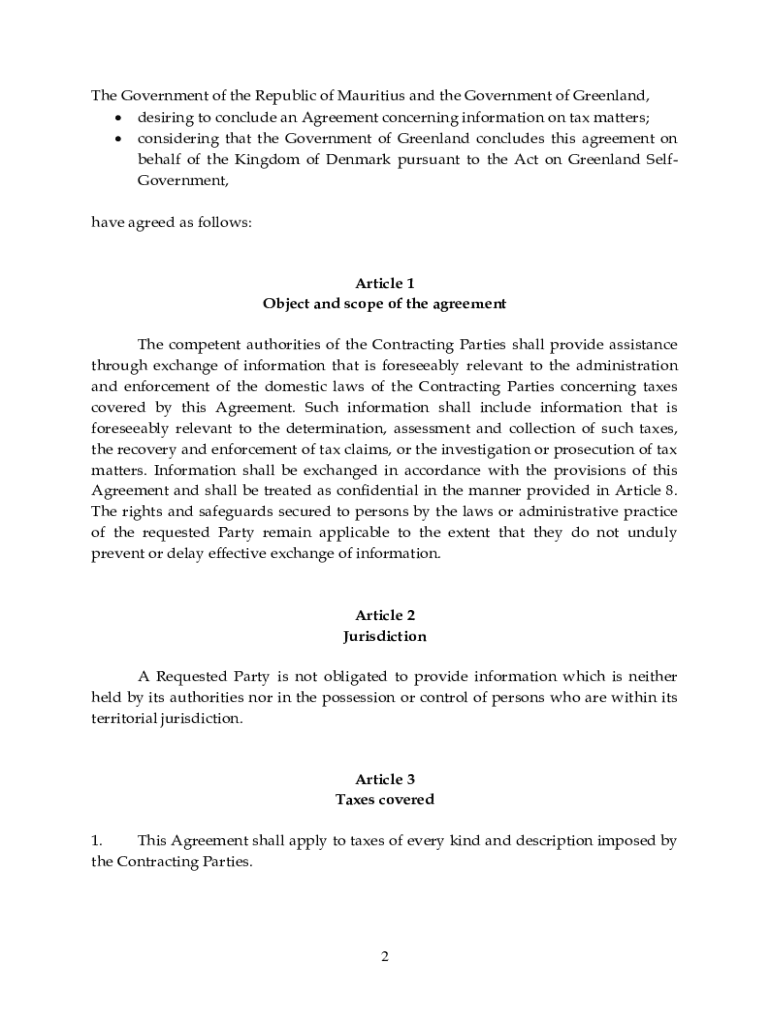

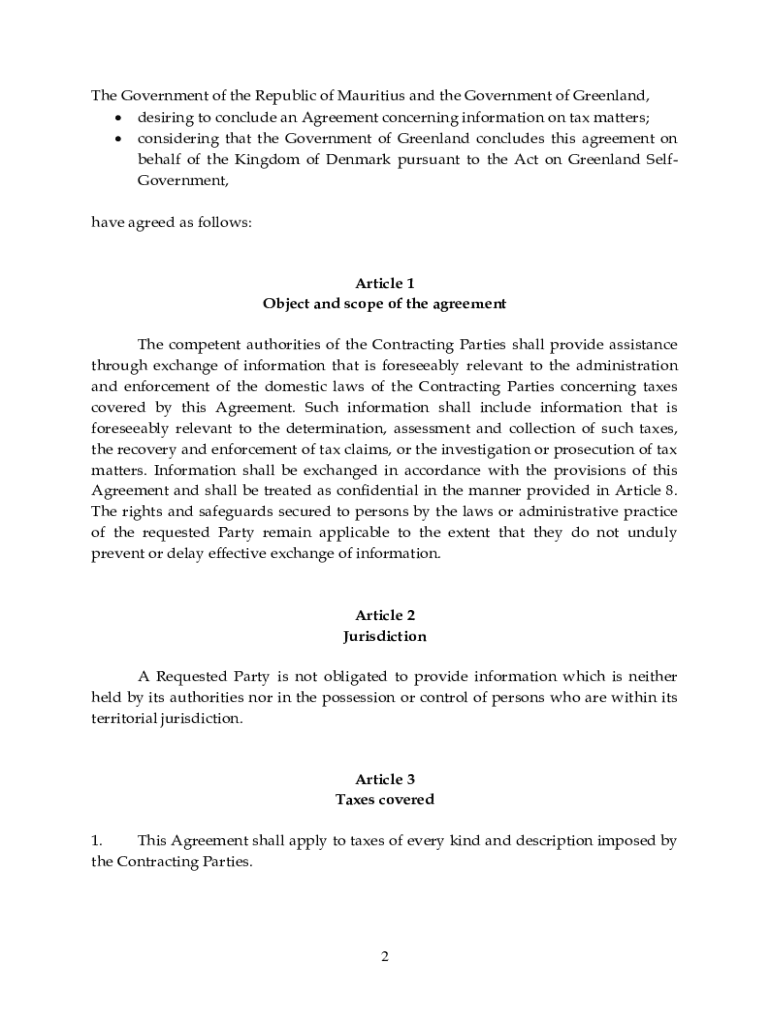

The Government of the Republic of Mauritius and the Government of Greenland, desiring to conclude an Agreement concerning information on tax matters; considering that the Government of Greenland concludes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tiea agreement between mauritius

Edit your tiea agreement between mauritius form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tiea agreement between mauritius form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tiea agreement between mauritius online

Here are the steps you need to follow to get started with our professional PDF editor:

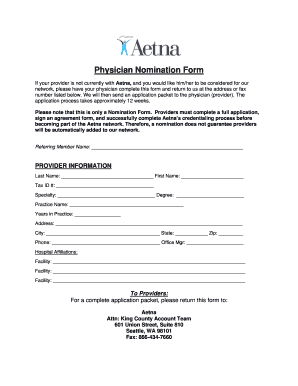

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tiea agreement between mauritius. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tiea agreement between mauritius

How to fill out tiea agreement between mauritius

01

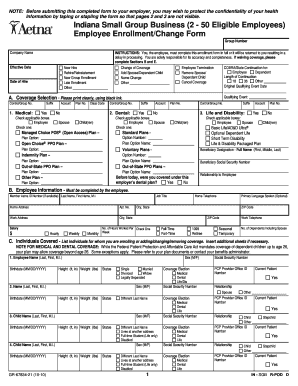

To fill out a TIEA (Tax Information Exchange Agreement) between Mauritius, follow these steps:

02

Start by gathering all the necessary information and documents required for the agreement.

03

Begin by entering the basic details of both parties involved in the agreement, including their names, addresses, and contact information.

04

Specify the purpose of the agreement and the scope of the exchange of tax information between Mauritius and the other party.

05

Provide provisions regarding the confidentiality and use of the exchanged information to ensure its proper handling and protection.

06

Outline the procedures and mechanisms for the exchange of tax information, including the timeline, methods, and channels to be used.

07

Clearly define the types of information that will be subject to exchange, such as bank account details, ownership and control information, etc.

08

Determine the conditions for denying or delaying the exchange of information in exceptional cases, and include any necessary safeguards.

09

Include provisions related to the costs, expenses, and any fees associated with the exchange of tax information.

10

Make sure to include dispute resolution mechanisms, such as arbitration or consultation, in the event of conflicts or disagreements.

11

Carefully review the completed agreement and seek legal advice if necessary before finalizing and signing it.

Who needs tiea agreement between mauritius?

01

A TIEA (Tax Information Exchange Agreement) between Mauritius is generally needed for the following parties:

02

- Countries or territories seeking to enhance their tax transparency and combat tax evasion by exchanging information with Mauritius.

03

- Governments or tax authorities aiming to investigate tax-related offenses and obtain relevant information from Mauritius.

04

- Individuals or entities involved in cross-border transactions or investments with Mauritius and requiring clarity on tax matters.

05

- International organizations working towards the promotion of global tax cooperation and information exchange.

06

- Financial institutions, banks, or other entities that need to comply with international tax regulations and reporting standards.

07

- Tax consultants, lawyers, or professionals specializing in international taxation who require information exchange agreements to support their advisory services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tiea agreement between mauritius?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific tiea agreement between mauritius and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit tiea agreement between mauritius on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tiea agreement between mauritius.

How do I fill out tiea agreement between mauritius using my mobile device?

Use the pdfFiller mobile app to complete and sign tiea agreement between mauritius on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is tiea agreement between mauritius?

The TIEA (Tax Information Exchange Agreement) between Mauritius is a treaty designed to promote international cooperation in tax matters by enabling the exchange of information between countries to combat tax evasion.

Who is required to file tiea agreement between mauritius?

Entities or individuals engaged in transactions that may involve tax implications or information that needs to be shared under the TIEA are required to file the agreement.

How to fill out tiea agreement between mauritius?

To fill out the TIEA agreement, one must provide the necessary identification details, specify the parties involved, include relevant tax information, and comply with the guidelines provided by the tax authorities of Mauritius.

What is the purpose of tiea agreement between mauritius?

The purpose of the TIEA agreement is to enhance transparency in tax matters, facilitate the exchange of tax-related information, and strengthen cooperation between Mauritius and other jurisdictions to combat tax evasion.

What information must be reported on tiea agreement between mauritius?

Information that must be reported includes details such as the names and addresses of the entities involved, amounts of income or assets, and any relevant tax identification numbers.

Fill out your tiea agreement between mauritius online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tiea Agreement Between Mauritius is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.