Get the free Inheritance Tax - PA Department of Revenue Homepage

Show details

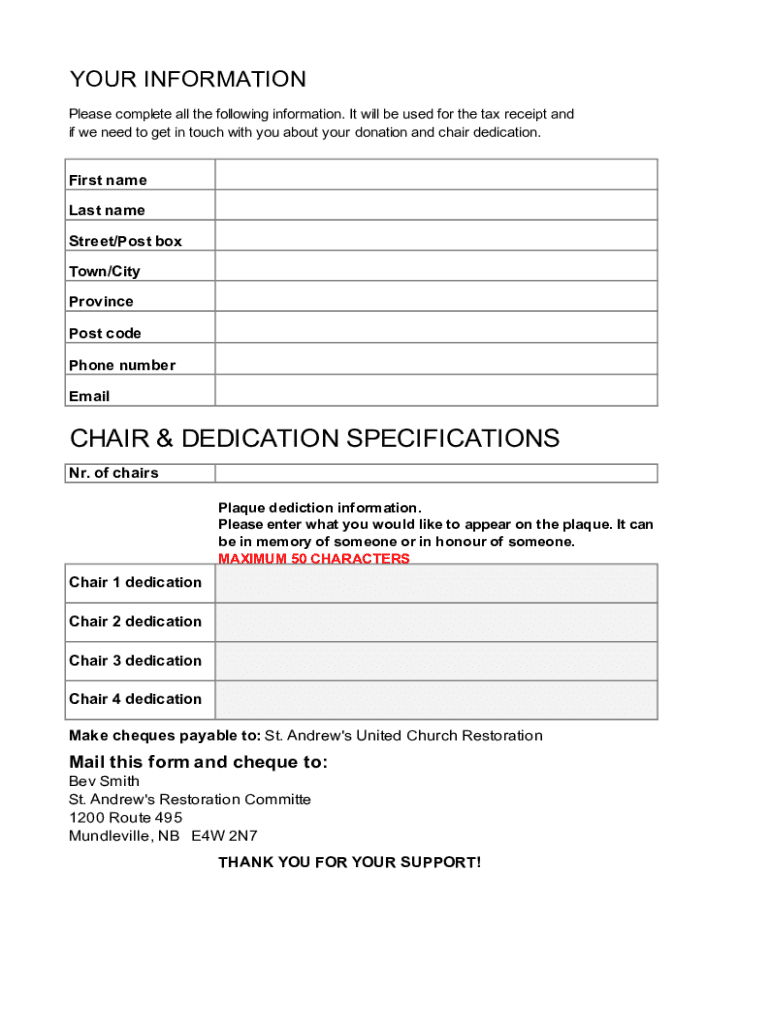

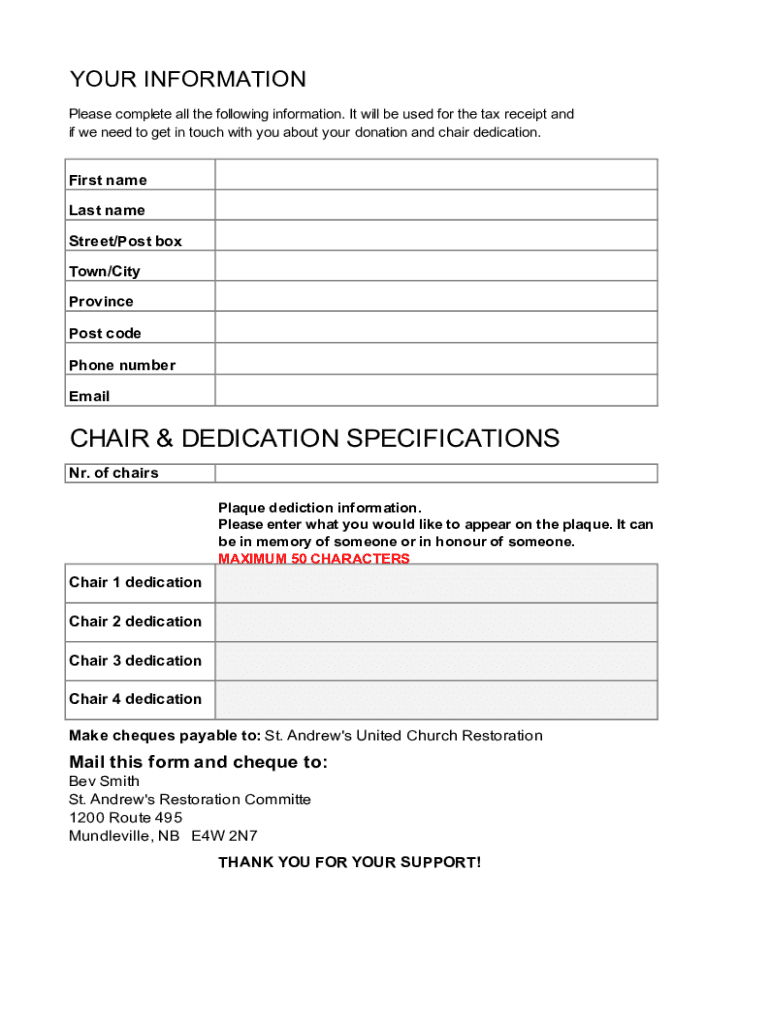

YOUR INFORMATION Please complete all the following information. It will be used for the tax receipt and if we need to get in touch with you about your donation and chair dedication. First name Last

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inheritance tax - pa

Edit your inheritance tax - pa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inheritance tax - pa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing inheritance tax - pa online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit inheritance tax - pa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out inheritance tax - pa

How to fill out inheritance tax - pa

01

Step 1: Gather all necessary documents such as the deceased's will, bank statements, property deeds, and any other relevant financial documents.

02

Step 2: Determine the value of the deceased's estate by calculating the total worth of their assets, including money, property, investments, and belongings.

03

Step 3: Identify the beneficiaries of the estate, such as family members or charitable organizations, who are entitled to receive a portion of the inheritance.

04

Step 4: Consult with a tax professional or solicitor who specializes in inheritance tax laws to understand the specific regulations and exemptions that may apply to your situation.

05

Step 5: Complete the necessary inheritance tax forms, providing accurate information about the estate's value and the beneficiaries.

06

Step 6: Submit the completed forms along with any required supporting documents to the appropriate inheritance tax office.

07

Step 7: Pay the inheritance tax owed to the tax authorities within the designated time frame.

08

Step 8: Keep documentation and records related to the inheritance tax filing for future reference or potential audits.

Who needs inheritance tax - pa?

01

Anyone who inherits assets or property from a deceased person may be subject to inheritance tax. The specific requirements and exemptions vary depending on the jurisdiction and the value of the estate.

02

Inheritance tax is typically levied on beneficiaries who receive a significant amount of wealth or property, usually beyond a certain threshold set by the government.

03

Different countries have different laws regarding inheritance tax, so it is important to consult with a tax professional or solicitor to determine if you are liable for inheritance tax in your jurisdiction.

04

In some cases, specific beneficiaries or types of assets may be exempt from inheritance tax, such as spouses, civil partners, or certain charitable organizations.

05

It is important to note that laws and regulations regarding inheritance tax can change over time, so staying informed and seeking professional advice is crucial when dealing with inheritance tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my inheritance tax - pa in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your inheritance tax - pa along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send inheritance tax - pa for eSignature?

To distribute your inheritance tax - pa, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in inheritance tax - pa?

The editing procedure is simple with pdfFiller. Open your inheritance tax - pa in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is inheritance tax - pa?

Inheritance tax in Pennsylvania is a tax imposed on the transfer of a deceased person's estate to their heirs or beneficiaries. The tax rate depends on the relationship of the heir to the deceased.

Who is required to file inheritance tax - pa?

In Pennsylvania, the executor or administrator of the estate is required to file an inheritance tax return on behalf of the estate. Beneficiaries receiving property or assets from the estate may also be required to pay the inheritance tax.

How to fill out inheritance tax - pa?

To fill out the inheritance tax return in Pennsylvania, you must complete Form REV-1500, providing details about the deceased, beneficiaries, the value of the estate, and any deductions. It is advisable to consult with a tax professional or attorney for assistance.

What is the purpose of inheritance tax - pa?

The purpose of the inheritance tax in Pennsylvania is to generate revenue for the state government and to tax the transfer of wealth from the deceased to their beneficiaries.

What information must be reported on inheritance tax - pa?

The inheritance tax return must report information including the value of the estate, details of the deceased, names and relationships of the heirs, and any exemptions or deductions that apply.

Fill out your inheritance tax - pa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inheritance Tax - Pa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.