Get the free Online Bookkeeping Accounting Software Made Easy - GoDaddyOnline Bookkeeping Account...

Show details

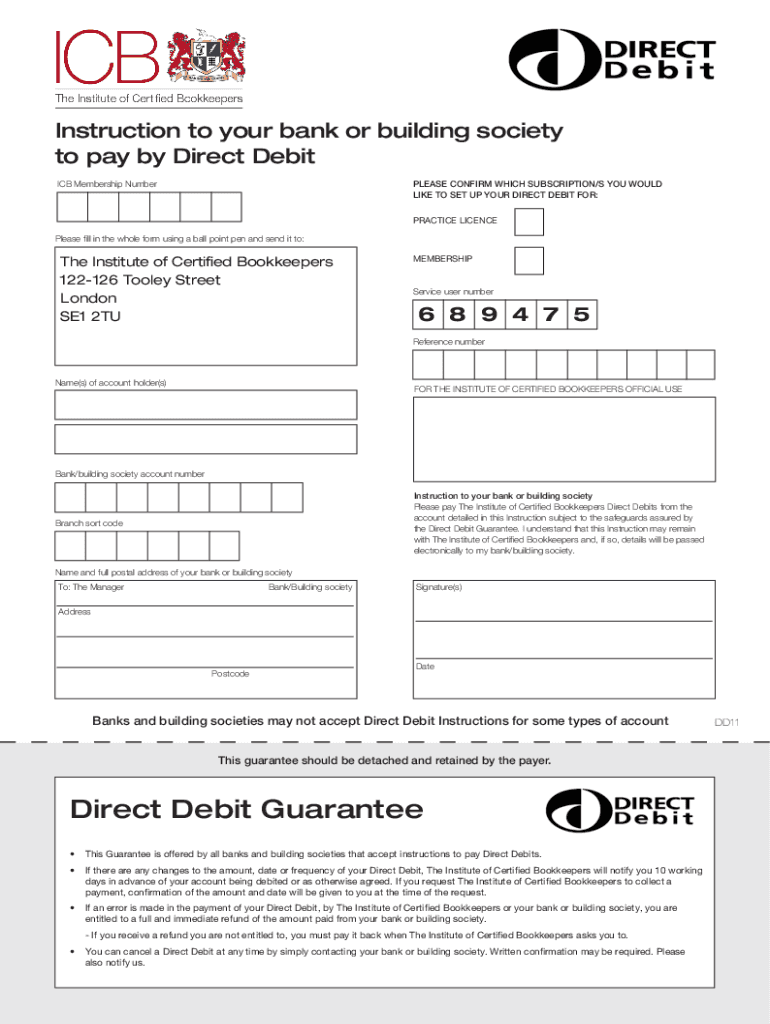

Instruction to your bank or building society to pay by Direct Debit ICB Membership Numberless CONFIRM WHICH SUBSCRIPTION/S YOU WOULD LIKE TO SET UP YOUR DIRECT DEBIT FOR: PRACTICE LICENCEPlease fill

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online bookkeeping accounting software

Edit your online bookkeeping accounting software form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online bookkeeping accounting software form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online bookkeeping accounting software online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit online bookkeeping accounting software. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online bookkeeping accounting software

01

To fill out online bookkeeping accounting software, start by creating an account on the platform of your choice.

02

Once you have created an account, provide the necessary information about your business, such as its name, address, and contact details.

03

Set up your chart of accounts by categorizing your income, expenses, assets, and liabilities. This will help you track and manage your financial transactions effectively.

04

Link your bank accounts, credit cards, and other relevant financial accounts to the software. This step allows for seamless synchronization of transactions, making it easier to reconcile your books.

05

Customize your invoices, quotes, and purchase orders with your business logo and information. This personalization helps create a professional image for your business when interacting with clients and suppliers.

06

Enter your income and expense transactions regularly into the software. Be sure to accurately categorize each transaction according to the appropriate account.

07

Use the software's reconciliation feature to match your bank statements with your recorded transactions. This step helps identify any discrepancies and ensures the accuracy of your financial records.

08

Generate financial reports, such as profit and loss statements, balance sheets, and cash flow statements, using the software's reporting tools. These reports provide crucial insights into your business's financial health and aid in making informed decisions.

09

Regularly back up your data to prevent the loss of important financial information. Most online bookkeeping accounting software platforms offer automatic backup features for convenience and peace of mind.

Who needs online bookkeeping accounting software?

01

Small business owners: Online bookkeeping accounting software offers affordable and user-friendly solutions for entrepreneurs who handle their finances independently.

02

Freelancers and self-employed professionals: Individuals who work as freelancers or self-employed can benefit from online bookkeeping software to manage their income, expenses, and tax obligations efficiently.

03

Bookkeepers and accountants: Professionals in the field of accounting and bookkeeping can leverage online software to streamline their clients' financial management and reporting processes.

04

Medium and large-sized businesses: Online bookkeeping accounting software provides scalable solutions that can cater to the needs of medium and large-size businesses, helping them maintain accurate and up-to-date financial records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send online bookkeeping accounting software for eSignature?

online bookkeeping accounting software is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find online bookkeeping accounting software?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the online bookkeeping accounting software in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit online bookkeeping accounting software straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing online bookkeeping accounting software, you need to install and log in to the app.

What is online bookkeeping accounting software?

Online bookkeeping accounting software is a cloud-based platform that allows businesses to manage their financial records, including tracking income and expenses, generating invoices, and preparing financial statements, all accessible via the internet.

Who is required to file online bookkeeping accounting software?

Typically, small to medium-sized businesses, freelancers, and self-employed individuals are required to use online bookkeeping accounting software to keep track of their financial transactions and comply with tax regulations.

How to fill out online bookkeeping accounting software?

To fill out online bookkeeping accounting software, users need to create an account, set up their business profile, input financial data such as income and expenses, categorize transactions, and ensure compliance with relevant accounting standards.

What is the purpose of online bookkeeping accounting software?

The purpose of online bookkeeping accounting software is to simplify financial management, automate calculations, enhance accuracy, and provide real-time insights into a business's financial health, enabling better decision-making.

What information must be reported on online bookkeeping accounting software?

Information that must be reported includes income statements, expense reports, balance sheets, cash flow statements, transactions, invoices, and any data relevant for tax filing and compliance.

Fill out your online bookkeeping accounting software online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Bookkeeping Accounting Software is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.