Get the free Empirical Credit Cycles and Capital Buffer Formation ...

Show details

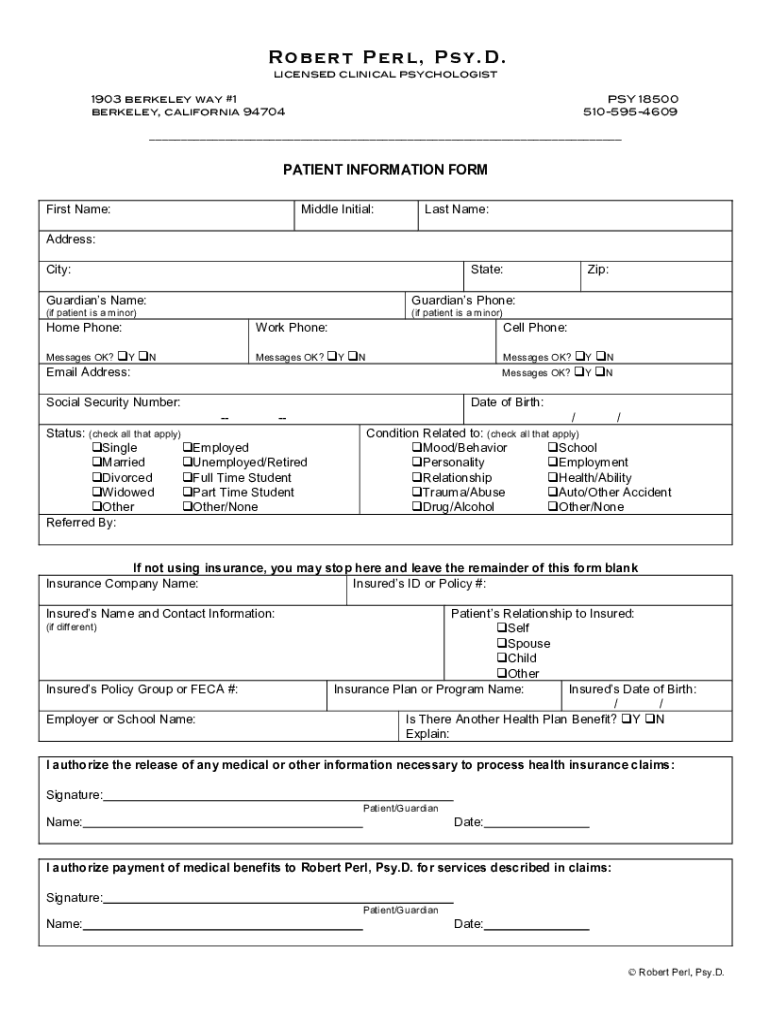

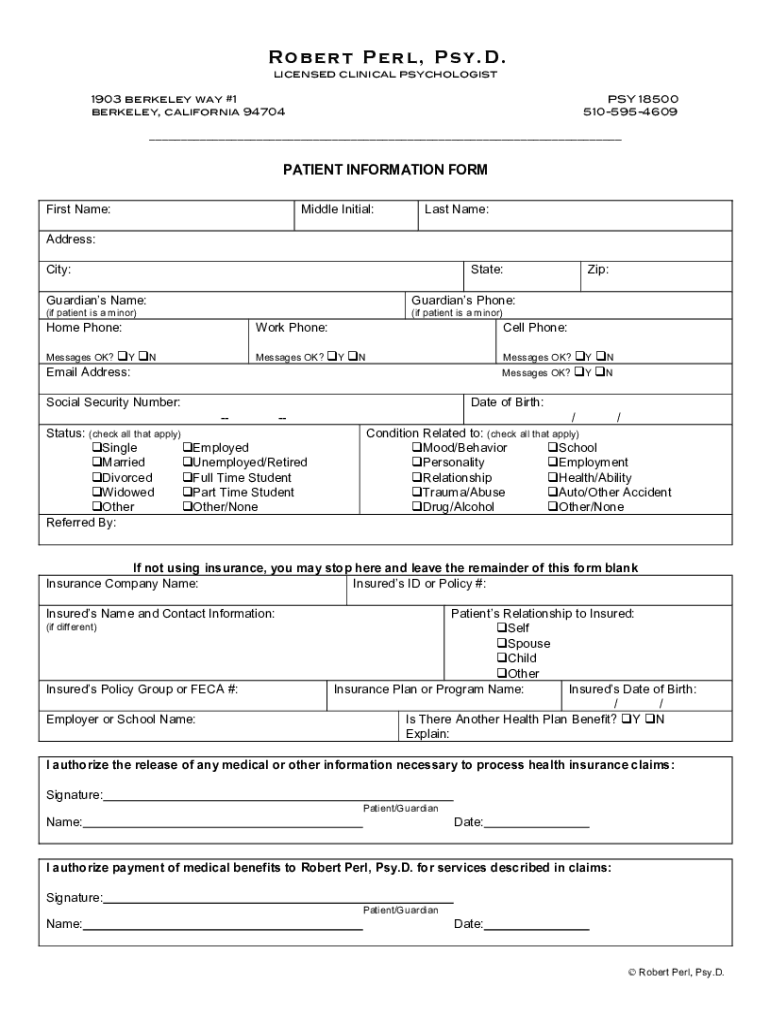

Robert Perl, Pay. D.

licensed clinical psychologist

1903 Berkeley way #1

Berkeley, California 94704PSY 18500

5105954609PATIENT INFORMATION FORM

First Name:Middle Initial:Last Name:Address:

City:State:Guardians

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign empirical credit cycles and

Edit your empirical credit cycles and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your empirical credit cycles and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing empirical credit cycles and online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit empirical credit cycles and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out empirical credit cycles and

How to fill out empirical credit cycles and

01

To fill out empirical credit cycles, follow these steps:

02

Gather relevant financial data: Collect historical data on credit transactions, delinquencies, defaults, and other credit-related metrics.

03

Preprocess and clean the data: Remove any duplicate or inconsistent entries, handle missing values, and convert the data into a suitable format for analysis.

04

Identify the time period: Determine the time range for which you want to analyze credit cycles. This could be a specific year, quarter, or a longer time frame.

05

Define credit cycle indicators: Choose relevant indicators to capture different aspects of credit cycles, such as credit growth, default rates, loan-to-value ratios, etc.

06

Analyze the data: Apply statistical and econometric techniques to study the patterns and dynamics of credit cycles. This may involve time series analysis, regression modeling, or other quantitative methods.

07

Interpret the results: Examine the findings to gain insights into the behavior of credit cycles. Look for patterns, trends, and potential drivers of credit cycles.

08

Document and communicate the findings: Summarize the analysis, present visualizations or charts to support the conclusions, and provide recommendations or implications for relevant stakeholders.

Who needs empirical credit cycles and?

01

Empirical credit cycles are useful for several stakeholders, including:

02

- Banks and Financial Institutions: They can use empirical credit cycles to assess credit risk, make informed lending decisions, and develop risk management strategies.

03

- Regulators: Credit cycles can help regulators monitor and evaluate the stability of the financial system, detect potential systemic risks, and design appropriate policy measures.

04

- Investors and Analysts: Understanding credit cycles can provide valuable insights for investment strategies, asset allocation decisions, and risk assessment in various financial markets.

05

- Researchers and Academics: Empirical credit cycles offer opportunities for studying the impact of credit on the economy, exploring the relationship between credit cycles and business cycles, and developing new theories or models.

06

- Government Agencies: Credit cycles can assist government agencies in formulating macroeconomic policies, designing targeted interventions to address credit market imbalances, and promoting financial stability.

07

- Risk Managers: Empirical credit cycles help risk managers identify potential vulnerabilities, develop early warning systems, and implement proactive risk mitigation strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my empirical credit cycles and in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign empirical credit cycles and and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete empirical credit cycles and online?

Completing and signing empirical credit cycles and online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit empirical credit cycles and on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing empirical credit cycles and right away.

What is empirical credit cycles?

Empirical credit cycles refer to the observable patterns and trends in credit availability and borrower behavior over time, reflecting fluctuations in credit conditions across various economic environments.

Who is required to file empirical credit cycles?

Entities that manage or report on credit data, including financial institutions, credit agencies, and certain regulatory bodies, are typically required to file empirical credit cycles.

How to fill out empirical credit cycles?

To fill out empirical credit cycles, organizations must gather and report data regarding their credit activities, using formatted templates provided by relevant authorities or regulatory bodies.

What is the purpose of empirical credit cycles?

The purpose of empirical credit cycles is to analyze the credit environment, identify trends in lending and borrowing, and assess the overall health of the financial system.

What information must be reported on empirical credit cycles?

Reporting on empirical credit cycles typically includes data on credit issuances, borrower demographics, repayment behaviors, default rates, and other related credit metrics.

Fill out your empirical credit cycles and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Empirical Credit Cycles And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.