Get the free TIPPENS CHARITABLE TRUST

Show details

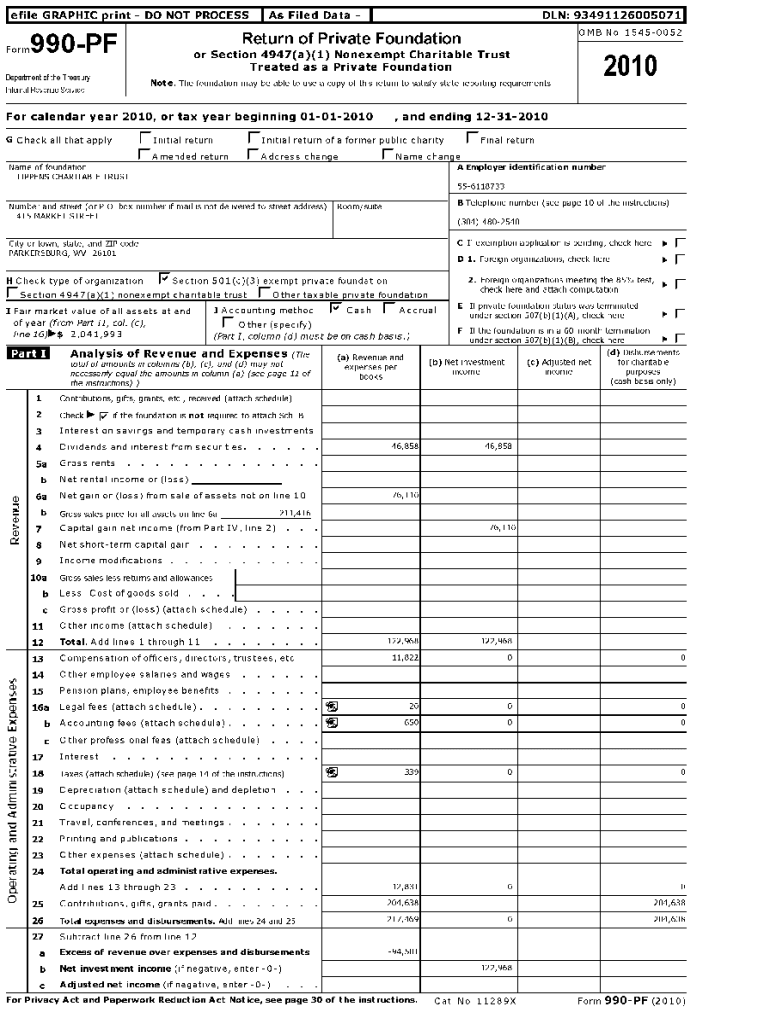

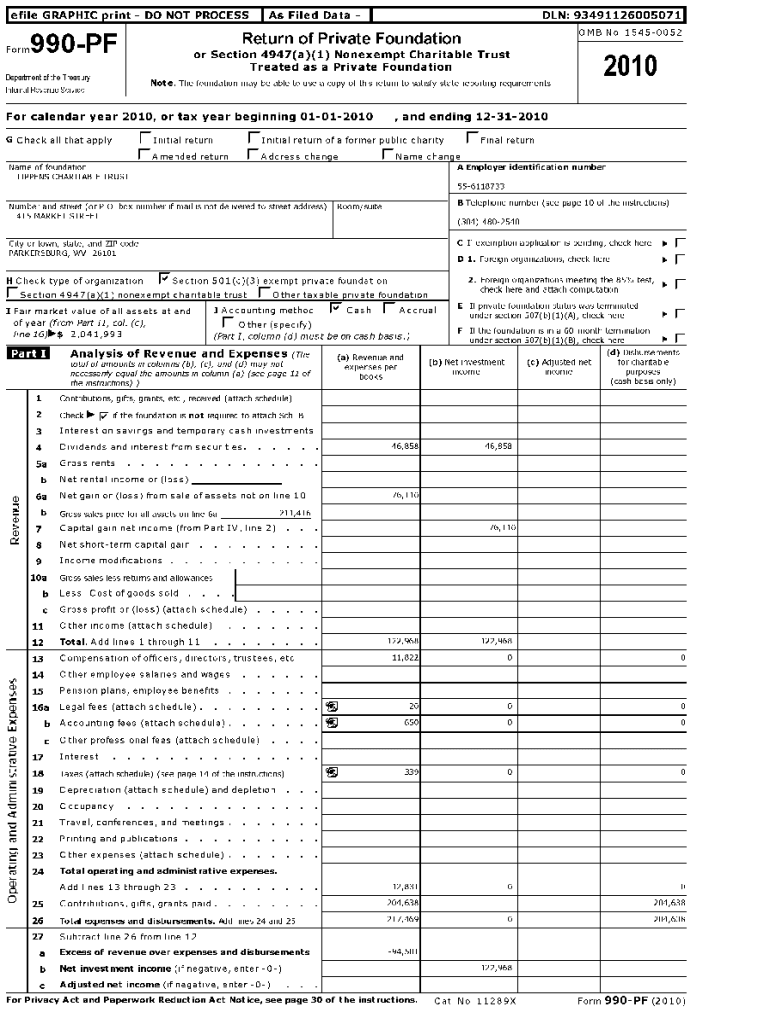

Le file Topographic print DO NOT Process Filed Data DAN: 93491126005071 OMB Return of Private Foundation990 PF15450052or Section 4947 (a)(1) Nonexempt Charitable Trust Treated as a Private FoundationRevenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tippens charitable trust

Edit your tippens charitable trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tippens charitable trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tippens charitable trust online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tippens charitable trust. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tippens charitable trust

How to fill out tippens charitable trust

01

To fill out Tippens Charitable Trust, follow these steps:

02

Start by gathering all the necessary information, including your personal details and the details of the beneficiaries and charitable organization(s) you wish to support.

03

Consult with an attorney or financial advisor to ensure you have a clear understanding of the legal requirements and implications of the trust.

04

Determine the specific assets or funds you want to contribute to the trust.

05

Create a trust document that outlines your intentions, including the beneficiaries, distribution rules, and any limitations or conditions you wish to impose.

06

Name a trustee who will be responsible for managing and distributing the trust's assets according to your instructions.

07

Sign the trust document in the presence of a notary public or other authorized witnesses.

08

Provide copies of the trust document to all relevant parties, including the trustee and beneficiaries.

09

Regularly review and update the trust as needed to reflect any changes in your circumstances or charitable interests.

10

Consider seeking legal advice periodically to ensure your trust continues to align with your intentions and any relevant legal changes.

Who needs tippens charitable trust?

01

Tippens Charitable Trust can be useful for individuals or families who have the desire and means to support charitable causes. It is particularly suitable for those who wish to establish a long-term philanthropic legacy and have control over how their assets are distributed after their passing. Additionally, individuals who want to benefit from potential tax advantages associated with charitable giving may find Tippens Charitable Trusts beneficial. It is always recommended to consult with a legal or financial professional to determine if a charitable trust is the right option for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the tippens charitable trust electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your tippens charitable trust in seconds.

How do I fill out the tippens charitable trust form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tippens charitable trust. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit tippens charitable trust on an iOS device?

You certainly can. You can quickly edit, distribute, and sign tippens charitable trust on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is tippens charitable trust?

The Tippens Charitable Trust is a type of trust designed to manage assets for charitable purposes while providing potential tax benefits to the donor.

Who is required to file tippens charitable trust?

Individuals or organizations that have established a Tippens Charitable Trust are typically required to file relevant tax forms or reports associated with the trust.

How to fill out tippens charitable trust?

To fill out a Tippens Charitable Trust, you should gather information about the trust's assets, beneficiaries, and any charitable donations. Then, complete the required forms accurately and submit them to the relevant tax authorities.

What is the purpose of tippens charitable trust?

The primary purpose of a Tippens Charitable Trust is to facilitate charitable giving while preserving assets for specific beneficiaries and providing tax advantages.

What information must be reported on tippens charitable trust?

Information typically reported on a Tippens Charitable Trust includes trust income, expenses, distributions to beneficiaries, and any applicable deductions for charitable contributions.

Fill out your tippens charitable trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tippens Charitable Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.