Get the free When a Company Pays for Stadium Naming Rights, Is It Time to ...

Show details

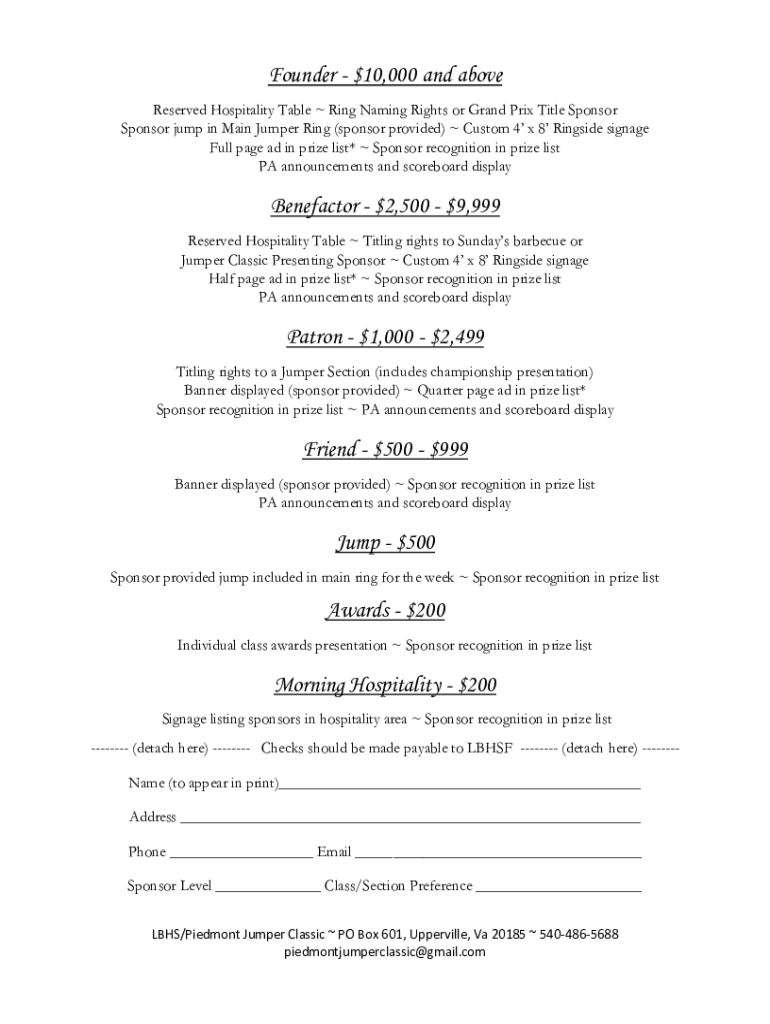

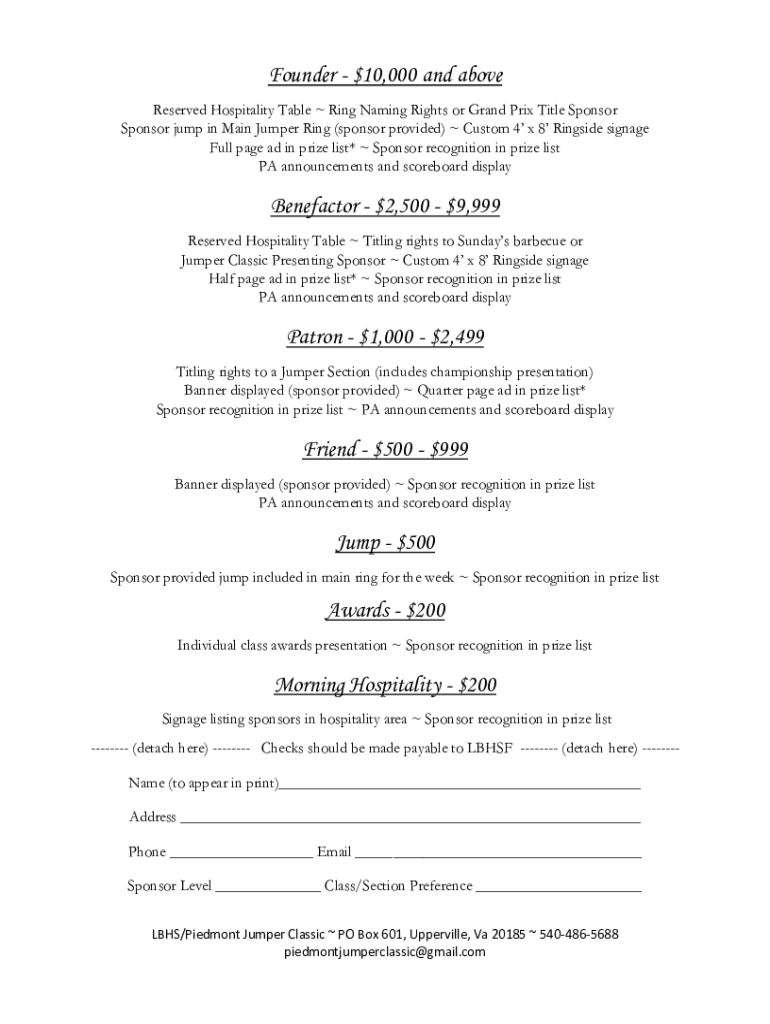

Founder $10,000 and above Reserved Hospitality Table Ring Naming Rights or Grand Prix Title Sponsor jump in Main Jumper Ring (sponsor provided) Custom 4 × 8 Ringside signage Full page ad in prize

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign when a company pays

Edit your when a company pays form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your when a company pays form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit when a company pays online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit when a company pays. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out when a company pays

How to fill out when a company pays

01

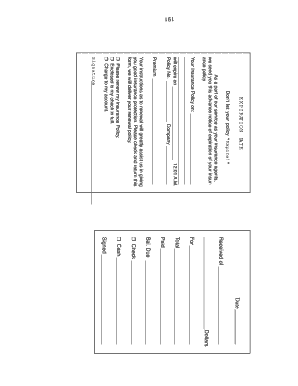

Collect all necessary information such as the company's name, address, and tax identification number.

02

Determine the payment method, whether it's by check, electronic transfer, or other means.

03

Prepare the payment voucher or invoice with the correct details, including the amount to be paid and any specific instructions.

04

Ensure that the company's financial records are up to date and that there are sufficient funds to cover the payment.

05

Double-check all the information before submitting the payment, including the recipient's details and any supporting documentation.

06

Follow the specified payment process or procedure set by the company, which may involve obtaining necessary approvals or signatures.

07

Record the payment in the company's accounts, including updating relevant ledgers or accounting software.

08

Keep a copy of the payment receipt or transaction record for future reference or reconciliation purposes.

Who needs when a company pays?

01

Companies need to fill out payments when they have financial obligations to vendors, suppliers, or service providers.

02

Individuals responsible for managing company finances, such as accountants or bookkeepers, also need to know how to fill out payments.

03

Government agencies or regulatory bodies may require companies to fill out payment documentation for compliance and reporting purposes.

04

External auditors or financial consultants may need to review payment records as part of their assessments or audits.

05

In some cases, employees who have been authorized to make payments on behalf of the company may also need to know the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my when a company pays in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your when a company pays and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in when a company pays?

The editing procedure is simple with pdfFiller. Open your when a company pays in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete when a company pays on an Android device?

On an Android device, use the pdfFiller mobile app to finish your when a company pays. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is when a company pays?

When a company pays refers to the process of reporting payments made to employees or contractors for tax purposes, often involving forms such as IRS Form 1099 or W-2.

Who is required to file when a company pays?

Employers who make payments to employees or independent contractors that meet certain thresholds are required to file the appropriate tax forms.

How to fill out when a company pays?

To fill out when a company pays forms, collect necessary information including payee details, payment amounts, and any taxes withheld, and then follow the specific form instructions.

What is the purpose of when a company pays?

The purpose is to report income to the IRS, ensure accurate tax withholding, and provide necessary documentation for tax liabilities.

What information must be reported on when a company pays?

The information typically includes the payee's name, address, taxpayer identification number, payment amounts, and any applicable tax withholdings.

Fill out your when a company pays online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

When A Company Pays is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.