Get the free IS A UNIT TRUST THE RIGHT PRODUCT FOR YOU?

Show details

INDIVIDUAL INVESTING

UNIT TRUSTSUnit Trust Application Form

1. BEFORE YOU INVEST

IS A UNIT TRUST THE RIGHT PRODUCT FOR YOU?

Collective Investment Schemes (commonly known as unit trusts) are funds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign is a unit trust

Edit your is a unit trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your is a unit trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

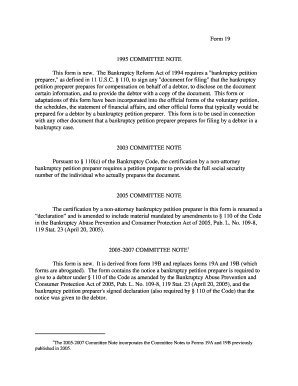

How to edit is a unit trust online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit is a unit trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

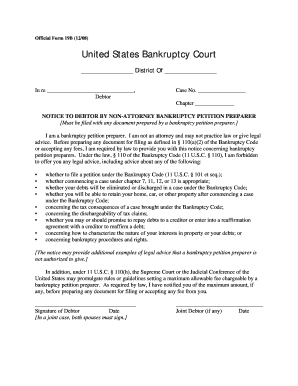

How to fill out is a unit trust

How to fill out is a unit trust

01

Obtain the necessary documents: Gather the required paperwork such as the application form, Know-Your-Customer (KYC) documents, and supporting documents.

02

Research and select a fund: Determine which unit trust fund suits your investment goals and risk tolerance. Consider factors such as the fund's performance, fees, and asset allocation.

03

Fill out the application form: Provide accurate information on the application form, including personal details, investment amount, choice of fund, and investment duration.

04

Complete KYC requirements: Submit the required KYC documents, which typically include proof of identity, proof of address, and bank account details.

05

Declare any additional information: Disclose any additional information required by the fund provider, such as tax residency or source of funds.

06

Review and sign the form: Carefully review the completed application form for accuracy and sign it.

07

Attach supporting documents: Attach any supporting documents requested by the fund provider, such as income proof or investment declaration.

08

Submit the application: Submit the filled-out application form and supporting documents to the designated office or through an online platform, as instructed by the fund provider.

09

Wait for processing: Allow time for the fund provider to process your application. This may involve verification of documents and compliance checks.

10

Receive confirmation and investment details: Once your application is approved, you will receive confirmation of your investment in the unit trust, along with details such as the number of units allocated and the current value.

11

Monitor your investment: Regularly review the performance of your unit trust investment and make necessary adjustments based on your financial goals and market conditions.

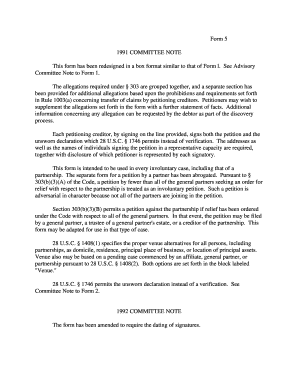

Who needs is a unit trust?

01

Individual investors: Unit trusts are suitable for individuals who want a diversified investment portfolio managed by professionals. It is ideal for individuals who may not have the time, expertise, or capital to invest directly in various securities.

02

Small investors: Unit trusts allow small investors with limited capital to gain exposure to a diversified portfolio of assets. It provides an opportunity to access investments that may otherwise be out of reach for individual investors due to high minimum investment requirements.

03

Investors seeking convenience: Investing in unit trusts is convenient as it allows investors to delegate investment decisions to professional fund managers. Fund managers handle the day-to-day management and rebalancing of the portfolio, saving investors time and effort.

04

Risk-averse investors: Unit trusts offer a range of funds with different risk profiles, allowing risk-averse investors to choose funds that align with their risk tolerance. It provides a balanced approach to investing and helps reduce the risk associated with investing in individual securities.

05

Investors seeking liquidity: Unit trusts offer liquidity as investors can buy or sell units on any business day. This provides flexibility in managing investments and allows investors to access their funds when needed.

06

Retirement planning: Unit trusts can be used as part of retirement planning. They offer long-term investment options with the potential for growth, allowing individuals to accumulate wealth for retirement.

07

Income generation: Some unit trust funds focus on generating regular income through dividends or interest. Investors seeking a steady income stream can opt for these funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send is a unit trust for eSignature?

Once your is a unit trust is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in is a unit trust?

The editing procedure is simple with pdfFiller. Open your is a unit trust in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit is a unit trust straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing is a unit trust, you can start right away.

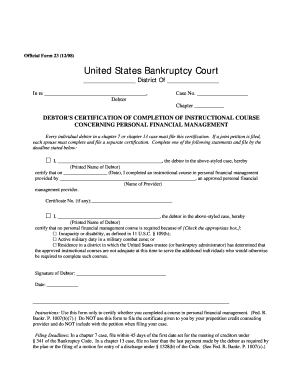

What is a unit trust?

A unit trust is an investment scheme where investors pool their money to buy shares in a collective investment portfolio managed by a professional fund manager.

Who is required to file is a unit trust?

Unit trusts are typically required to file reports and documentation by their trustees or fund managers, depending on the regulatory framework governing the trust.

How to fill out is a unit trust?

Filling out documents related to a unit trust involves providing details such as the trust's information, investor details, transaction records, and the financial statements that reflect the trust's performance.

What is the purpose of is a unit trust?

The purpose of a unit trust is to provide investors with access to a diversified portfolio of assets, managed by experts, allowing them to benefit from professional investment management.

What information must be reported on is a unit trust?

Information that must be reported typically includes the trust's financial performance, asset allocation, income distribution, and any changes in the trust's management or structure.

Fill out your is a unit trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Is A Unit Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.