Get the free IndiaFirst Savings Plan - CAMSRep

Show details

Popup Request Form (Pleas e read the instructions carefully before proceeding)Date:Name of the Policyholder: DDMMYYYYPolicy No:Client ID: Contact No. (Off/Res): Mobile: Email I'd: I would like to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiafirst savings plan

Edit your indiafirst savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiafirst savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

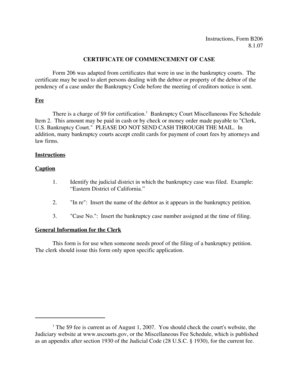

How to edit indiafirst savings plan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indiafirst savings plan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

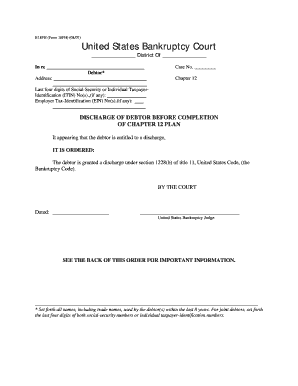

How to fill out indiafirst savings plan

How to fill out indiafirst savings plan

01

Step 1: Start by obtaining the application form for the IndiaFirst Savings Plan from the nearest IndiaFirst Life Insurance branch or download it from their official website.

02

Step 2: Fill out your personal details accurately, including your name, age, gender, contact information, and address.

03

Step 3: Provide your nominee details, including their name, relationship with you, and contact information.

04

Step 4: Choose the premium payment frequency that suits your needs, such as monthly, quarterly, half-yearly, or yearly.

05

Step 5: Decide on the policy term and sum assured amount based on your financial goals and requirements.

06

Step 6: Select any optional riders or add-ons you may want to enhance your coverage. These could include critical illness cover, accidental death benefit, or waiver of premium.

07

Step 7: Review the filled-out form carefully to ensure all the information provided is accurate and complete.

08

Step 8: Sign and date the application form.

09

Step 9: Submit the application form along with the required documents, such as identity proof, address proof, and medical reports, if applicable.

10

Step 10: Make the initial premium payment as per the chosen premium payment frequency and receive the policy document once the application is approved.

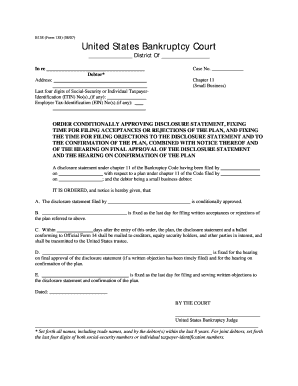

Who needs indiafirst savings plan?

01

Individuals looking for a long-term savings avenue with life insurance coverage can benefit from the IndiaFirst Savings Plan.

02

Those who want to build a corpus over time to fulfill financial goals like education, marriage, retirement, or buying a house can opt for this plan.

03

It is suitable for individuals who prefer a disciplined approach to savings and want to avail of tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961.

04

Those seeking financial protection for their family in case of unfortunate events like death or disability can also consider this plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get indiafirst savings plan?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the indiafirst savings plan. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the indiafirst savings plan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign indiafirst savings plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit indiafirst savings plan on an Android device?

With the pdfFiller Android app, you can edit, sign, and share indiafirst savings plan on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is indiafirst savings plan?

The IndiaFirst Savings Plan is a savings-oriented life insurance product offered by IndiaFirst Life Insurance Company. It aims to provide financial security along with savings benefits to policyholders.

Who is required to file indiafirst savings plan?

Individuals seeking to avail the benefits of the IndiaFirst Savings Plan must file the plan, typically including anyone eligible for life insurance products.

How to fill out indiafirst savings plan?

To fill out the IndiaFirst Savings Plan, applicants need to complete a proposal form which includes personal details, nominee information, and payment details.

What is the purpose of indiafirst savings plan?

The purpose of the IndiaFirst Savings Plan is to provide financial protection in case of unforeseen events and to help policyholders save for future needs.

What information must be reported on indiafirst savings plan?

Information required to be reported includes personal details of the applicant, nominee details, medical history, and financial information for policy underwriting.

Fill out your indiafirst savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiafirst Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.