Get the free Pass Through Entities - PA Department of Revenue Homepage

Show details

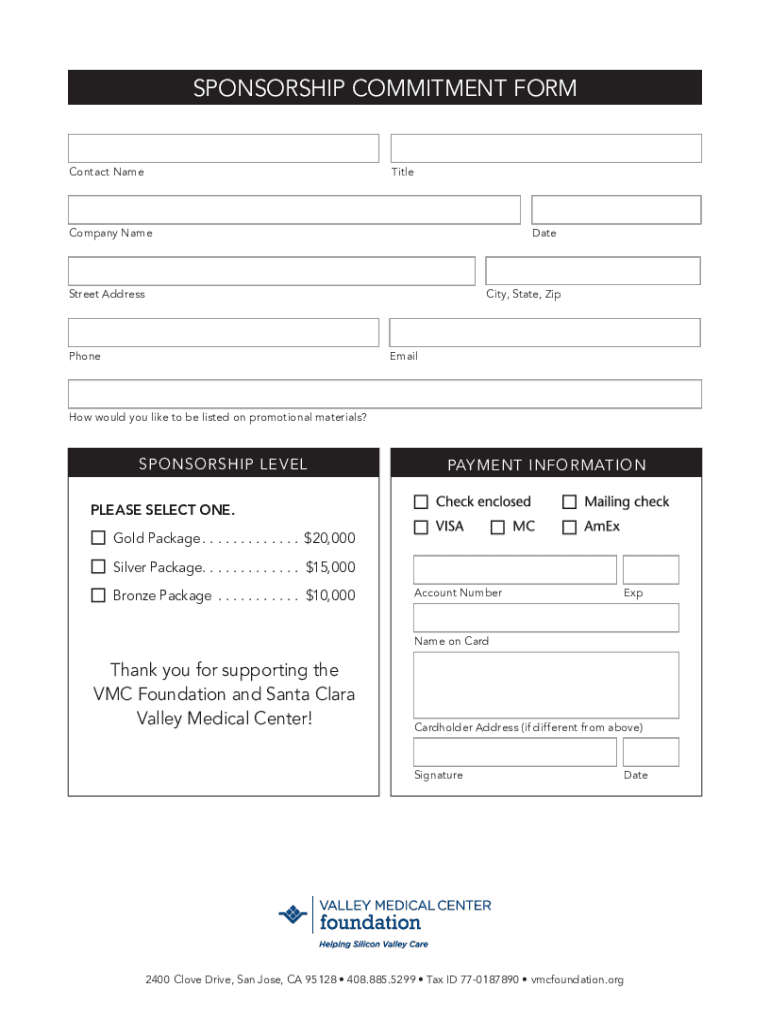

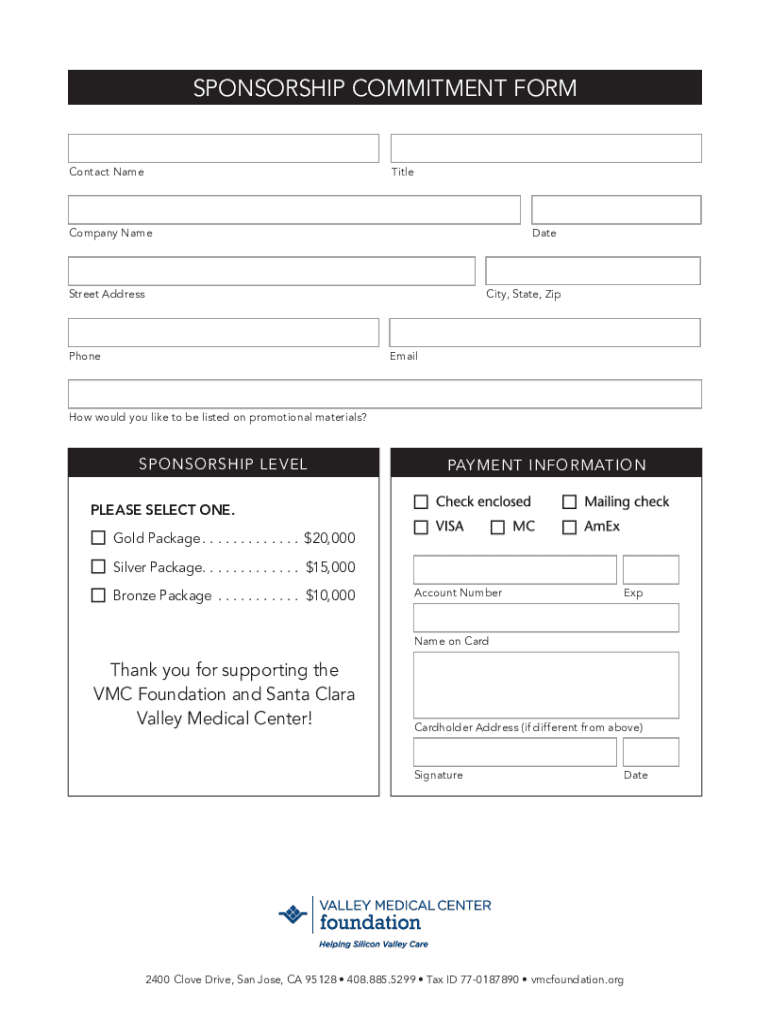

2 0 19 E V E N T PA R T N E R S H I P S Contact Julie Out, Director of Events Julie. Out HHS.school.org 408.282.2687Gold $20,000Silver $15,000Bronze $10,000Premier Vendor Fair SpringPremier Vendor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pass through entities

Edit your pass through entities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pass through entities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pass through entities online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pass through entities. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pass through entities

How to fill out pass through entities

01

To fill out pass through entities, follow these steps:

02

Gather all necessary information and documentation required to complete the form.

03

Start by identifying the type of pass through entity you are dealing with. This can include partnerships, S corporations, and certain limited liability companies (LLCs).

04

Next, provide the basic information about the entity, such as its name, EIN (Employer Identification Number), and address.

05

Proceed to report the income, deductions, and credits of the pass through entity. This typically involves completing various schedules and forms that are relevant to the specific type of entity.

06

Ensure that all information is accurate and that all required attachments, such as supporting documentation, are included.

07

Review the completed form for any errors or omissions.

08

Sign and date the form, if applicable, and keep a copy for your records.

09

Submit the completed form to the appropriate tax authority, following their specific guidelines and deadline requirements.

Who needs pass through entities?

01

Pass through entities are commonly used by businesses or individuals who want to avoid double taxation and pass their income, deductions, and credits through to their owners or shareholders.

02

Some examples of who needs pass through entities are:

03

- Small business owners who operate as a partnership or an LLC and want to maintain a separate legal entity for liability protection while avoiding corporate taxation.

04

- Real estate investors who form partnerships or LLCs to hold and manage their real estate properties.

05

- Venture capitalists and angel investors who invest in start-up companies and prefer to receive pass through income from their investments.

06

- Family-owned businesses that want to transfer wealth and assets to future generations.

07

- Professional service providers such as lawyers, doctors, and consultants who form partnerships or LLCs to pool resources and share profits while maintaining personal liability protection.

08

It's important to note that the eligibility and suitability of pass through entities may vary depending on the specific circumstances and applicable tax laws of each jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pass through entities directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your pass through entities and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit pass through entities online?

With pdfFiller, the editing process is straightforward. Open your pass through entities in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit pass through entities in Chrome?

Install the pdfFiller Google Chrome Extension to edit pass through entities and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is pass through entities?

Pass through entities are business structures that do not pay corporate income tax. Instead, income from these entities is passed through to the individual owners or shareholders, who report it on their personal tax returns.

Who is required to file pass through entities?

Owners of pass through entities such as partnerships, S corporations, and limited liability companies (LLCs) are required to file pass through entities, as well as the entities themselves for informational purposes.

How to fill out pass through entities?

To fill out pass through entities, one must complete the appropriate tax forms, such as Form 1065 for partnerships or Form 1120S for S corporations, providing necessary financial information and distributing K-1 forms to each owner to report their share of income.

What is the purpose of pass through entities?

The purpose of pass through entities is to avoid double taxation that occurs with traditional corporations, where the entity pays taxes on its income and then shareholders pay taxes on dividends.

What information must be reported on pass through entities?

Pass through entities must report information including the entity's income, deductions, credits, and other relevant financial data, as well as the allocation of income to each partner or shareholder.

Fill out your pass through entities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pass Through Entities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.