Get the free Schedule M-3 (Form 1065) - irs

Show details

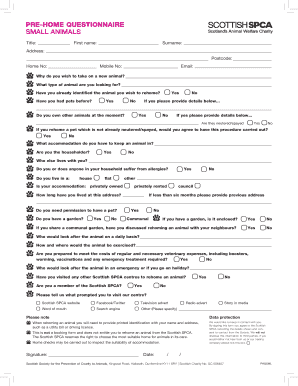

This is an early release draft of Schedule M-3, which is used for reconciling net income or loss for certain partnerships with income reported on tax returns. It includes information on total assets,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule m-3 form 1065

Edit your schedule m-3 form 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule m-3 form 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule m-3 form 1065 online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule m-3 form 1065. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule m-3 form 1065

How to fill out Schedule M-3 (Form 1065)

01

Download Schedule M-3 (Form 1065) from the IRS website.

02

Gather all financial information needed, including income, deductions, and balances for the partnership.

03

Complete Section A: Identify the partnership by entering the name, EIN, and tax year.

04

Fill out Section B: Report total income and deductions to reconcile financial statement amounts to tax return amounts.

05

Complete any necessary parts of Section C: Detailed reconciliation of income and deductions, if applicable.

06

Review all entries for accuracy before submission.

07

Attach the completed Schedule M-3 to Form 1065 when filing.

Who needs Schedule M-3 (Form 1065)?

01

Any partnership that has total assets of $10 million or more at the end of the tax year.

02

Partnerships that are required to file Form 1065 must also file Schedule M-3 if they meet the asset threshold.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Schedule M-3?

corporations required to file Form 1120, U.S. Corporation Income Tax Return, that reports on Form 1120, Schedule L, Balance Sheets per Books, total assets at the end of the corporation's tax year that equal or exceed $10 million must file Schedule M-3 instead of Schedule M-1, Reconciliation of Income (Loss) per Books

When was Schedule M-3 introduced?

Schedule M-3, released in draft on January 28, 2004, will be used by Large and Midsize Business (LMSB) taxpayers (those with total assets of $10 million or more) filing Form 1120, U.S. Corporation Income Tax Return.

Who is required to file M.3 1120s?

Any corporation required to file Form 1120-S U.S. Income Tax Return for an S Corporation that reports on Schedule L of Form 1120-S total assets at the end of the corporation's tax year that exceed $10 million must complete and file Schedule M-3 (Form 1120-S) Net Income (Loss) Reconciliation for S Corporations With

What is the difference between schedule M-1 and M-3?

The Schedule M-1 must be prepared by corporations with total receipts or total assets of $250,000 or more. The Schedule M-3 must be prepared by corporations reporting gross assets of $10 million or more in assets on Schedule L of Form 1120.

What is the difference between Schedule 1 and Schedule 3 tax forms?

Schedule 1 for additional income and "above the line" deductions. Schedule 2 for additional taxes. Schedule 3 for additional credits and payments.

What is Schedule M-1 used for?

Schedule M-1 is the bridge (reconciliation) between the books and records of a corporation and its income tax return. Items included on this schedule will not be found in the corporate books and must be analyzed from workpapers prepared by the taxpayer.

What does schedule m3 stand for?

Schedule M-3, Part I, asks certain questions about the partnership's financial statements and reconciles financial statement net income (loss) for the consolidated financial statement group to income (loss) per the income statement for the partnership.

Who must file schedule m-3 part II?

If you're a partnership, you'll need to complete Parts II and III if your ending total assets are $50 million or more. You don't have to complete Schedule M-3, Parts II and III if your ending total assets are less than $50 million, or if the partnership is filing Schedule M-3 as a voluntary filer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule M-3 (Form 1065)?

Schedule M-3 (Form 1065) is a tax form used by partnerships to report their income, deductions, and other financial information to the IRS. It provides a detailed reconciliation of book income to tax income, helping to identify differences between financial accounting and tax accounting.

Who is required to file Schedule M-3 (Form 1065)?

Partnerships with total assets of $10 million or more at the end of the tax year are required to file Schedule M-3 (Form 1065). Certain large partnerships with substantial book income may also be required to file this schedule.

How to fill out Schedule M-3 (Form 1065)?

To fill out Schedule M-3 (Form 1065), partnerships must provide information on their financial statements and reconcile their financial accounting income with their taxable income. The form consists of three parts: Part I for income and deductions, Part II for reconciling items, and Part III for the balance sheet.

What is the purpose of Schedule M-3 (Form 1065)?

The purpose of Schedule M-3 (Form 1065) is to improve transparency and compliance by providing the IRS with detailed information about a partnership's financial activities and the differences between book and tax income. It aims to help the IRS identify potential tax avoidance strategies.

What information must be reported on Schedule M-3 (Form 1065)?

Schedule M-3 (Form 1065) requires reporting of total income, deductions, tax credits, adjustments for book-to-tax differences, a detailed reconciliation of income (loss) items, and a balance sheet for the partnership. Specific line items may vary based on the partnership's financial situation.

Fill out your schedule m-3 form 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule M-3 Form 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.