Get the free Long-Term Care Insurance Explained - NerdWalletShould You Buy Long Term Care Insuran...

Show details

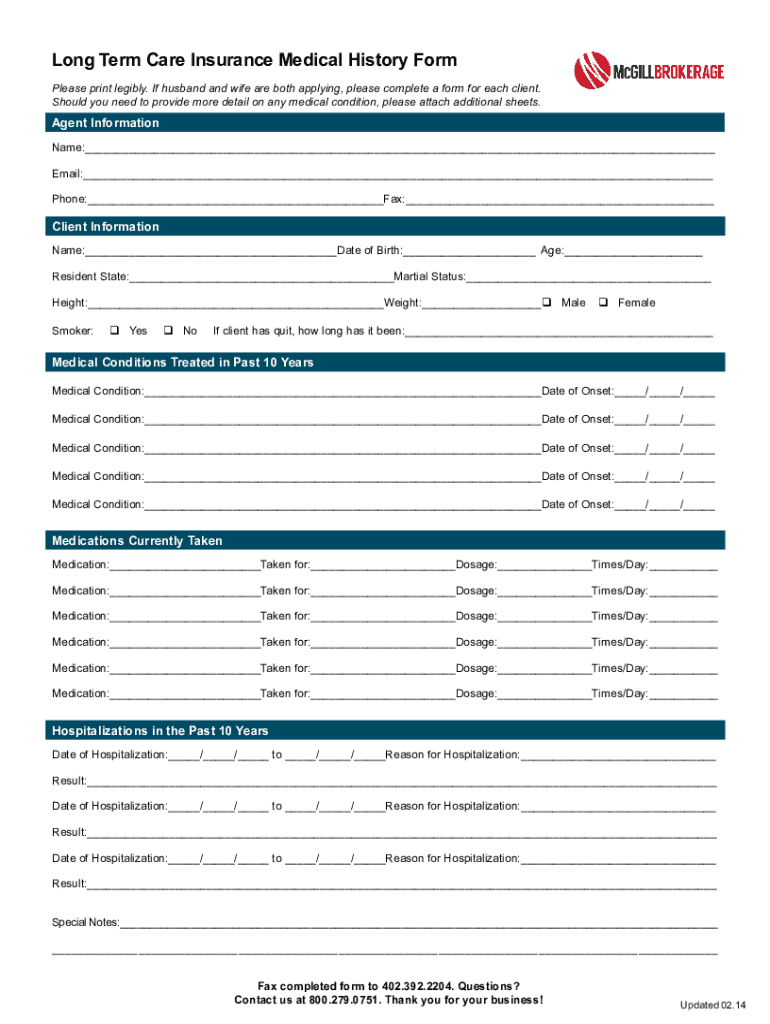

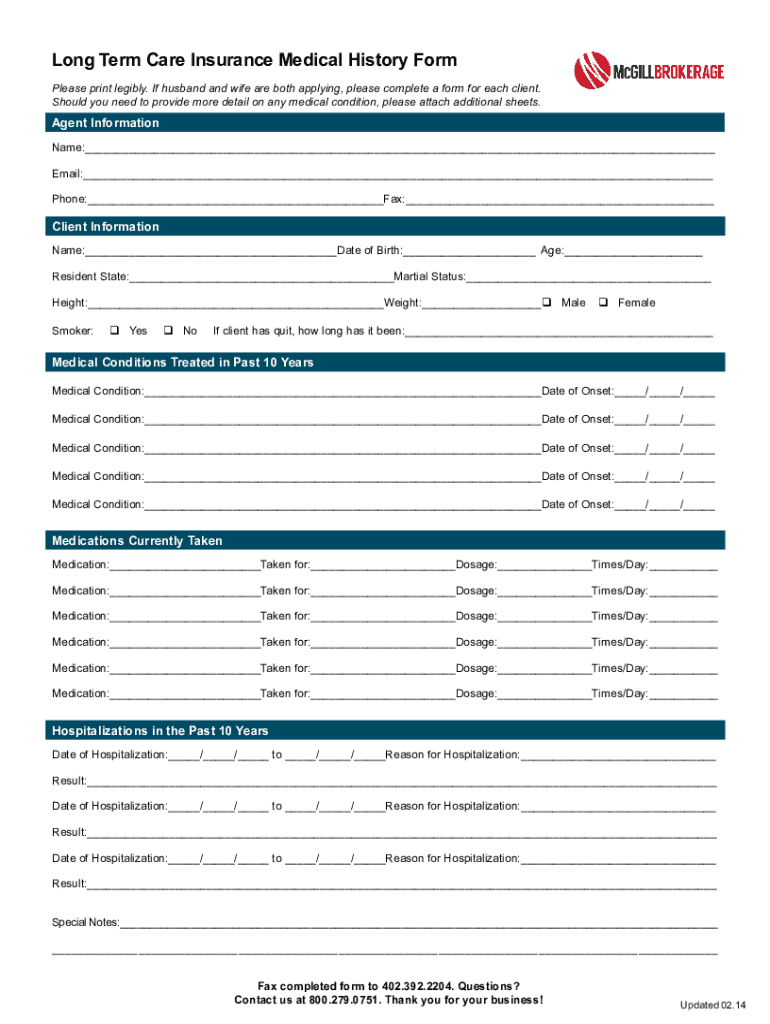

Long Term Care Insurance Medical History Form Please print legibly. If husband and wife are both applying, please complete a form for each client. Should you need to provide more detail on any medical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term care insurance explained

Edit your long-term care insurance explained form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care insurance explained form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term care insurance explained online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit long-term care insurance explained. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term care insurance explained

How to fill out long-term care insurance explained

01

Start by gathering all the necessary information and documents such as your personal information, medical history, and financial information.

02

Research different long-term care insurance providers and policies to find the one that best suits your needs and budget.

03

Consider consulting with a financial advisor or insurance agent who specializes in long-term care insurance to get expert advice and guidance.

04

Evaluate your current and potential future long-term care needs to determine the amount of coverage you require.

05

Once you have chosen a policy, carefully review all the terms, conditions, and exclusions before signing any paperwork.

06

Fill out the application form accurately and completely, providing all the required information.

07

Submit the completed application along with any necessary supporting documents like medical records or financial statements.

08

Pay the insurance premiums as required by the policy.

09

After submitting your application, wait for the insurance company to review and process it.

10

If approved, carefully review the issued policy and make sure you understand its benefits, limitations, and how to make a claim if needed.

11

Keep the policy in a safe place and regularly review it to ensure it still meets your needs and make any necessary updates or changes as your circumstances evolve.

Who needs long-term care insurance explained?

01

Long-term care insurance is beneficial for individuals who want to protect their financial assets and ensure they can afford necessary care in case they develop a chronic illness or disability.

02

This type of insurance is particularly important for individuals who do not have sufficient savings to cover long-term care expenses.

03

It can also be helpful for those who want to maintain control over the type and quality of care they receive in their later years.

04

People who have a family history of chronic illnesses or disabilities may also consider long-term care insurance to mitigate potential future costs.

05

Ultimately, anyone who wants to be financially prepared for the possibility of needing long-term care should consider long-term care insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my long-term care insurance explained in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your long-term care insurance explained and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the long-term care insurance explained in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your long-term care insurance explained right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit long-term care insurance explained straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing long-term care insurance explained right away.

What is long-term care insurance explained?

Long-term care insurance is a type of insurance designed to cover the cost of long-term care services such as nursing home care, assisted living, and in-home care. It provides financial support for individuals who need assistance with daily activities over an extended period.

Who is required to file long-term care insurance explained?

Individuals who have purchased long-term care insurance policies typically need to file claims when they require care. However, there are no specific requirements regarding who must file as this depends on the policyholder's situation.

How to fill out long-term care insurance explained?

Filling out long-term care insurance typically involves completing a claim form provided by the insurance company. This process may include detailing the type of care received, submitting medical documentation, and providing information about the caregivers.

What is the purpose of long-term care insurance explained?

The purpose of long-term care insurance is to protect individuals from the high costs associated with long-term care, allowing them to plan for potential future needs while preserving their savings and assets.

What information must be reported on long-term care insurance explained?

When filing a long-term care insurance claim, individuals must report information such as the date of service, type of care received, provider details, and any relevant medical documentation to support the claim.

Fill out your long-term care insurance explained online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Care Insurance Explained is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.