Get the free What is Planned Giving? Introductory Guide to Maximize ...Planned Gifts: The Introdu...

Show details

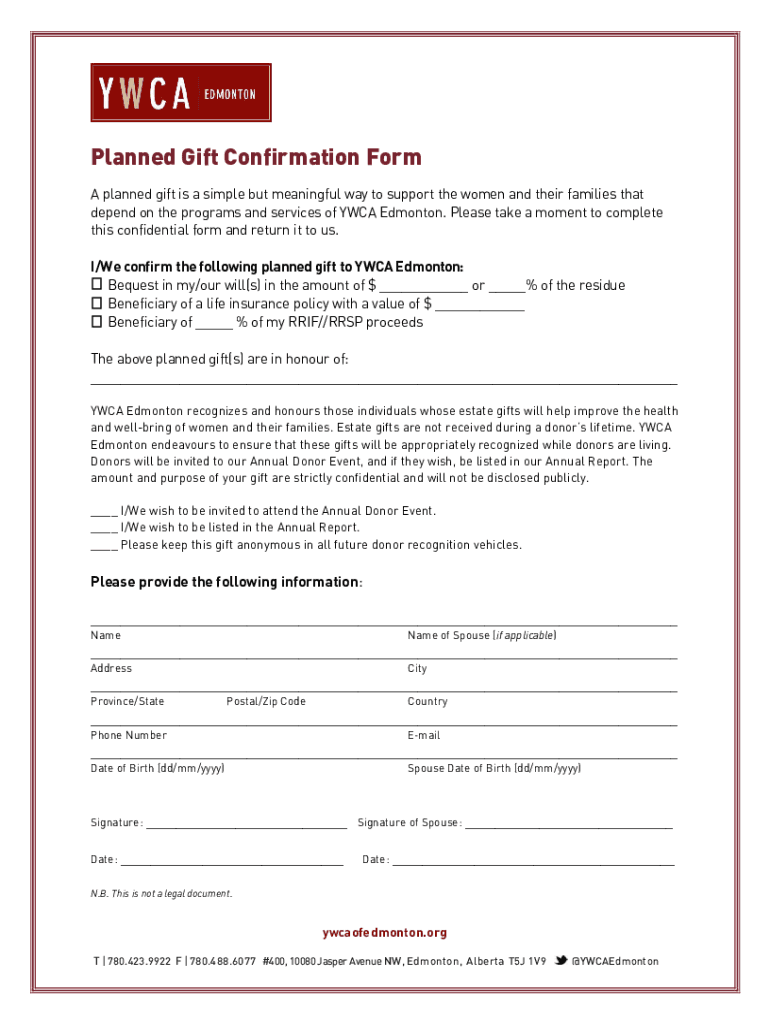

Planned Gift Confirmation Form A planned gift is a simple but meaningful way to support the women and their families that depend on the programs and services of YWCA Edmonton. Please take a moment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is planned giving

Edit your what is planned giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is planned giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what is planned giving online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit what is planned giving. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is planned giving

How to fill out what is planned giving

01

To fill out what is planned giving, follow these steps:

02

Determine what type of planned giving you want to engage in. This can include bequests, charitable gift annuities, charitable remainder trusts, and more.

03

Research and choose the charitable organization or organizations you wish to support through planned giving. Consider their mission, values, and track record.

04

Contact the chosen organization(s) and inquire about their planned giving program. They will provide you with the necessary information, forms, and guidance.

05

Review the planned giving options offered by the organization(s). Understand the benefits, tax implications, and any potential restrictions or requirements.

06

Consult with your financial advisor, lawyer, or tax professional to ensure the planned giving strategy aligns with your overall financial and estate plan.

07

Complete the required forms accurately and provide any supporting documents as requested by the organization(s).

08

Submit the completed forms to the organization(s) according to their instructions.

09

Keep copies of all documents for your records.

10

Consider regularly reviewing and updating your planned giving strategy as your circumstances or charitable goals evolve.

Who needs what is planned giving?

01

Anyone who wants to make a lasting impact on a charitable organization or cause can benefit from what is planned giving.

02

Specifically, planned giving can be advantageous for:

03

- Individuals who wish to leave a legacy or continue supporting their favorite charity beyond their lifetime.

04

- Donors who want to maximize the impact of their giving by utilizing tax incentives and financial planning strategies.

05

- Philanthropists who want to support multiple organizations or establish a long-term charitable foundation.

06

- Individuals with significant assets or wealth who want to minimize estate taxes or preserve their assets while providing support to causes they care about.

07

- Anyone who wants to ensure their charitable giving aligns with their personal values and long-term goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in what is planned giving without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing what is planned giving and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out what is planned giving using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign what is planned giving and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit what is planned giving on an Android device?

With the pdfFiller Android app, you can edit, sign, and share what is planned giving on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is planned giving?

Planned giving refers to a donation made to a nonprofit organization, often as part of a donor's estate plan. It allows individuals to make significant charitable contributions through their will or trust, typically involving financial or real estate assets.

Who is required to file planned giving?

Individuals who incorporate planned giving into their estate plans may not be required to file anything specific unless it involves taxable gifts or estate tax considerations. However, organizations that receive planned gifts may need to report these as part of their financial disclosures.

How to fill out planned giving?

Filling out planned giving documentation involves specifying the intended gift, such as cash, property, or stock, through legal documentation like a will or trust, and ensuring compliance with tax laws and nonprofit requirements.

What is the purpose of planned giving?

The purpose of planned giving is to provide a way for individuals to contribute to charitable organizations in a meaningful way that fits into their financial and estate planning while potentially receiving tax benefits.

What information must be reported on planned giving?

Information that may need to be reported includes the type of asset being donated, the estimated value, the intended recipient organization, and any related tax implications.

Fill out your what is planned giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Planned Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.