Get the free Paycheck Protection Program: Second Draw Borrower Application ...

Show details

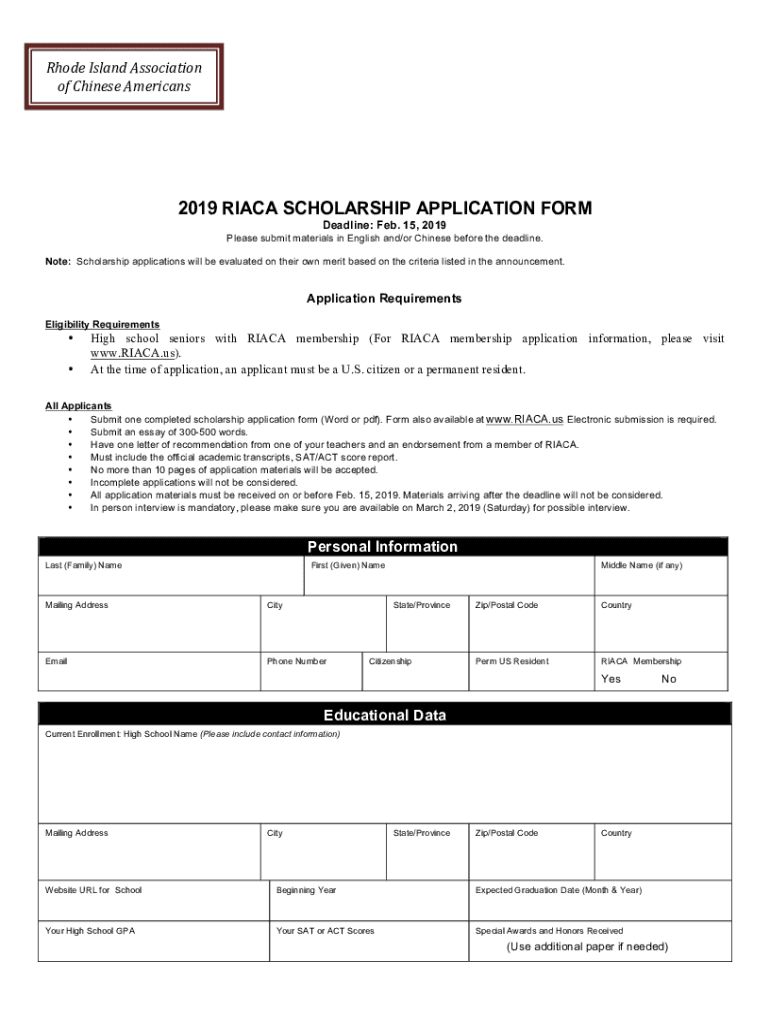

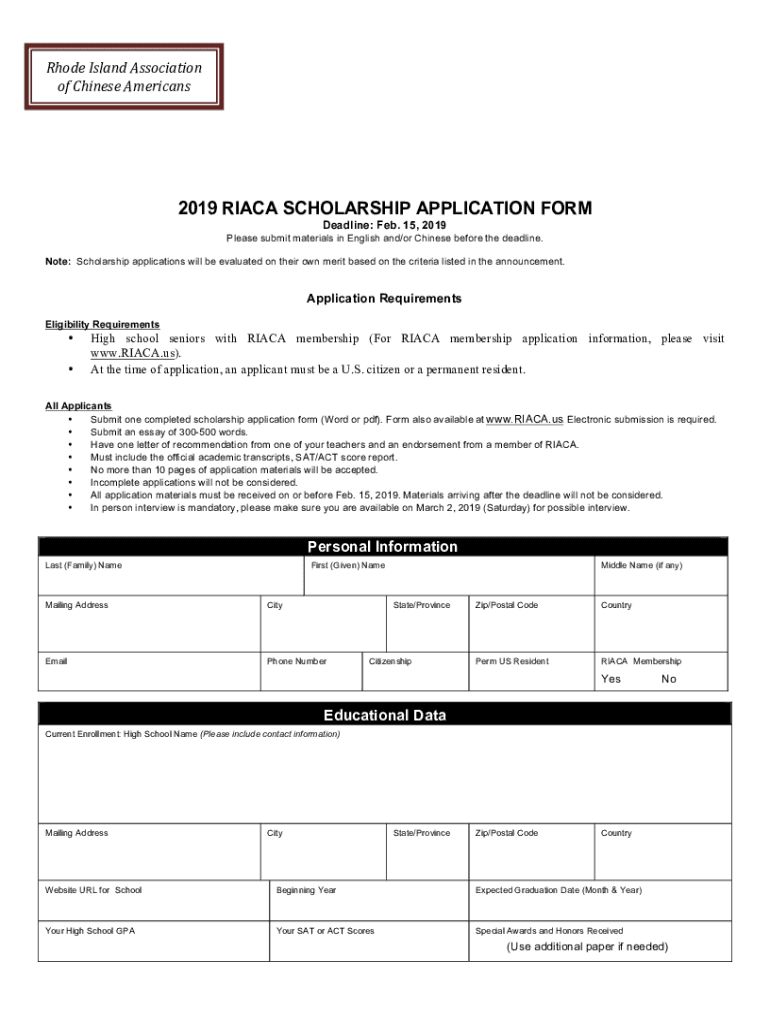

RhodeIslandAssociation ofChineseAmericans2019 RI ACA SCHOLARSHIP APPLICATION FORM Deadline: Feb. 15, 2019 Please submit materials in English and/or Chinese before the deadline. Note: Scholarship applications

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paycheck protection program second

Edit your paycheck protection program second form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paycheck protection program second form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paycheck protection program second online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit paycheck protection program second. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paycheck protection program second

How to fill out paycheck protection program second

01

To fill out the Paycheck Protection Program Second (PPP2) application, follow these steps:

02

Gather the required documents, including your business payroll records, tax filings, and financial statements.

03

Access the application form, either online or in paper format.

04

Provide information about your business, such as its legal name, address, and Employer Identification Number (EIN).

05

Indicate whether your business operates as a sole proprietorship, partnership, corporation, or LLC.

06

Enter the loan amount you are requesting based on your average monthly payroll costs.

07

Calculate your average monthly payroll costs using the guidelines provided by the Small Business Administration (SBA).

08

Submit supporting documentation to verify your average monthly payroll costs.

09

Provide details about any Economic Injury Disaster Loan (EIDL) you have received or applied for.

10

Review and certify the accuracy of the information provided.

11

Sign and date the application form.

12

Submit the completed application and supporting documentation to your lender.

13

Keep track of your application status and follow up with your lender as needed.

14

Note: The specific steps and requirements may vary based on your lender and the updated guidelines from the SBA. It is important to consult the official PPP2 resources and your lender for the most accurate and up-to-date information.

Who needs paycheck protection program second?

01

Small business owners, self-employed individuals, and certain nonprofit organizations may need the Paycheck Protection Program Second (PPP2) if they meet certain eligibility criteria. Those who need PPP2 include:

02

- Small businesses with fewer than 500 employees, including sole proprietors, independent contractors, and self-employed individuals.

03

- Certain nonprofit organizations, such as 501(c)(3) organizations, 501(c)(6) organizations, and others that meet the SBA's requirements.

04

- Accommodation and food service businesses (NAICS code starting with 72) with fewer than 300 employees per physical location.

05

- Eligible businesses that have experienced a revenue reduction of at least 25% in any quarter of 2020 compared to the same quarter in 2019.

06

It is important to review the specific eligibility criteria provided by the Small Business Administration (SBA) and consult with your lender to determine if you qualify for PPP2.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send paycheck protection program second to be eSigned by others?

To distribute your paycheck protection program second, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my paycheck protection program second in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your paycheck protection program second and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out paycheck protection program second on an Android device?

Use the pdfFiller app for Android to finish your paycheck protection program second. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is paycheck protection program second?

The Paycheck Protection Program Second Draw (PPP Second Draw) is a federal loan initiative aimed at providing financial assistance to small businesses affected by the COVID-19 pandemic. It allows eligible businesses to apply for a second round of forgivable loans to help keep their workforce employed during challenging economic conditions.

Who is required to file paycheck protection program second?

Businesses that received a first draw of the Paycheck Protection Program and are seeking a second draw to support their operations during the COVID-19 pandemic may file for the Paycheck Protection Program Second Draw. Eligibility criteria include demonstrating a reduction in revenue and meeting size standards.

How to fill out paycheck protection program second?

To fill out the Paycheck Protection Program Second Draw application, businesses need to complete the required forms provided by the lender. This includes providing information such as average monthly payroll costs, the number of employees, and documentation proving a revenue decline.

What is the purpose of paycheck protection program second?

The purpose of the Paycheck Protection Program Second Draw is to provide economic relief to small businesses affected by the COVID-19 pandemic, helping them retain employees and maintain operations by offering forgivable loans under certain conditions.

What information must be reported on paycheck protection program second?

Applicants must report information including their business size, average monthly payroll costs, revenue decline, and the business's number of employees. Documentation of payroll and other eligible expenses is also required.

Fill out your paycheck protection program second online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paycheck Protection Program Second is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.