Get the free Required Minimum Distribution Request - 14643

Show details

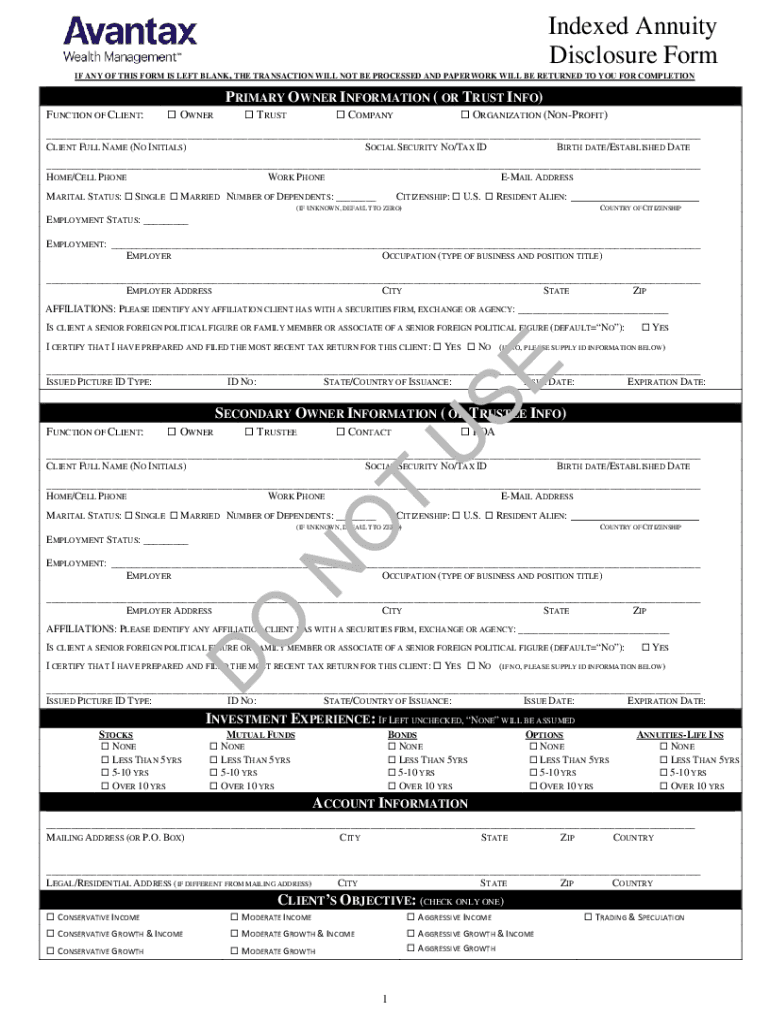

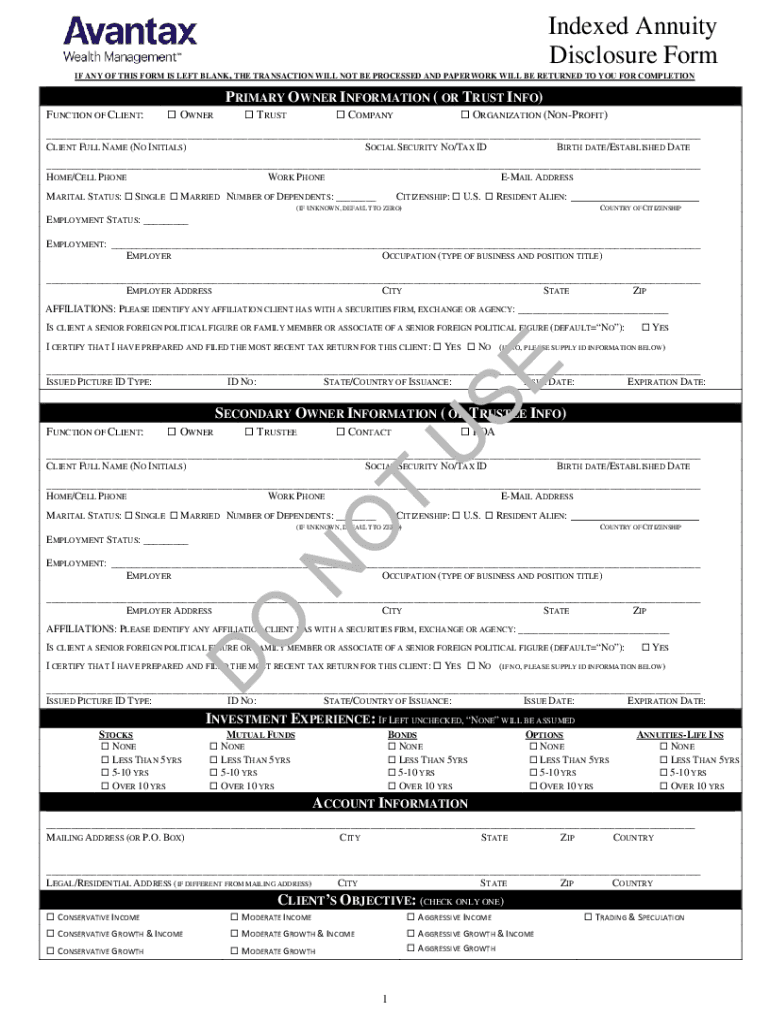

Indexed Annuity Disclosure Form IF ANY OF THIS FORM IS LEFT BLANK, THE TRANSACTION WILL NOT BE PROCESSED AND PAPERWORK WILL BE RETURNED TO YOU FOR COMPLETIONPRIMARY OWNER INFORMATION (OR TRUST INFO)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign required minimum distribution request

Edit your required minimum distribution request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your required minimum distribution request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit required minimum distribution request online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit required minimum distribution request. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out required minimum distribution request

How to fill out required minimum distribution request

01

To fill out a required minimum distribution request, follow these steps:

02

Gather the necessary documents and information, such as your retirement account details, social security number, and identification proof.

03

Contact your retirement account provider to obtain the required minimum distribution request form. This can usually be done online or over the phone.

04

Fill out the form accurately and provide all the requested information, such as the amount you want to withdraw and the frequency of distributions.

05

Double-check the form for any errors or missing information before submitting it.

06

Submit the completed form to your retirement account provider. You may do this through mail, fax, or online submission, depending on their preferred method.

07

Follow up with your retirement account provider to ensure that your required minimum distribution request has been processed.

08

Keep a copy of the submitted form and any related documentation for your records.

09

It is important to consult with a financial advisor or tax professional for specific guidance on filling out the required minimum distribution request form, as it may have implications on your tax obligations and retirement savings strategies.

Who needs required minimum distribution request?

01

Individuals who need to request a required minimum distribution (RMD) are usually those who have reached the age of 72 or 70½, depending on their date of birth, and hold retirement accounts such as traditional IRAs, SEP IRAs, SIMPLE IRAs, or 401(k) plans.

02

The IRS requires individuals to take RMDs from these accounts to ensure that taxpayers don't indefinitely defer their taxes on retirement savings.

03

Failure to take the required minimum distribution by the deadline can result in significant tax penalties.

04

Therefore, anyone who meets the eligibility criteria and holds one of these retirement accounts needs to request a required minimum distribution according to the IRS rules.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit required minimum distribution request in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing required minimum distribution request and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the required minimum distribution request in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my required minimum distribution request in Gmail?

Create your eSignature using pdfFiller and then eSign your required minimum distribution request immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is required minimum distribution request?

A required minimum distribution (RMD) request is a formal request to withdraw a minimum amount from retirement accounts, such as IRAs and 401(k)s, as mandated by the IRS, starting at age 72.

Who is required to file required minimum distribution request?

Individuals who have reached the age of 72 and own certain retirement accounts, such as traditional IRAs, 401(k)s, and other qualified retirement plans, are required to file a required minimum distribution request.

How to fill out required minimum distribution request?

To fill out an RMD request, individuals should provide personal information, account details, the amount to be withdrawn, and any additional instructions or designations on the form provided by their financial institution.

What is the purpose of required minimum distribution request?

The purpose of the required minimum distribution request is to ensure that individuals withdraw a minimum amount from their retirement accounts, thereby fulfilling IRS regulations and ensuring that taxes are collected on retirement savings during retirement.

What information must be reported on required minimum distribution request?

The required minimum distribution request must report the account holder's name, social security number, account number, the amount requested, and any instructions for where to send the funds.

Fill out your required minimum distribution request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Required Minimum Distribution Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.