Get the free Nonprofit Organizations and Sales ... - Florida Dept. of Revenue

Show details

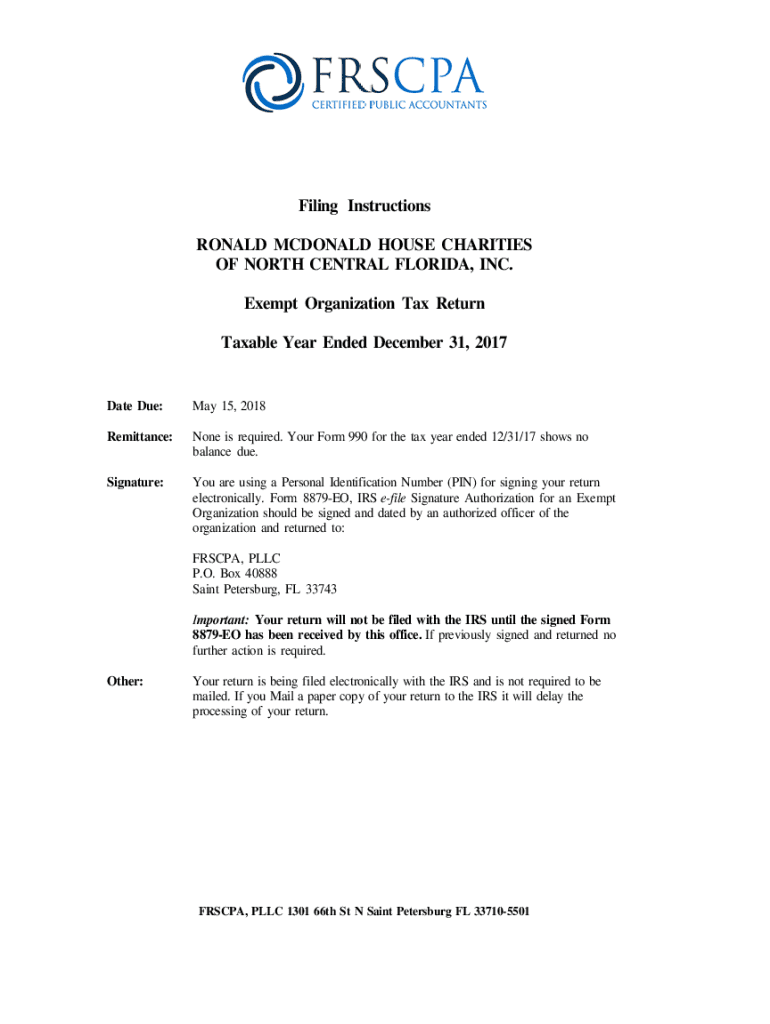

Filing Instructions

Ronald McDonald HOUSE CHARITIES

OF NORTH CENTRAL FLORIDA, INC.

Exempt Organization Tax Return

Taxable Year Ended December 31, 2017Date Due:May 15, 2018Remittance:None is required.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit organizations and sales

Edit your nonprofit organizations and sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit organizations and sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit organizations and sales online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nonprofit organizations and sales. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

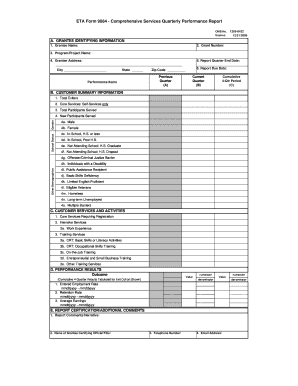

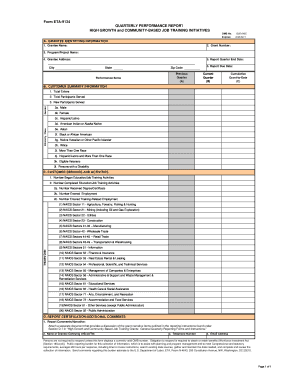

How to fill out nonprofit organizations and sales

How to fill out nonprofit organizations and sales

01

To fill out nonprofit organizations and sales, follow these steps:

02

Gather all the necessary information and documents about your nonprofit organization, such as its name, purpose, address, etc.

03

Determine the appropriate form or application for filing nonprofit organizations and sales. This may vary depending on your location and the specific requirements of your jurisdiction.

04

Complete the form or application accurately and in its entirety. Make sure to provide all the required information and attach any supporting documents as requested.

05

Review the filled-out form or application for any errors or missing information. Correct any mistakes before submitting it.

06

Submit the filled-out form or application to the appropriate authority or regulatory body. This may involve mailing it, submitting it electronically, or delivering it in person.

07

Pay any applicable fees or obtain any necessary certifications or permits as required by the authorities.

08

Keep a copy of the submitted form or application and any related documents for your records.

09

Follow up with the authorities or regulatory body to ensure that your nonprofit organization and sales are properly registered and approved.

10

Comply with any ongoing reporting or compliance obligations to maintain the legal status of your nonprofit organization and sales.

Who needs nonprofit organizations and sales?

01

Nonprofit organizations and sales are needed by individuals, groups, or entities who are engaged in activities that are not primarily for profit-making purposes.

02

Some examples of those who need nonprofit organizations and sales are:

03

- Charitable organizations that provide social services or support to disadvantaged groups or communities.

04

- Educational institutions or foundations that seek to promote knowledge and learning.

05

- Religious or spiritual organizations that serve a specific faith or belief system.

06

- Cultural organizations that preserve and promote arts, heritage, or traditions.

07

- Advocacy or lobbying groups that work towards specific causes or public interest issues.

08

In general, nonprofit organizations and sales are necessary for those who want to establish a legally recognized and structured entity to carry out activities that benefit the public or a specific target audience, rather than primarily aiming for financial gain.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nonprofit organizations and sales directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign nonprofit organizations and sales and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit nonprofit organizations and sales from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including nonprofit organizations and sales, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the nonprofit organizations and sales in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your nonprofit organizations and sales directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is nonprofit organizations and sales?

Nonprofit organizations are entities that operate for a charitable purpose rather than for profit. These organizations may engage in sales of products or services to support their mission, but they do not distribute profits to shareholders.

Who is required to file nonprofit organizations and sales?

Nonprofit organizations that engage in sales activities and earn revenue typically need to file specific tax forms, such as IRS Form 990, to report their financial activities and maintain tax-exempt status.

How to fill out nonprofit organizations and sales?

To fill out forms related to nonprofit organizations and sales, you must gather financial information, including income from sales, expenses, and donations. Follow the instructions provided with the forms, often using accounting software or consulting with a tax professional for accuracy.

What is the purpose of nonprofit organizations and sales?

The purpose of nonprofit organizations and their sales activities is to generate revenue that supports their charitable missions while also providing goods or services that benefit the community.

What information must be reported on nonprofit organizations and sales?

Nonprofit organizations must report their revenue from sales, expenses, program activities, changes in net assets, and any compensation paid to employees or contractors, along with other financial and operational details.

Fill out your nonprofit organizations and sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Organizations And Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.