Get the free Core Bond Fund

Show details

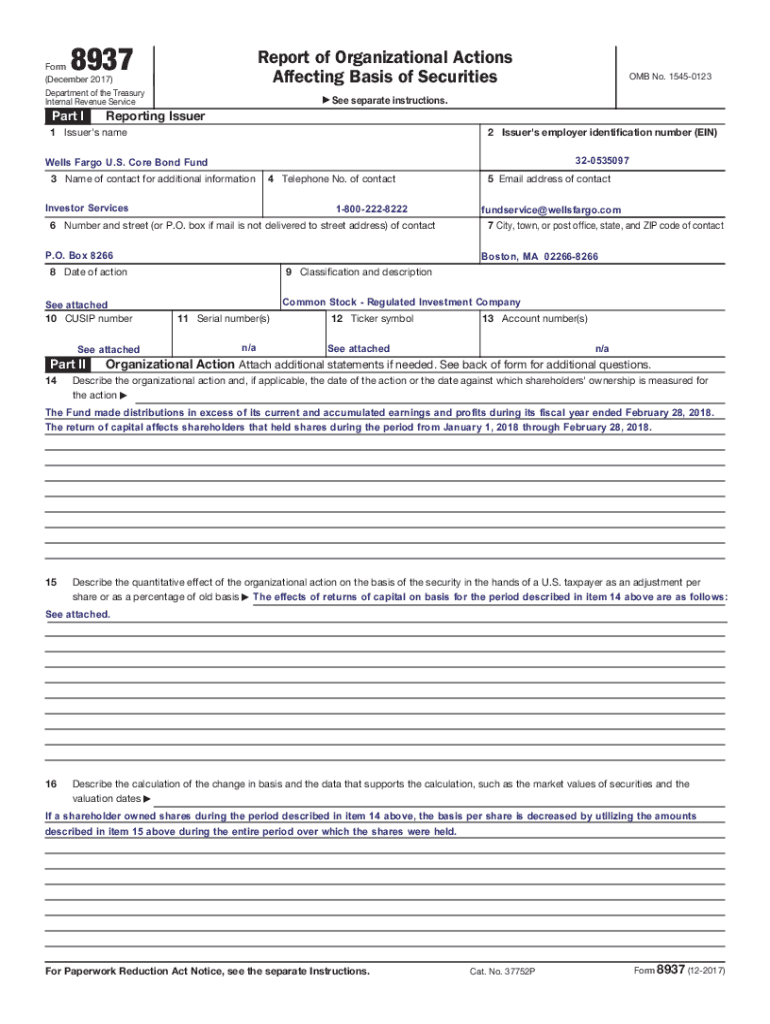

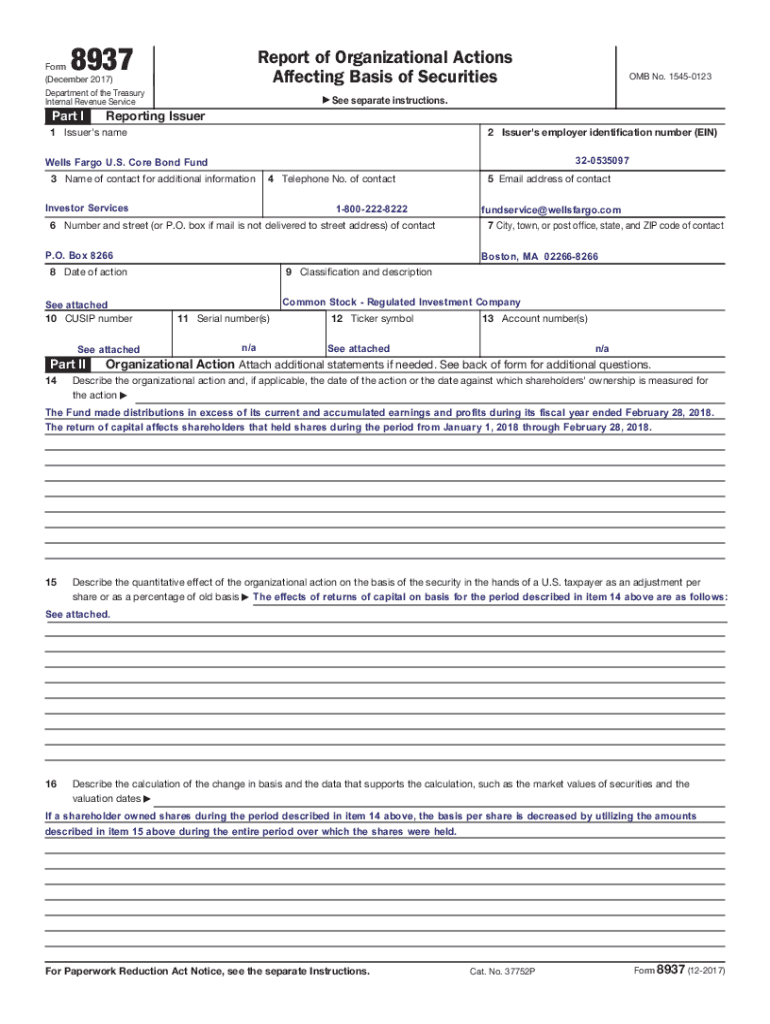

8937Report of Organizational Actions

Affecting Basis of SecuritiesForm

(December 2017)

Department of the Treasury

Internal Revenue Serviceman Ia See separate instructions. Reporting Issuer1 Issuer\'s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign core bond fund

Edit your core bond fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your core bond fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit core bond fund online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit core bond fund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out core bond fund

How to fill out core bond fund

01

To fill out a core bond fund, follow these steps:

02

Determine your investment goal: Understand why you want to invest in a core bond fund, whether it's for capital preservation, income generation, or diversification.

03

Research various core bond funds: Look for funds that align with your investment goals, risk tolerance, and time horizon. Compare their performance, expense ratio, and investment strategy.

04

Choose a reputable fund provider: Select a reliable and well-established asset management company that offers core bond funds. Consider their track record, expertise, and customer reviews.

05

Open an investment account: Contact the fund provider or your preferred broker to open an investment account. Provide the necessary personal and financial information to comply with legal requirements.

06

Determine your investment amount: Decide how much money you want to invest in the core bond fund. Consider your overall financial portfolio and risk tolerance while setting the investment amount.

07

Complete the application form: Fill out the required application form provided by the fund provider or broker. Provide accurate information about your personal details and investment preferences.

08

Choose your investment strategy: Decide whether you want to invest a lump sum or make periodic contributions. Also, consider whether you want to reinvest the dividends or receive them as cash.

09

Review and submit the application: Read the filled application form carefully to ensure accuracy. Submit the completed form along with any required supporting documents as requested.

10

Fund your investment: Transfer the desired investment amount to the specified account. Follow the instructions provided by the fund provider or broker for a smooth transaction.

11

Monitor your investment: Keep track of your core bond fund's performance, any updates or changes in the fund strategy, and periodically review its suitability for your investment goals.

Who needs core bond fund?

01

Core bond funds are suitable for individuals who:

02

- Seek a stable and relatively lower-risk investment option

03

- Aim for current income generation and preservation of capital

04

- Want to diversify their investment portfolio by including fixed-income securities

05

- Have a mid to long-term investment horizon

06

- Are comfortable with moderate fluctuations in the value of their investment

07

- Are looking for a professionally managed investment option without the need for extensive research and active management

08

- Want exposure to a broad range of bonds issued by governments, municipalities, and corporations

09

- Desire the potential to earn higher returns than traditional savings or money market accounts

10

It is recommended to consult with a financial advisor or professional before investing in a core bond fund to ensure it aligns with your specific financial goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in core bond fund?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your core bond fund to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the core bond fund in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your core bond fund and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit core bond fund straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing core bond fund right away.

What is core bond fund?

A core bond fund is a type of investment fund that primarily invests in a diversified portfolio of bonds, aiming to provide steady income and capital preservation, typically holding a mix of government, municipal, and corporate bonds.

Who is required to file core bond fund?

Investors and institutions that invest in core bond funds are required to report their holdings and financial information as part of regulatory obligations, including fund managers and financial advisors who manage such funds.

How to fill out core bond fund?

Filling out a core bond fund requires providing detailed information about the fund's investments, including the types of bonds held, their credit ratings, maturity dates, and overall performance metrics, usually through official reporting forms designated by regulatory bodies.

What is the purpose of core bond fund?

The purpose of a core bond fund is to provide investors with a low-risk investment option that generates consistent income through interest payments while helping preserve capital against market volatility.

What information must be reported on core bond fund?

The information that must be reported on a core bond fund includes the fund's total assets, investment portfolio details, performance metrics, level of diversification, expense ratios, and any fees associated with managing the fund.

Fill out your core bond fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Core Bond Fund is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.