IRS 941-SS 2021 free printable template

Show details

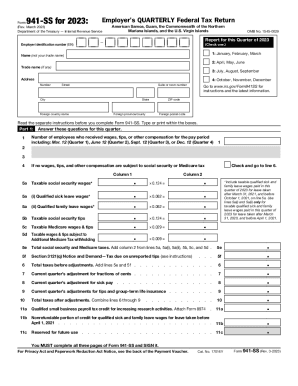

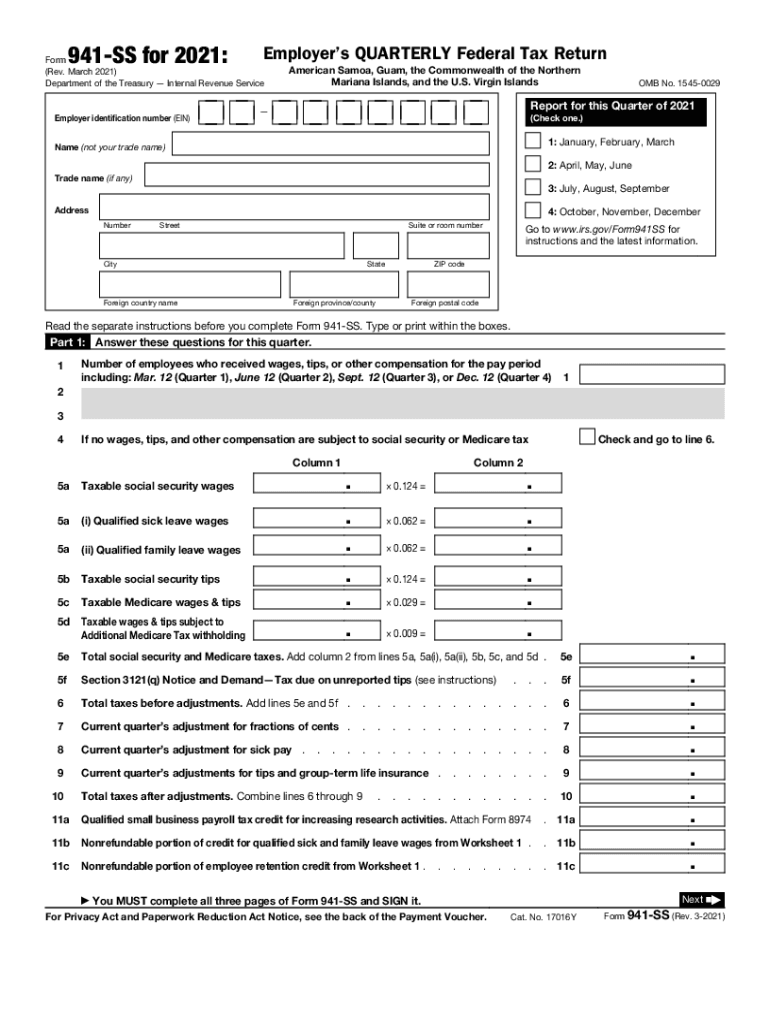

941SS for 2021:Employers QUARTERLY Federal Tax Returner (Rev. March 2021) Department of the Treasury Internal Revenue ServiceEmployer identification number (EIN)American Samoa, Guam, the Commonwealth

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941-SS

How to edit IRS 941-SS

How to fill out IRS 941-SS

Instructions and Help about IRS 941-SS

How to edit IRS 941-SS

To edit the IRS 941-SS form, you can utilize tools like pdfFiller that allow you to upload a scanned or digital copy of the form. You can then make necessary changes directly on the form using the editing features. Ensure that any edits maintain the form's integrity and comply with IRS guidelines.

How to fill out IRS 941-SS

To fill out the IRS 941-SS, follow these steps:

01

Download the form from the IRS website or access it through an online form service.

02

Provide your business information, including the Employer Identification Number (EIN).

03

Report wages and taxes withheld on the form's designated lines, ensuring accuracy in calculations.

04

Sign and date the form, certifying the information is correct.

05

Submit the form by the due date, using mail or electronic submission options.

About IRS 941-SS 2021 previous version

What is IRS 941-SS?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 941-SS 2021 previous version

What is IRS 941-SS?

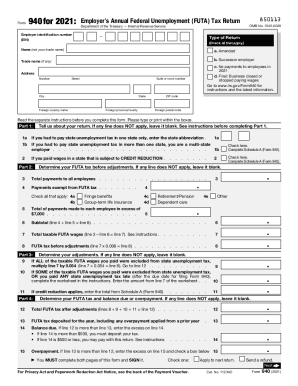

IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically used by employers operating in U.S. territories to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for maintaining compliance with federal tax obligations.

What is the purpose of this form?

The purpose of IRS Form 941-SS is to provide the IRS with information regarding the income tax, Social Security, and Medicare taxes that have been withheld from employee wages, as well as the employer’s share of these taxes. It facilitates proper tracking and payment of payroll taxes on a quarterly basis.

Who needs the form?

Employers who pay wages to employees in U.S. territories, such as Puerto Rico, American Samoa, Guam, and the U.S. Virgin Islands, are required to file Form 941-SS. This includes both for-profit businesses and non-profit organizations that meet these criteria.

When am I exempt from filling out this form?

You may be exempt from using IRS Form 941-SS if you do not have any employees or if your total tax liability is zero for the quarter. Additionally, certain government entities or specific tax-exempt organizations may also qualify for exemptions.

Components of the form

The IRS 941-SS includes several key components, such as identification information about the employer, a report of taxable wages, the calculation of taxes owed, and sections for adjustments or credits. Each section must be completed with accurate financial data to ensure compliance and correct tax reporting.

What are the penalties for not issuing the form?

Failure to file IRS Form 941-SS on time can result in penalties assessed by the IRS. The penalty rate is typically 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%. Additionally, failing to pay the owed taxes can lead to further interest charges and potential legal consequences.

What information do you need when you file the form?

When filing IRS Form 941-SS, you need to gather the following information:

01

Employer Identification Number (EIN).

02

Employee wages and the amount of federal tax withheld.

03

Social Security and Medicare taxes for both employees and employers.

04

Any adjustments made from previous forms.

05

Signature of the responsible party.

Is the form accompanied by other forms?

IRS Form 941-SS typically does not require accompanying forms; however, if there are adjustments or specific credits being claimed, additional forms may need to be filed simultaneously. It’s essential to check specific IRS instructions for any necessary supplementary paperwork.

Where do I send the form?

IRS Form 941-SS should be mailed to the appropriate address based on the employer's location and whether the form is submitted with a payment. For those submitting without a payment, specific addresses are designated by IRS guidelines and can vary based on region. Always verify the correct address on the IRS website to ensure proper delivery.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easiest thing out there dealing with PDF!

I am loving what I can do with this program and so far each time I log in I discover even more that can be done with it.

See what our users say