Get the free Templeton Income Trust - Templeton International Bond Fund

Show details

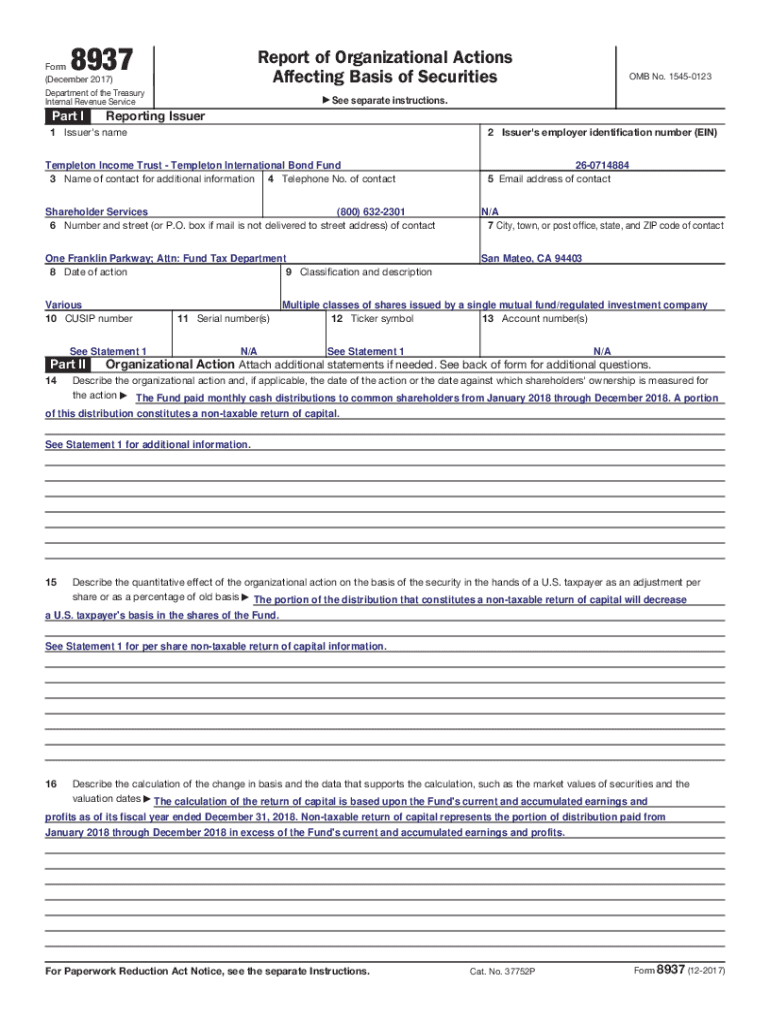

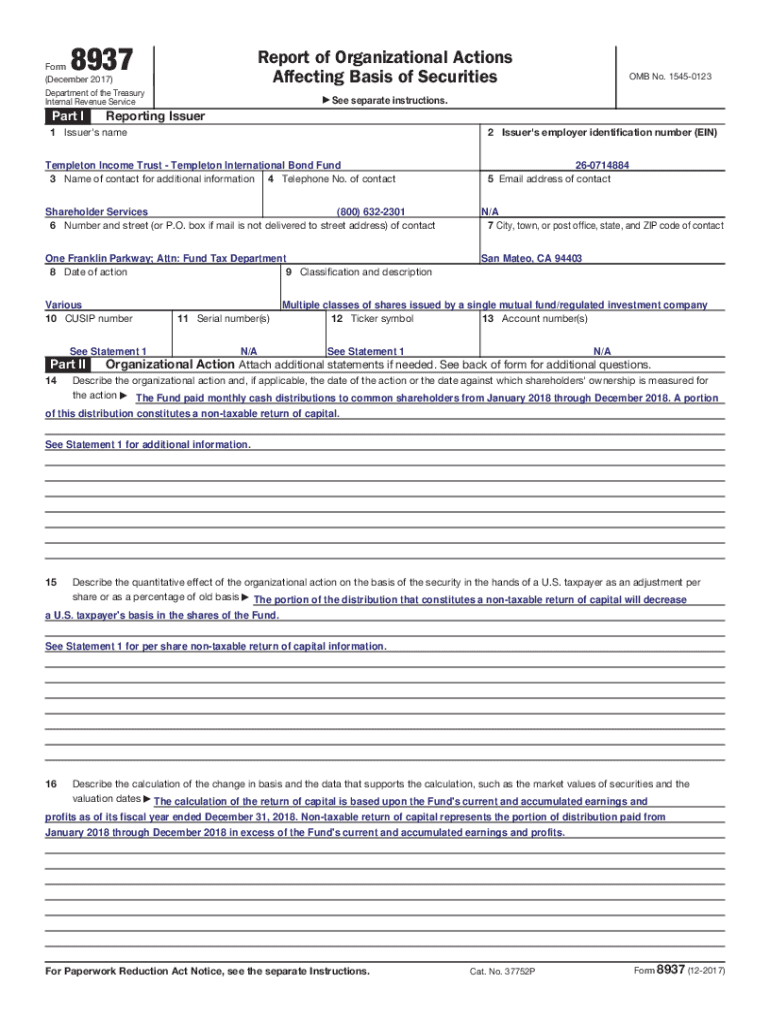

8937Report of Organizational Actions Affecting Basis of SecuritiesForm (December 2017) Department of the Treasury Internal Revenue Serviceman Ia See OMB No. 15450123separate instructions. Reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign templeton income trust

Edit your templeton income trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your templeton income trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit templeton income trust online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit templeton income trust. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out templeton income trust

How to fill out templeton income trust

01

Start by obtaining the necessary documents, such as the Templeton Income Trust application form and any other required forms or paperwork.

02

Carefully read and understand the instructions provided with the application form to ensure you are aware of any specific requirements or guidelines.

03

Fill out the application form accurately and completely, providing all the requested information, including personal details, contact information, and any financial or investment details as required.

04

Review your completed application form to ensure accuracy and double-check for any missing or incomplete information.

05

Attach any supporting documents or additional paperwork that may be requested, such as identification proof or income verification.

06

Make sure to sign the application form and any other required sections or declarations.

07

Submit your filled-out application form and any accompanying documents through the designated submission channels, such as online submission, mailing address, or in-person submission at the relevant office or institution.

08

Keep a copy of your filled-out application form and any supporting documents for your records.

09

Wait for the processing of your application to be completed. This may take some time, so it is important to be patient.

10

Once your application is processed and approved, you may be contacted by the Templeton Income Trust or the relevant institution with further instructions or information.

11

Follow any additional steps or guidelines provided by the Templeton Income Trust or the institution to successfully complete the process.

Who needs templeton income trust?

01

Individuals who are looking for a reliable investment option with a focus on income generation may consider Templeton Income Trust.

02

Investors who prefer a professionally managed portfolio and want exposure to a diversified range of income-generating assets may find Templeton Income Trust suitable.

03

Those who are willing to undertake some level of investment risk in pursuit of potential returns may find Templeton Income Trust appealing.

04

Depending on individual financial goals, Templeton Income Trust may be suitable for investors who are seeking regular income or looking for long-term capital growth.

05

Investors who are interested in accessing global markets and potentially benefiting from Templeton's expertise in global investment opportunities may find Templeton Income Trust attractive.

06

It is important for potential investors to carefully consider their investment objectives, risk tolerance, and seek professional financial advice before deciding if Templeton Income Trust is a suitable investment option for them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my templeton income trust directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign templeton income trust and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit templeton income trust from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your templeton income trust into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my templeton income trust in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your templeton income trust and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is templeton income trust?

Templeton Income Trust is a collective investment scheme designed to provide income through a diversified portfolio of fixed income and equity investments.

Who is required to file templeton income trust?

Investors, fund managers, and other entities involved in the management or investment of the Templeton Income Trust are required to file appropriate documentation.

How to fill out templeton income trust?

To fill out Templeton Income Trust documentation, gather necessary financial information, complete the required forms accurately, and submit them as per the guidelines provided by the managing authority.

What is the purpose of templeton income trust?

The purpose of Templeton Income Trust is to provide investors with regular income and capital appreciation by investing in fixed income securities and dividend-paying stocks.

What information must be reported on templeton income trust?

Information that must be reported includes account details, investment performance, income distribution, and any changes in investment strategy.

Fill out your templeton income trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Templeton Income Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.