Get the free State Administrative & Accounting Manual (SAAM)Office of ...

Show details

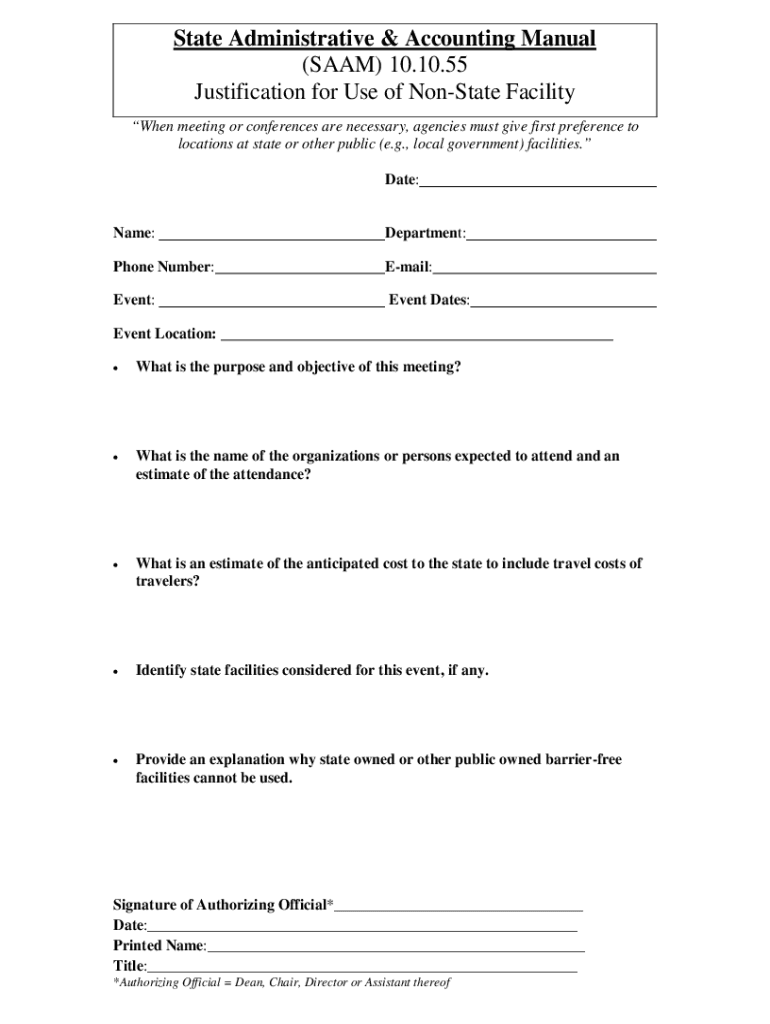

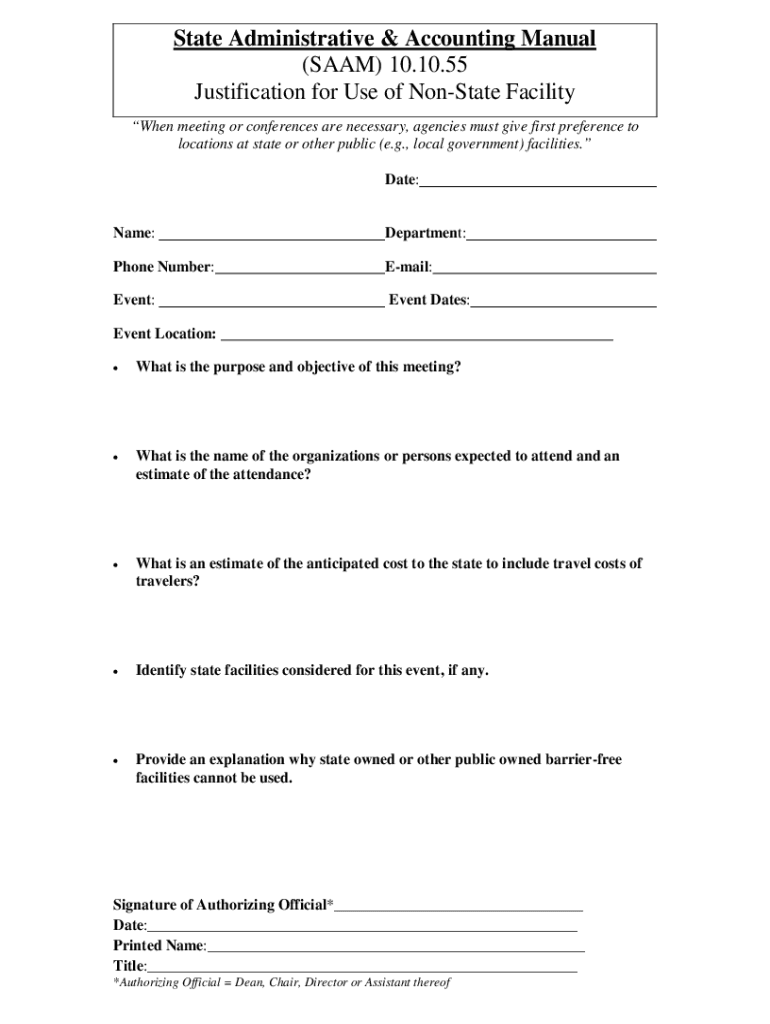

State Administrative & Accounting Manual

(SAM) 10.10.55

Justification for Use of Onstage Facility

When meeting or conferences are necessary, agencies must give first preference to

locations at state

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state administrative ampamp accounting

Edit your state administrative ampamp accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state administrative ampamp accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state administrative ampamp accounting online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state administrative ampamp accounting. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state administrative ampamp accounting

How to fill out state administrative ampamp accounting

01

To fill out state administrative and accounting, follow these steps:

02

Collect all relevant financial documents, such as receipts, invoices, and bank statements.

03

Create a chart of accounts to categorize your expenses and income.

04

Enter all financial transactions into the accounting software or system you are using.

05

Reconcile bank statements with your recorded transactions to ensure accuracy.

06

Calculate and report your business taxes based on the accounting records.

07

Prepare financial statements, such as balance sheets and income statements, to analyze your financial position.

08

Submit the necessary reports and documentation to the state administrative authorities following their guidelines.

09

Keep a copy of all records and reports for future reference and auditing purposes.

10

Review and update your state administrative and accounting processes regularly to stay compliant with any changes in regulations.

Who needs state administrative ampamp accounting?

01

State administrative and accounting is needed by various entities, including:

02

- Businesses and corporations that are required by law to maintain accurate financial records for tax purposes and regulatory compliance.

03

- Government agencies and departments that need to track and manage public funds.

04

- Non-profit organizations that must demonstrate transparency and accountability in their financial operations.

05

- Individuals or households who want to keep track of their personal income, expenses, and financial goals.

06

- Financial institutions that require accurate accounting records for loan applications and financial analysis.

07

- Investors and shareholders who rely on accurate financial information to make informed decisions about investments or corporate governance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify state administrative ampamp accounting without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your state administrative ampamp accounting into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send state administrative ampamp accounting to be eSigned by others?

When your state administrative ampamp accounting is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the state administrative ampamp accounting electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your state administrative ampamp accounting in seconds.

What is state administrative accounting?

State administrative accounting refers to the financial management and reporting processes used by state government entities to record, analyze, and report financial transactions in accordance with regulations and standards.

Who is required to file state administrative accounting?

Typically, state agencies, departments, and certain public entities that manage funds and resources are required to file state administrative accounting.

How to fill out state administrative accounting?

To fill out state administrative accounting, agencies must gather financial data, complete the required forms detailing revenue and expenditures, and submit them according to the specified guidelines set by the state's financial authority.

What is the purpose of state administrative accounting?

The purpose of state administrative accounting is to ensure transparency and accountability in the use of public funds, facilitate financial reporting, and support effective decision-making within state agencies.

What information must be reported on state administrative accounting?

State administrative accounting must report information such as revenues, expenditures, balance sheets, fund transfers, and any relevant financial statements that reflect the financial position of the agency.

Fill out your state administrative ampamp accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Administrative Ampamp Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.