Get the free 10 Budget Categories That Belong in Your PlanQuicken

Show details

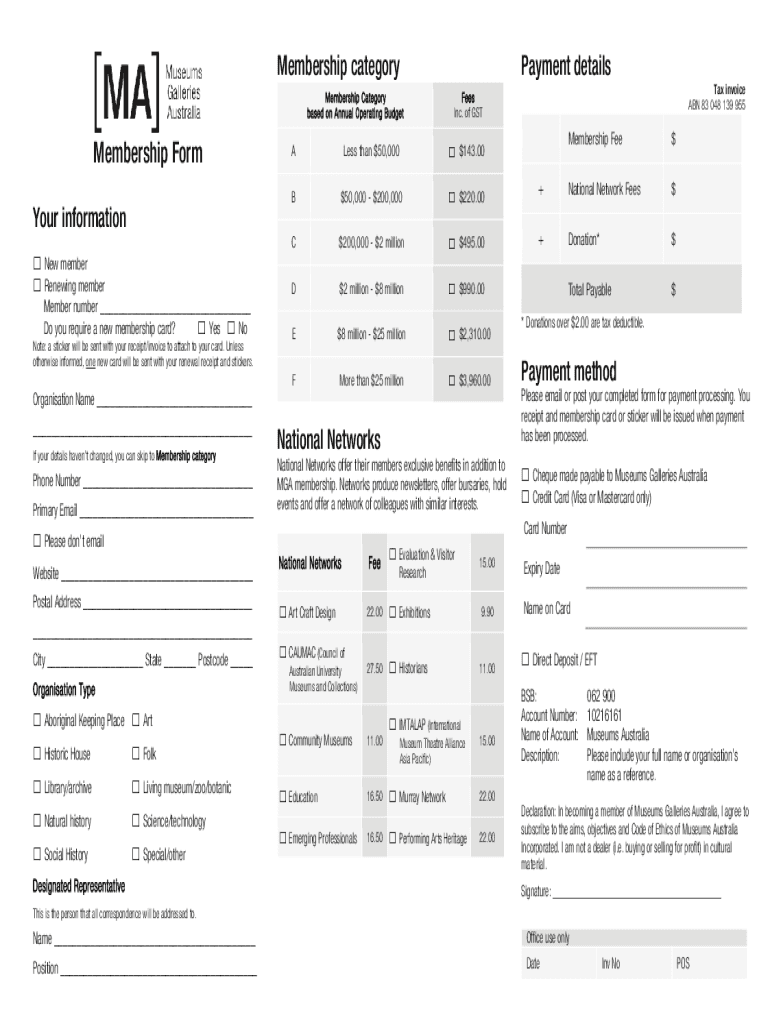

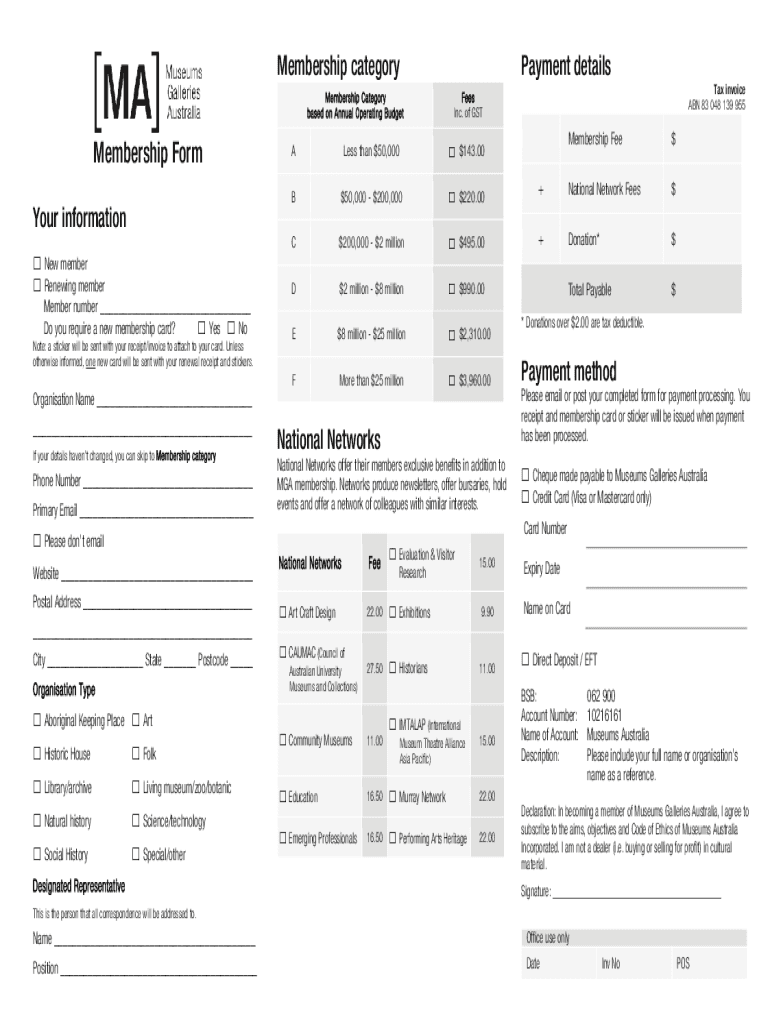

Payment detailsMembership category Membership Category based on Annual Operating BudgetMembership Formless than $$50,000143.00B$$$50,000200,000220.00C$$200,0002 million $495.00D$2 million $8 million

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 10 budget categories that

Edit your 10 budget categories that form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10 budget categories that form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 10 budget categories that online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 10 budget categories that. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10 budget categories that

How to fill out 10 budget categories that

01

To fill out 10 budget categories, follow these steps:

02

Start by listing all your sources of income. This could include your salary, side hustles, rental income, and any other money you receive regularly.

03

Next, categorize your expenses into different groups. Some common categories can include housing, transportation, groceries, dining out, entertainment, healthcare, insurance, debt payments, savings, and miscellaneous.

04

Assign a specific budget amount to each category. This will depend on your financial goals and priorities. You may need to adjust the numbers to align with your income and lifestyle.

05

Keep track of your actual expenses in each category. This could be done through manual tracking using a spreadsheet or by using budgeting apps that automatically categorize your transactions.

06

Review your budget regularly and make adjustments as needed. If you consistently overspend in a particular category, consider reallocating funds from other categories or finding ways to cut expenses.

07

Make sure to set aside some money for unexpected expenses and emergencies. This can be achieved by creating an 'emergency fund' category in your budget.

08

Aim to save a certain percentage of your income each month. This could be directed towards long-term goals like retirement or short-term goals like a vacation.

09

Stay disciplined and avoid unnecessary impulse purchases. Stick to your budget and resist the temptation to overspend.

10

Monitor your progress towards your financial goals. Regularly review your budget and assess if you're on track or need to make adjustments.

11

Seek advice from financial experts or use budgeting resources to gain more knowledge and refine your budgeting strategies.

12

By following these steps, you'll be able to effectively fill out 10 budget categories and manage your finances more efficiently.

Who needs 10 budget categories that?

01

Anyone who wants to gain better control over their finances can benefit from using 10 budget categories.

02

It is especially useful for individuals or households who want to track their income and expenses in a detailed manner.

03

By having specific categories, it becomes easier to analyze spending patterns, identify areas of improvement, and make informed financial decisions.

04

People who have financial goals, such as saving for a down payment on a house, paying off debt, or planning for retirement, can effectively manage their progress by using 10 budget categories.

05

Ultimately, having a well-structured budget with 10 categories can help individuals and families achieve financial stability and make their money work for them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 10 budget categories that from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 10 budget categories that, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send 10 budget categories that to be eSigned by others?

Once your 10 budget categories that is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the 10 budget categories that electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 10 budget categories that in minutes.

What is 10 budget categories that?

The 10 budget categories typically include housing, utilities, food, transportation, healthcare, insurance, entertainment, savings, personal expenses, and education.

Who is required to file 10 budget categories that?

Individuals and households seeking to manage their finances effectively are encouraged to use budget categories, although there is no legal requirement to file them.

How to fill out 10 budget categories that?

To fill out the 10 budget categories, list expected income for the month, allocate funds to each category based on past spending and future needs, and adjust as necessary.

What is the purpose of 10 budget categories that?

The purpose of the 10 budget categories is to provide a structured way to track income and expenses, aiding in financial planning and promoting savings.

What information must be reported on 10 budget categories that?

Information to report includes estimated income, planned expenses for each budget category, actual spending for each category, and any adjustments made during the budgeting period.

Fill out your 10 budget categories that online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10 Budget Categories That is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.