Get the free Certificates of Deposit - Tri-Town Teachers Federal Credit Union

Show details

61 JESUS ROAD

WESTPORT, CT 06880

Web address: www.tttfcu.org

Telephone:

Fax:203 2278511

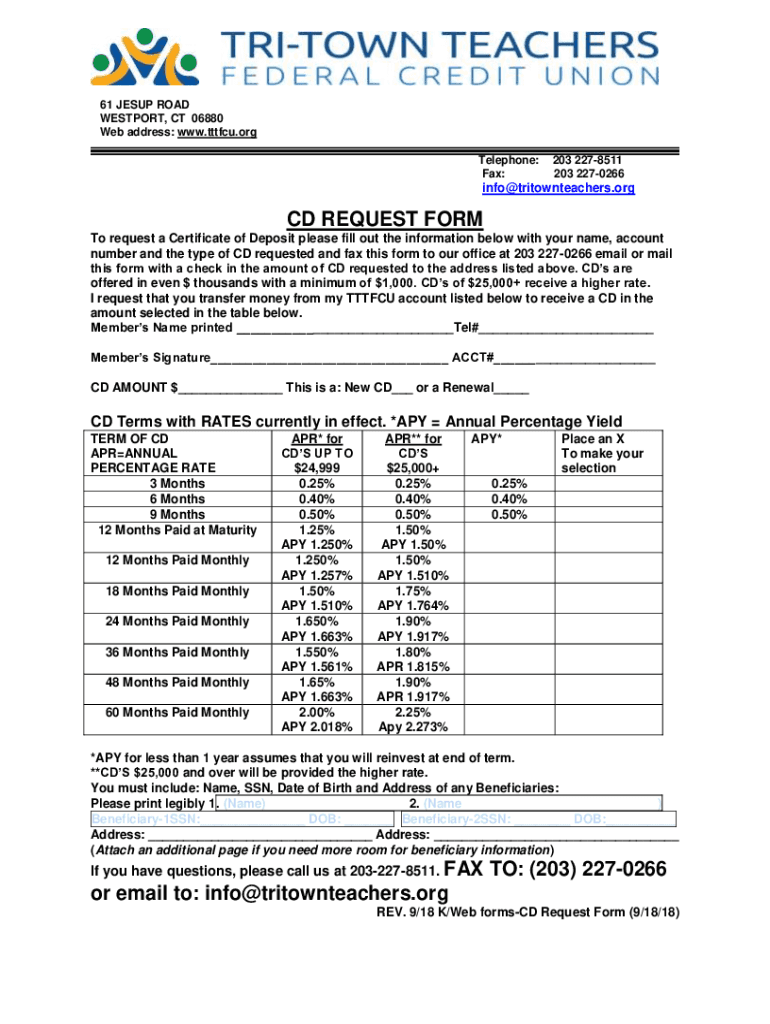

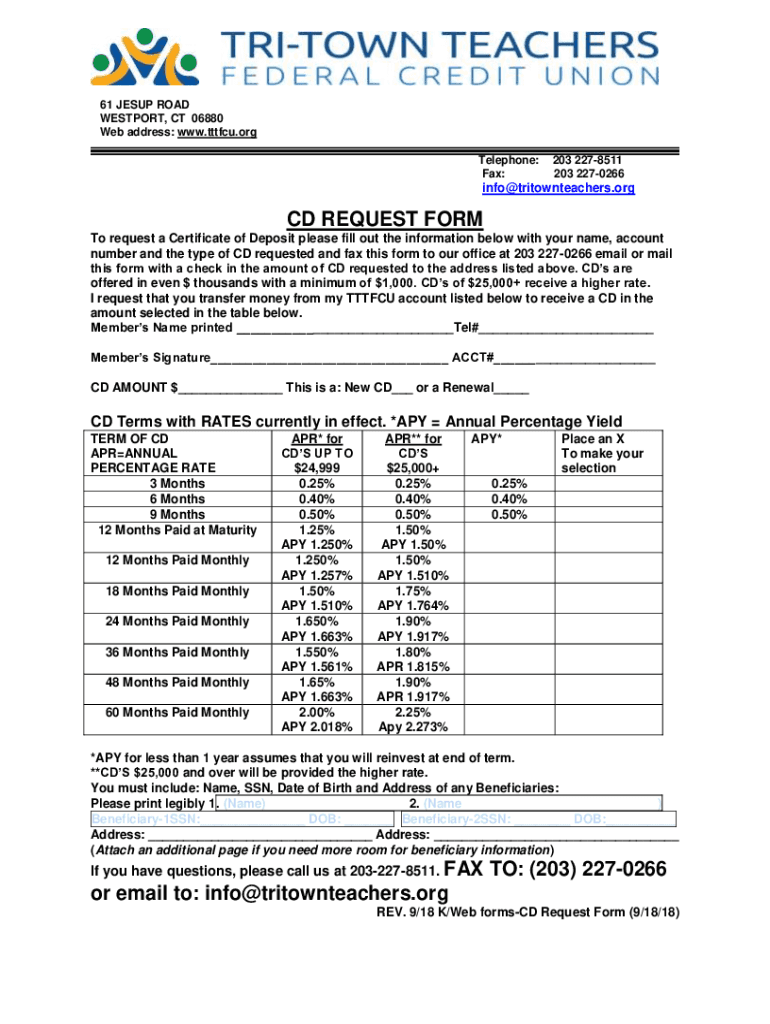

203 2270266info@tritownteachers.orgCD REQUEST FORM

To request a Certificate of Deposit please fill out the information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificates of deposit

Edit your certificates of deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificates of deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificates of deposit online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit certificates of deposit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificates of deposit

How to fill out certificates of deposit

01

To fill out a certificate of deposit (CD), follow these steps:

02

Gather the necessary information: You will need the name of the account holder, account number, and the desired amount of the deposit.

03

Obtain the CD application form: Contact your bank or financial institution to request the CD application form, or download it from their website if available.

04

Fill in the account holder's information: Enter the name, address, phone number, and social security number or taxpayer identification number of the account holder.

05

Provide the account details: Write down the account number and type of account, such as individual or joint account.

06

Specify the deposit amount: Enter the amount of money you want to deposit into the CD. Ensure it meets the minimum deposit requirements.

07

Choose the CD term: Indicate the desired term length for the CD, such as 6 months, 1 year, or more.

08

Sign and date the application: Read the terms and conditions carefully, then sign and date the application form.

09

Submit the application: Return the completed application to your bank or financial institution either in person or by mail.

10

Make the deposit: Once your application is approved, you may need to provide the funds for the CD deposit. Follow the instructions given by your bank to complete the transaction.

11

Receive the certificate: After the funds have been deposited, you will receive the certificate of deposit as proof of your investment.

Who needs certificates of deposit?

01

Certificates of deposit can be beneficial for various individuals, including:

02

- Savers: People who want to earn higher interest rates on their savings than what regular savings accounts offer.

03

- Risk-averse investors: Those who prioritize the safety of their investment rather than potential high returns.

04

- Retirees: Individuals who want to supplement their retirement income by investing in a low-risk financial product.

05

- Short-term financial planners: People who are saving for a specific short-term goal, such as a down payment on a house or a major purchase.

06

- Those who want fixed returns: Individuals who prefer knowing how much interest they will earn over a fixed period.

07

- Conservative investors: People who are not comfortable with the volatility of the stock market and prefer stable investment options.

08

- Those looking for FDIC insurance: CD deposits are usually insured by the Federal Deposit Insurance Corporation (FDIC), providing added security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find certificates of deposit?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific certificates of deposit and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit certificates of deposit online?

The editing procedure is simple with pdfFiller. Open your certificates of deposit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete certificates of deposit on an Android device?

Use the pdfFiller mobile app to complete your certificates of deposit on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is certificates of deposit?

Certificates of deposit (CDs) are financial products offered by banks that allow individuals to deposit money for a fixed term in exchange for a higher interest rate than a regular savings account.

Who is required to file certificates of deposit?

Individuals or entities that hold certificates of deposit with banks or financial institutions are typically required to report them for taxation or regulatory purposes.

How to fill out certificates of deposit?

To fill out a certificate of deposit, one typically provides personal information, account number, deposit amount, term length, and may need to sign the document.

What is the purpose of certificates of deposit?

The purpose of certificates of deposit is to offer a secure investment option with a guaranteed return for a specific term, typically with higher interest rates than traditional savings accounts.

What information must be reported on certificates of deposit?

Information that must be reported includes the depositor's name, the amount of the deposit, the interest rate, and the duration of the term.

Fill out your certificates of deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificates Of Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.