UK IVA 1C 2021 free printable template

Show details

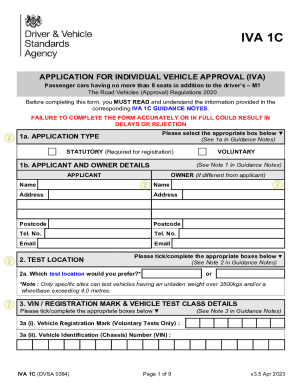

IVA 1C APPLICATION FOR INDIVIDUAL VEHICLE APPROVAL (IVA) Passenger cars having no more than 8 seats in addition to the drivers M1 The Road Vehicles (Approval) Regulations 2020Before completing this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK IVA 1C

Edit your UK IVA 1C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK IVA 1C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK IVA 1C online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK IVA 1C. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK IVA 1C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK IVA 1C

How to fill out UK IVA 1C

01

Gather necessary documents: Collect evidence of your income, expenses, debts, and assets.

02

Complete the personal details section: Fill in your name, address, and contact information accurately.

03

Disclose your financial situation: Provide detailed information on your income sources and amounts.

04

List your expenses: Include all regular expenses such as rent, utilities, and food.

05

Detail your debts: Clearly list all creditors, amounts owed, and any outstanding payments.

06

Report your assets: Include any properties, savings, or valuable possessions you own.

07

Calculate your disposable income: Subtract your total expenses from your total income.

08

Review your completed form: Ensure all information is correct and complete, making adjustments as necessary.

09

Submit the form: Send the completed IVA 1C form to your Insolvency Practitioner or the designated authority.

Who needs UK IVA 1C?

01

Individuals in the UK facing financial difficulties and seeking a formal agreement to repay debts over time should complete the IVA 1C.

02

It is suitable for those whose debts exceed the value of their assets and who have a regular income to contribute towards repayment.

Fill

form

: Try Risk Free

People Also Ask about

What does M1 mean for a car?

Category M1: passenger vehicles with no more than eight seats (in addition to the driver's).

What are the different categories of vehicles?

Transport Vehicle Non-Transport Vehicle (i) Motor cycle with side car for carrying goods. (ii) Motor cycle with trailer to carry goods. (iii) Motor cycle used for hire to carry one passenger on pillion and motorised cycle-rickshaw for goods or passengers on hire. (iv) Luxury Cab.

What does N1 category mean?

Category N1: small commercials designed for the carriage of goods and less than 3.5 tonnes. Category N2: commercials that are more than 3.5 tonnes, but not more than 12 tonnes.

What does N1 mean for vehicles?

M1 vehicles - passenger cars. M2 and M3 vehicles - buses and coaches. N1 vehicles - light goods vehicles (up to 3,500kgs) N2 and N3 vehicles - heavy goods vehicles (over 3,500kgs) O1, O2, O3 and O4 vehicles - light and heavy trailers.

What is N1 tax certification?

If this is marked as N1 or N2 then the vehicle counts as an LCV and is taxed as a van. If it says M1 or M2, however, then it's a car not a commercial, and subject to car road tax rates instead.

What is vehicle category N1/N2 N3?

Category N1: having a maximum mass not exceeding 3.5 tonnes (7,700 lb) Category N2: having a maximum mass exceeding 3.5 tonnes but not exceeding 12 tonnes (26,000 lb) Category N3: having a maximum mass exceeding 12 tonnes.

Is N1 a van?

M2 – it's a minibus. N1 – it's a van. N2 – it's a van.

What is an M1 vehicle?

Category M1: no more than eight seats in addition to the driver seat (mainly, cars) more than eight seats in addition to the driver seat (buses): Category M2: having a maximum mass not exceeding 5 tonnes (11,000 lb) Category M3: having a maximum mass exceeding 5 tonnes.

What is category M1?

M1 vehicle means, for the purpose of this scheme, a new motor vehicle used for the carriage of persons and which may carry no more than eight passengers in addition to the driver.

What is M1 and N1 category vehicles?

M1 vehicles - passenger cars. M2 and M3 vehicles - buses and coaches. N1 vehicles - light goods vehicles (up to 3,500kgs) N2 and N3 vehicles - heavy goods vehicles (over 3,500kgs)

Can I change vehicle category from N1 to M1?

Answered by Dan Powell. In our experience, the DVLA is usually reluctant to change the classification of a crew cab van from N1 to M1. This is down to the fact that the owner usually wants their van to qualify for the higher, car-like speed limits.

What is N1 speed limits?

This means you're limited to 30mph in built up areas, 50mph on single and 60mph on duel carriageways. Motorway speeds are the same as cars, 70mph, unless you're towing a trailer, which lowers it to 60mph.

What is N1 vehicle approval?

In general, motor vehicles designed and built to transport goods, having at least 4 wheels and mass not exceeding 3.5 tonnes, lie within the N1 type approval (truck) category in international classification. These means vehicles with N1 type approval can be driven by holders of a normal driving licence.

What is Category N1 vehicle?

Category N1: small commercials designed for the carriage of goods and less than 3.5 tonnes. Category N2: commercials that are more than 3.5 tonnes, but not more than 12 tonnes.

Is N1 classed as a van?

Also known as the logbook, the V5C has a European classification section on it. If this is marked as N1 or N2 then the vehicle counts as an LCV and is taxed as a van. If it says M1 or M2, however, then it's a car not a commercial, and subject to car road tax rates instead.

What is an N1 category vehicle?

Category N1: small commercials designed for the carriage of goods and less than 3.5 tonnes.

What is N1 vehicle class?

In general, motor vehicles designed and built to transport goods, having at least 4 wheels and mass not exceeding 3.5 tonnes, lie within the N1 type approval (truck) category in international classification. These means vehicles with N1 type approval can be driven by holders of a normal driving licence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK IVA 1C in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your UK IVA 1C and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my UK IVA 1C in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UK IVA 1C directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit UK IVA 1C straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing UK IVA 1C right away.

What is UK IVA 1C?

UK IVA 1C is a form used in the United Kingdom to report information related to the Individual Voluntary Arrangement (IVA) for individuals seeking to manage their debts.

Who is required to file UK IVA 1C?

Individuals who are setting up an IVA or those who are required to submit annual reviews as part of their IVA agreement must file UK IVA 1C.

How to fill out UK IVA 1C?

To fill out UK IVA 1C, you need to provide personal details, financial information, and any changes in your circumstances since the last submission. It typically involves completing sections related to income, expenses, and debts.

What is the purpose of UK IVA 1C?

The purpose of UK IVA 1C is to ensure that the debtor provides a complete and accurate account of their financial situation, which helps the insolvency practitioner assess compliance with the IVA terms.

What information must be reported on UK IVA 1C?

UK IVA 1C requires reporting of personal identification, financial details including income and expenses, assets, debts, and any changes in circumstances since previous filings.

Fill out your UK IVA 1C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK IVA 1c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.