Get the free Tax planning for investments gets more complicatedTimpe CPAs

Show details

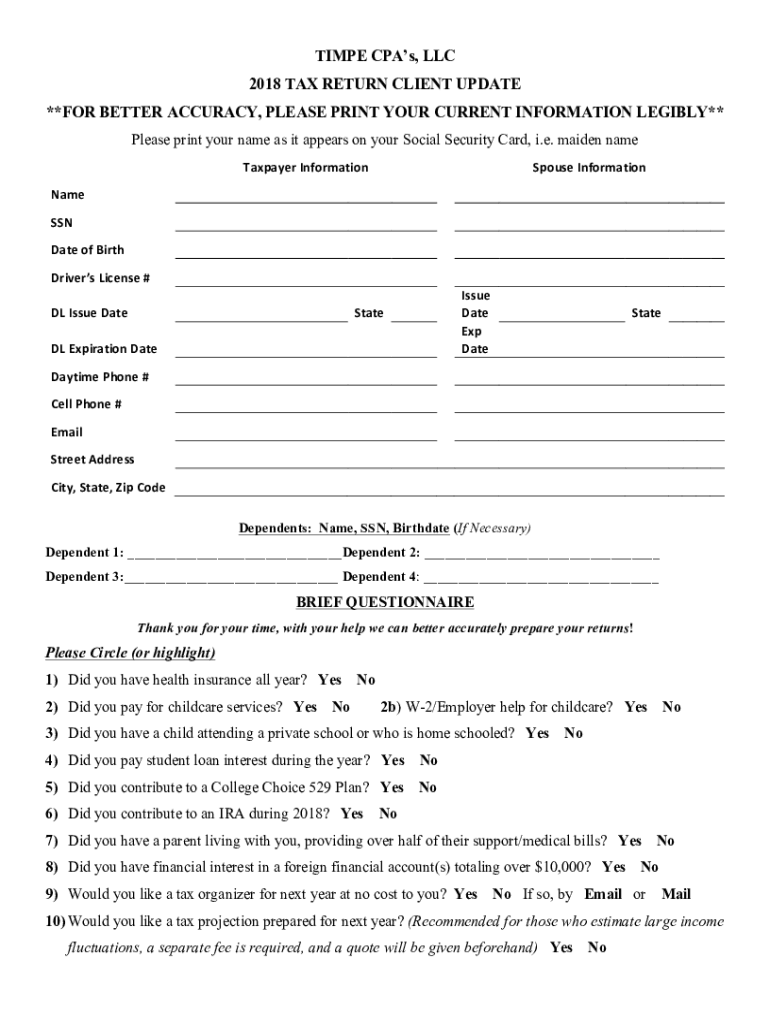

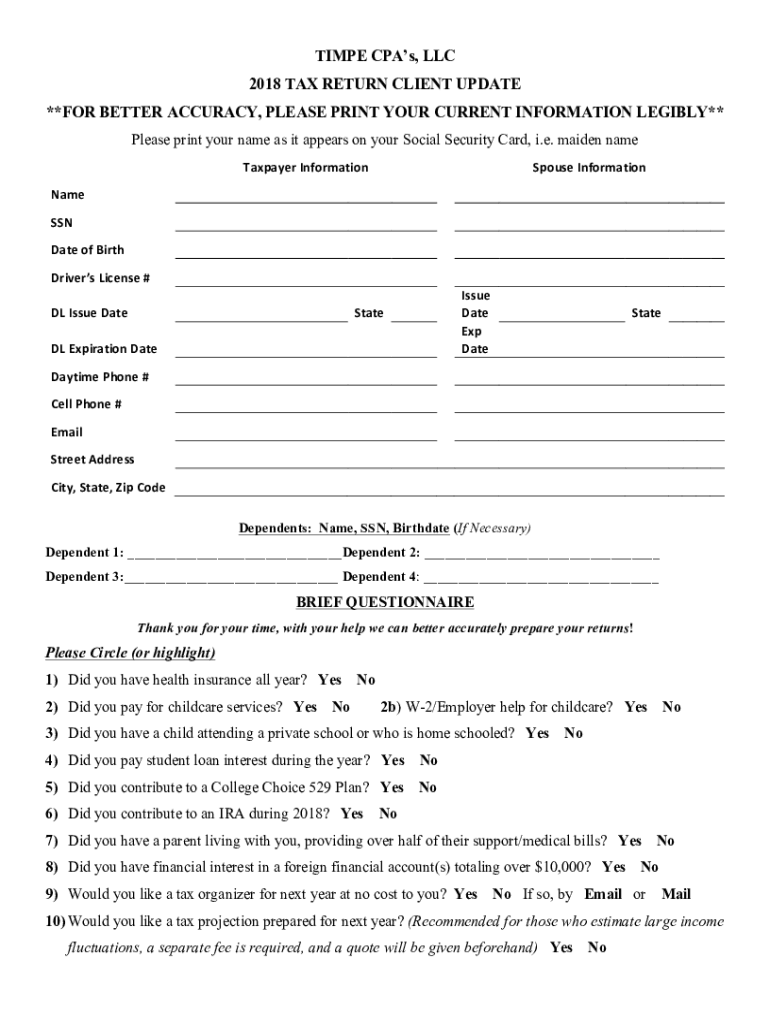

TIME CPA's, LLC

2018 TAX RETURN CLIENT UPDATE

**FOR BETTER ACCURACY, PLEASE PRINT YOUR CURRENT INFORMATION LEGIBLY**

Please print your name as it appears on your Social Security Card, i.e. maiden

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax planning for investments

Edit your tax planning for investments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax planning for investments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax planning for investments online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax planning for investments. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax planning for investments

How to fill out tax planning for investments

01

To fill out tax planning for investments, follow these steps:

02

Gather all necessary financial documents and investment records.

03

Determine the types of investments you have made, such as stocks, bonds, mutual funds, real estate, or retirement accounts.

04

Understand the tax implications for each type of investment. Research applicable tax laws and regulations.

05

Identify any tax deductions or credits for which you may be eligible. This could include deductions for contributions to retirement accounts or tax credits for certain types of investments.

06

Calculate your capital gains and losses from the investments. This can be done by subtracting the purchase price from the selling price for each investment.

07

Determine your tax bracket and the applicable tax rates for your investment income.

08

Consider utilizing tax-efficient investment strategies, such as tax-loss harvesting or maximizing contributions to tax-advantaged accounts.

09

Consult with a tax professional or financial advisor for personalized advice and guidance.

10

Complete the necessary tax forms accurately and submit them to the appropriate tax authorities.

11

Keep thorough records of your investment activities and tax filings for future reference or potential audits.

Who needs tax planning for investments?

01

Tax planning for investments is beneficial for the following individuals or entities:

02

- Individual investors who engage in various types of investment activities, such as buying/selling stocks, bonds, or real estate.

03

- High net worth individuals who have significant investment portfolios.

04

- Business owners or entrepreneurs who have invested in their own businesses or other ventures.

05

- Retirement account holders who want to optimize their tax strategy for distributions or conversions.

06

- Estate planners or individuals involved in estate planning who need to consider tax implications of their investment holdings.

07

- Anyone who wants to minimize their tax liabilities and maximize their after-tax returns on investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax planning for investments online?

Easy online tax planning for investments completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in tax planning for investments?

With pdfFiller, it's easy to make changes. Open your tax planning for investments in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out tax planning for investments on an Android device?

Complete tax planning for investments and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tax planning for investments?

Tax planning for investments involves strategizing to minimize tax liabilities on various investment incomes through deductions, credits, and tax-efficient investment choices.

Who is required to file tax planning for investments?

Individuals and entities that have investment income, such as dividends, interest, or capital gains, are generally required to engage in tax planning for investments.

How to fill out tax planning for investments?

To fill out tax planning for investments, gather relevant financial documents, determine income types and amounts, identify applicable deductions and credits, and complete the necessary tax forms using the gathered information.

What is the purpose of tax planning for investments?

The purpose of tax planning for investments is to reduce overall tax liability, enhance post-tax returns on investments, and ensure compliance with tax regulations.

What information must be reported on tax planning for investments?

Information that must be reported includes all sources of investment income, related expenses, deductions, credits claimed, and any capital gains or losses realized during the tax year.

Fill out your tax planning for investments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Planning For Investments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.