Get the free Certificates of Deposit Terms & Conditions - First State Bank of ...

Show details

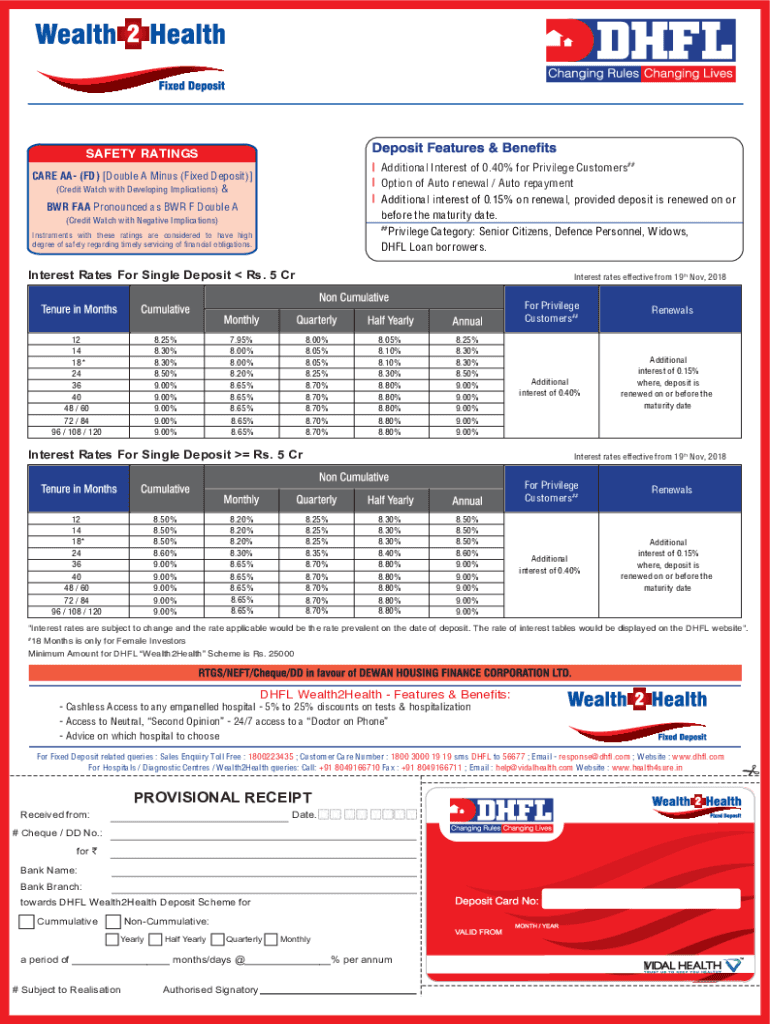

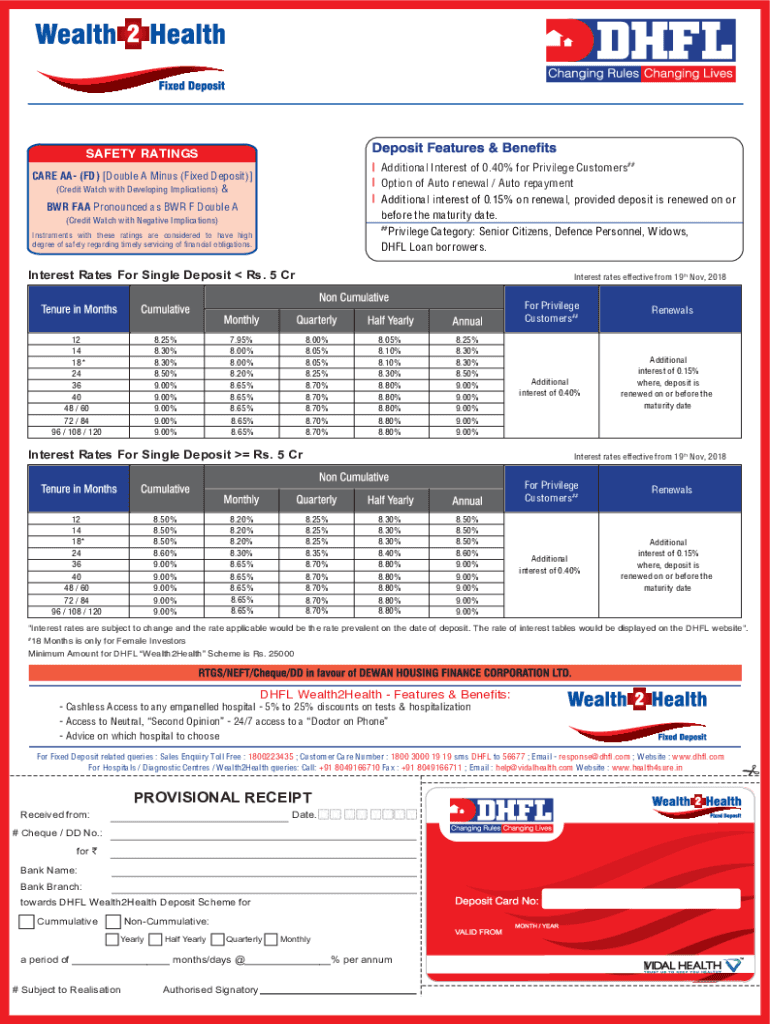

SAFETY RATINGSAdditional Interest of 0.40% for Privilege Customers## Option of Auto renewal / Auto repayment Additional interest of 0.15% on renewal, provided deposit is renewed on or before the maturity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificates of deposit terms

Edit your certificates of deposit terms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificates of deposit terms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certificates of deposit terms online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificates of deposit terms. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificates of deposit terms

How to fill out certificates of deposit terms

01

Start by gathering all the necessary information, including the details of the certificate of deposit (CD) account and the terms and conditions provided by the bank or financial institution.

02

Carefully read and understand the terms and conditions of the CD. Pay attention to the interest rate, maturity date, penalties for early withdrawal, and any other important details.

03

Fill in the required information on the certificate of deposit form provided by the bank. This usually includes personal details such as name, address, contact number, and social security number or tax identification number.

04

Specify the desired term length of the CD. This refers to the period during which you agree to keep the funds deposited. Common term lengths are 3 months, 6 months, 1 year, 2 years, or longer.

05

Indicate the amount to be deposited into the CD account. This can be a fixed amount or within a predetermined range set by the bank.

06

Provide instructions on how the interest earned should be handled. You may choose to have it reinvested into the CD, paid out to another account, or receive it in cash.

07

Review the filled-out certificate of deposit terms for accuracy and completeness. Make sure all necessary fields are filled and all information provided is correct.

08

Sign the certificate of deposit form. This signifies your agreement to the terms stated and your consent for the bank to hold and manage the deposited funds.

09

Submit the completed form to the bank or financial institution. Follow any additional instructions provided by the staff to complete the process.

10

Keep a copy of the filled-out certificate of deposit terms and any related documents for your records. This can be useful for future reference or in case of any disputes or clarifications needed.

Who needs certificates of deposit terms?

01

Certificates of deposit terms are beneficial for individuals or investors who are looking for a secure and low-risk option to grow their savings.

02

People who want to earn a fixed interest rate on their deposited funds while keeping their investment relatively safe may opt for certificates of deposit.

03

Financially conservative individuals or those who have a specific savings goal in mind can benefit from the structured nature of certificates of deposit terms.

04

Certificates of deposit terms may also be suitable for people who do not require immediate access to their funds and are willing to commit their money for a certain period of time.

05

Banks and financial institutions may also use certificates of deposit terms as a way to attract and retain customers by offering competitive interest rates and flexible terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificates of deposit terms for eSignature?

When you're ready to share your certificates of deposit terms, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I edit certificates of deposit terms on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing certificates of deposit terms.

How do I fill out the certificates of deposit terms form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign certificates of deposit terms and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is certificates of deposit terms?

Certificates of deposit (CDs) terms refer to the specific conditions under which a CD is issued, including the duration of the deposit, interest rate, minimum deposit requirements, and penalties for early withdrawal.

Who is required to file certificates of deposit terms?

Typically, financial institutions that issue certificates of deposit are required to file certificates of deposit terms with regulatory bodies to ensure compliance with banking regulations.

How to fill out certificates of deposit terms?

To fill out certificates of deposit terms, one usually needs to provide detailed information including the depositor's name, account number, terms of the deposit, maturity date, interest rate, and any special conditions applicable to the CD.

What is the purpose of certificates of deposit terms?

The purpose of certificates of deposit terms is to outline the contractual agreement between the depositor and the bank, specifying the terms under which the funds are held and the interest earned.

What information must be reported on certificates of deposit terms?

Information that must be reported includes the depositor's details, amount of the deposit, interest rate, maturity date, and any fees or penalties associated with early withdrawal.

Fill out your certificates of deposit terms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificates Of Deposit Terms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.