Get the free Donor of Stock

Show details

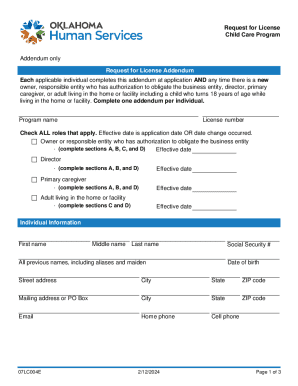

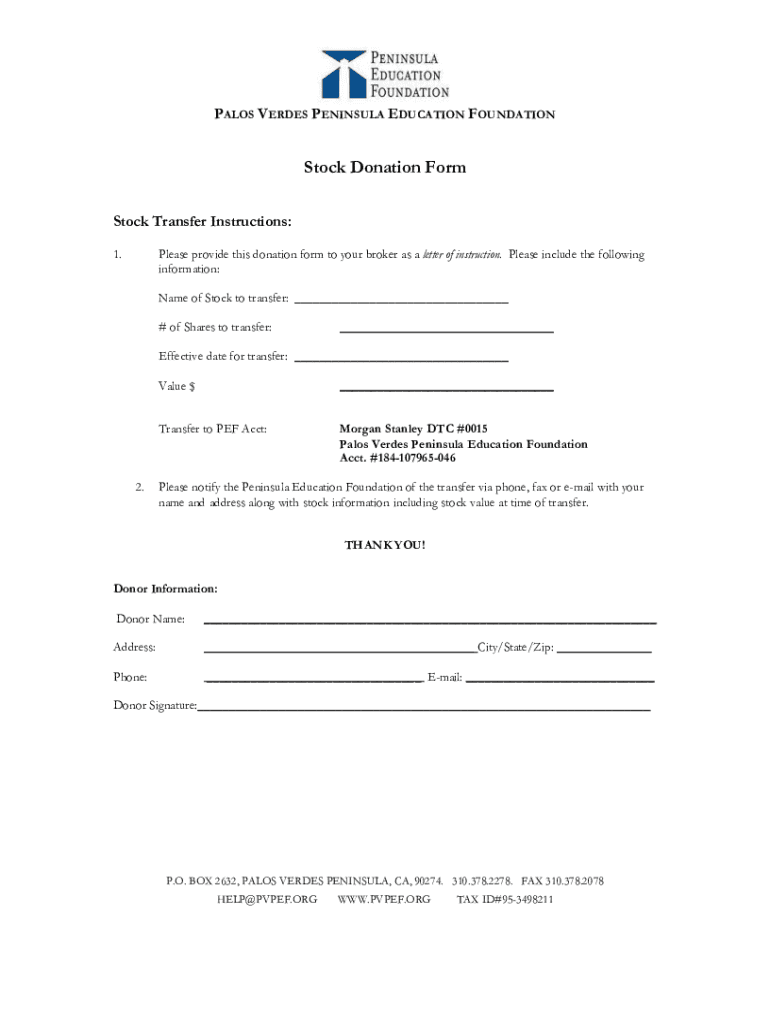

PALOS VERDES PENINSULA EDUCATION FOUNDATIONStock Donation Form Stock Transfer Instructions: 1. Please provide this donation form to your broker as a letter of instruction. Please include the following

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor of stock

Edit your donor of stock form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor of stock form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donor of stock online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donor of stock. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor of stock

How to fill out donor of stock

01

Obtain the required forms from the organization or institution to which you want to donate the stock.

02

Fill out the donor information section of the forms, providing your personal details such as name, address, and contact information.

03

Consult with a financial advisor or tax professional to understand the potential tax implications and benefits of donating stock.

04

Gather the necessary details about the stock you wish to donate, such as the name of the company, stock symbol, and the number of shares you intend to donate.

05

Determine the method of donation, whether it will be through electronic transfer or physical delivery of the stock certificates.

06

Follow the instructions provided by the organization or institution for completing the stock transfer process.

07

Notify the organization or institution once the stock transfer is complete and provide any additional required documentation.

08

Maintain copies of all completed forms and communication related to the stock donation for your records and any future reference.

Who needs donor of stock?

01

Non-profit organizations and charitable institutions often need donor of stock.

02

Individuals or entities seeking to support a cause or organization through stock donations.

03

Investors with appreciated stocks who want to avoid capital gains tax by donating the stock instead of selling it.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donor of stock in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your donor of stock along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find donor of stock?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific donor of stock and other forms. Find the template you need and change it using powerful tools.

How do I make changes in donor of stock?

The editing procedure is simple with pdfFiller. Open your donor of stock in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is donor of stock?

A donor of stock refers to an individual or an entity that transfers ownership of shares or stock to another party without expecting anything in return.

Who is required to file donor of stock?

The donor of stock is required to file, particularly when the transfer of shares exceeds a certain value or when the transfer is not a gift and potential tax liabilities are involved.

How to fill out donor of stock?

To fill out donor of stock, the donor needs to provide details such as the name and address of both the donor and recipient, the number of shares being transferred, the date of transfer, and any applicable valuations.

What is the purpose of donor of stock?

The purpose of donor of stock is to document the transfer of ownership of stock from one individual or entity to another, ensuring compliance with tax laws and regulations.

What information must be reported on donor of stock?

Information that must be reported includes the names and addresses of both the sender and receiver, the number of shares, their estimated value at the time of transfer, and any relevant dates.

Fill out your donor of stock online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Of Stock is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.