Get the free Non-Registered Savings Plan (NREG) Enrolment form

Show details

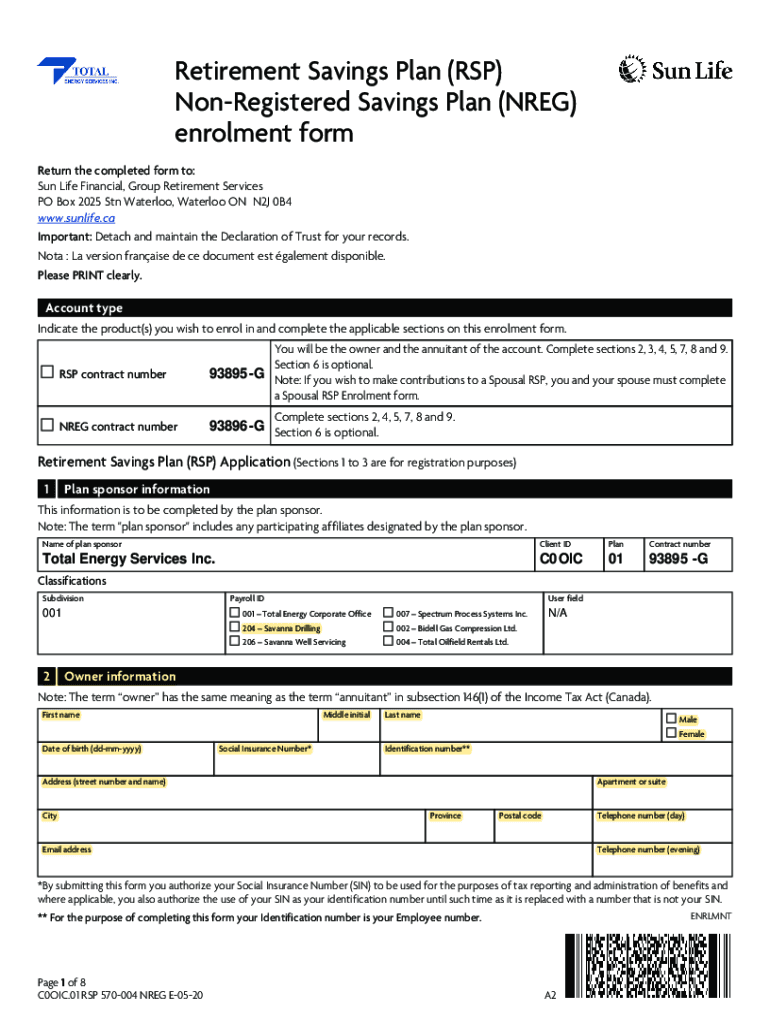

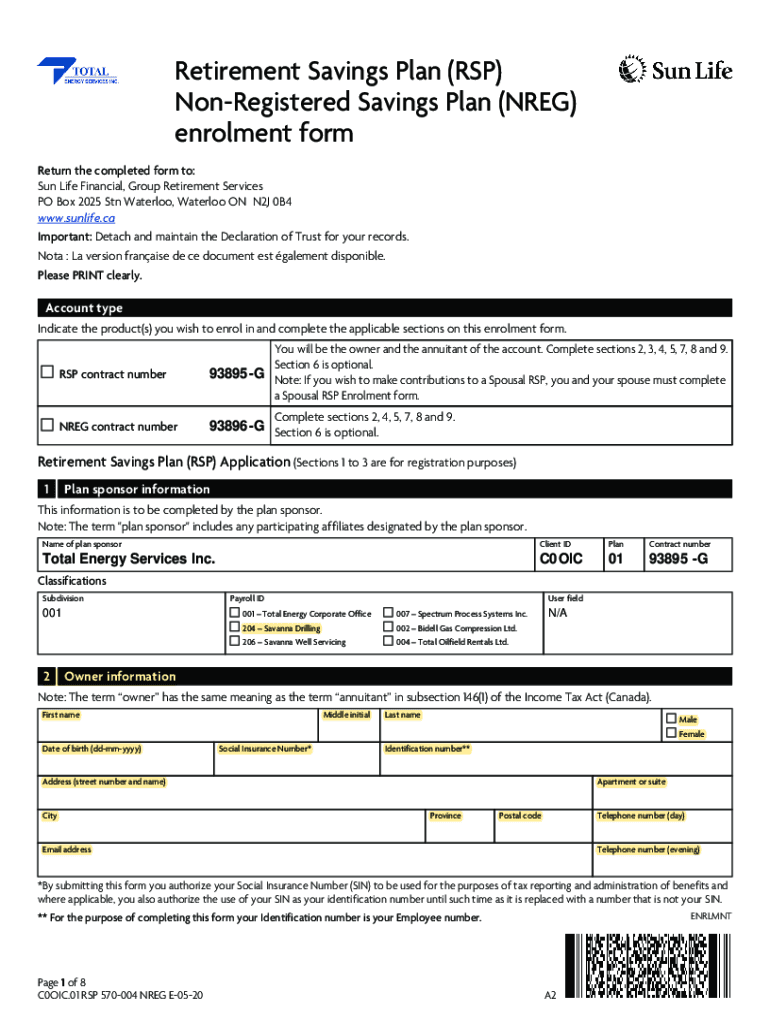

Retirement Savings Plan (RSP)

Unregistered Savings Plan (GREG)

enrollment form

Return the completed form to:

Sun Life Financial, Group Retirement Services

PO Box 2025 STN Waterloo, Waterloo ON N2J

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-registered savings plan nreg

Edit your non-registered savings plan nreg form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-registered savings plan nreg form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-registered savings plan nreg online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-registered savings plan nreg. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-registered savings plan nreg

How to fill out non-registered savings plan nreg

01

Gather all necessary documents such as identification proof, proof of address, and your financial information.

02

Research different financial institutions or investment firms that offer non-registered savings plans.

03

Compare the features, benefits, and fees associated with each non-registered savings plan.

04

Choose the financial institution or investment firm that best suits your needs and preferences.

05

Visit the chosen institution or firm's website or contact them directly to request an application form for the non-registered savings plan.

06

Fill out the application form accurately and completely, providing all required information.

07

Attach any necessary documents as specified in the application form, such as copies of your identification proof and proof of address.

08

Review the completed application form and attached documents to ensure everything is accurate and complete.

09

Submit the application form and any required documents to the financial institution or investment firm through the specified channel, such as by mail or in person.

10

Wait for confirmation from the institution or firm regarding the acceptance of your application for the non-registered savings plan.

Who needs non-registered savings plan nreg?

01

Anyone who wants to invest money outside of registered accounts like RRSP (Registered Retired Savings Plan) or TFSA (Tax-Free Savings Account) can benefit from a non-registered savings plan.

02

Individuals who have already maximized their contributions to registered accounts may choose to invest additional funds in a non-registered savings plan.

03

Business owners and self-employed individuals may also find non-registered savings plans beneficial for saving money for future business expenses or retirement.

04

Non-residents of Canada who are not eligible for registered accounts can also opt for a non-registered savings plan to save and invest their money.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non-registered savings plan nreg from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your non-registered savings plan nreg into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find non-registered savings plan nreg?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the non-registered savings plan nreg in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit non-registered savings plan nreg straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing non-registered savings plan nreg, you need to install and log in to the app.

What is non-registered savings plan nreg?

A Non-Registered Savings Plan (NReg) is a type of saving account where funds are not registered with the tax authorities, allowing for flexible contributions and withdrawals. However, interest earned may be subject to taxation.

Who is required to file non-registered savings plan nreg?

Individuals who earn interest or other investment income from non-registered savings accounts are required to report their earnings and file a Non-Registered Savings Plan (NReg) form.

How to fill out non-registered savings plan nreg?

To fill out the NReg form, individuals must provide personal information, details of the account, and report any income earned from the savings plan, including interest or capital gains.

What is the purpose of non-registered savings plan nreg?

The purpose of a Non-Registered Savings Plan (NReg) is to provide individuals with a flexible saving option that allows them to save money without the contribution limits associated with registered accounts, while still requiring reporting of earnings for tax purposes.

What information must be reported on non-registered savings plan nreg?

Information that must be reported includes the account holder's personal details, the total amount of contributions made, the interest earned, and any withdrawals or changes to the account during the reporting period.

Fill out your non-registered savings plan nreg online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Registered Savings Plan Nreg is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.