Get the free 3 in 1 Account : Link Saving account, Trading & Demat ...

Show details

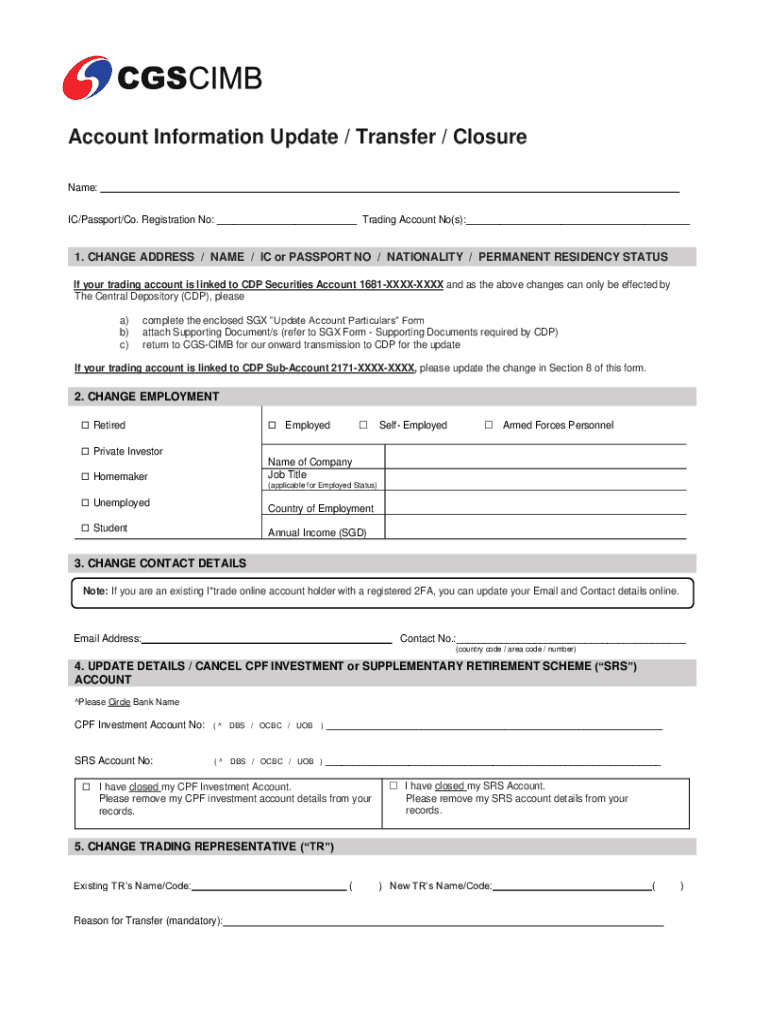

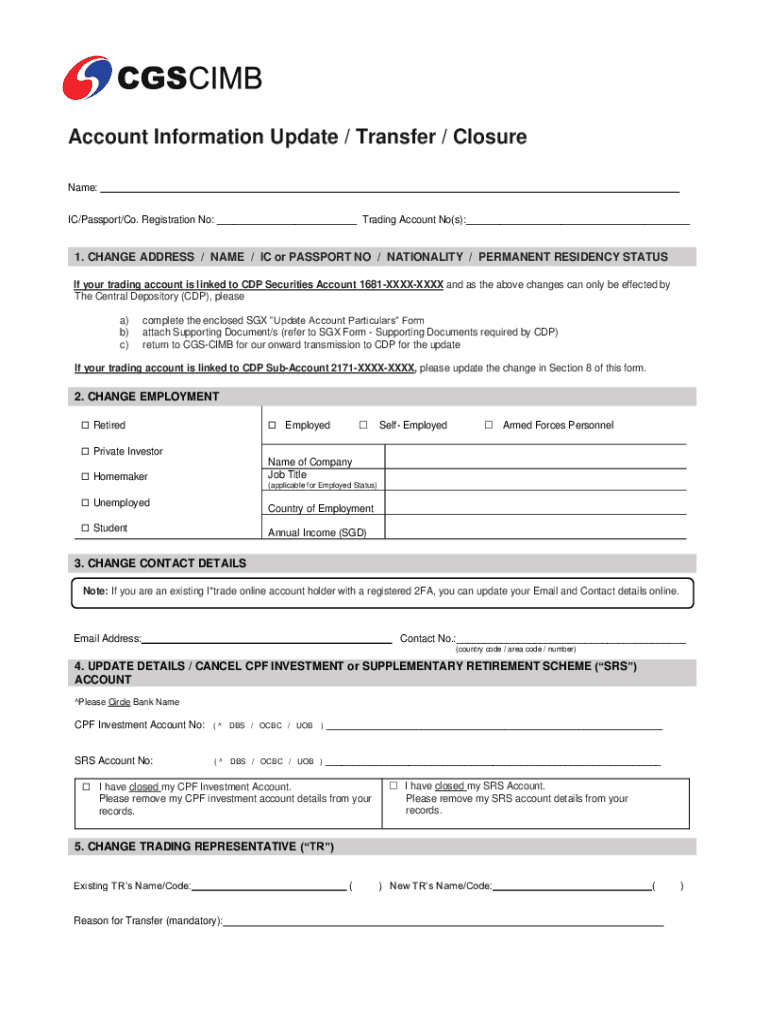

Account Information Update / Transfer / Closure Name: IC/Passport/Co. Registration No: Trading Account No(s): 1. CHANGE ADDRESS / NAME / IC or PASSPORT NO / NATIONALITY / PERMANENT RESIDENCY STATUS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3 in 1 account

Edit your 3 in 1 account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3 in 1 account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 3 in 1 account online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 3 in 1 account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3 in 1 account

How to fill out 3 in 1 account

01

To fill out a 3 in 1 account, follow these steps:

02

Research and choose a suitable financial institution or broker that offers 3 in 1 account services.

03

Visit the official website or physical branch of the chosen institution.

04

Complete the account opening form, providing accurate personal information such as name, address, contact details, and identification proofs.

05

Submit the necessary supporting documents, including identity proof, address proof, income proof, and photographs as per the requirements of the institution.

06

Provide the required initial deposit amount as specified by the financial institution.

07

Review the terms and conditions of the 3 in 1 account and sign the agreement, acknowledging your understanding and agreement.

08

Ensure all provided information and documents are valid and correct.

09

Submit the completed application form along with the necessary documents to the institution.

10

Wait for the institution to verify and process your application.

11

Once approved, you will receive your 3 in 1 account details, including login credentials, account number, and other relevant information.

12

Start using your 3 in 1 account for various financial activities, such as trading in stocks, mutual funds, and managing your savings and demat account.

Who needs 3 in 1 account?

01

A 3 in 1 account is beneficial for individuals who:

02

- want to invest in various financial instruments, such as stocks, mutual funds, IPOs, etc.

03

- require a seamless and integrated platform to manage their savings, trading, and demat accounts.

04

- prefer the convenience of having all their financial accounts linked together.

05

- seek real-time access to market updates and trading opportunities.

06

- value the ease of fund transfers between different accounts without external transactions.

07

- wish to simplify their financial management by having a single account for all their investment and banking needs.

08

- aim to optimize their portfolio and make informed investment decisions through comprehensive data and research tools provided by the 3 in 1 account provider.

09

- want to enjoy the benefits of reduced paperwork, faster transactions, and centralized tracking of investments.

10

- are looking for a reliable and trusted financial institution with robust security measures in place to safeguard their assets and data.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 3 in 1 account in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your 3 in 1 account and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit 3 in 1 account on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 3 in 1 account.

How do I complete 3 in 1 account on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 3 in 1 account by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is 3 in 1 account?

A 3 in 1 account is a type of financial account that combines three key services: a current account, a savings account, and a fixed deposit account, allowing users to manage their finances more efficiently.

Who is required to file 3 in 1 account?

Individuals and businesses that hold a 3 in 1 account are typically required to file it as part of their financial reporting obligations, especially for tax purposes.

How to fill out 3 in 1 account?

To fill out a 3 in 1 account, individuals or businesses need to provide accurate information on their financial transactions, including deposits, withdrawals, and interest earned, usually via a designated form provided by the financial institution.

What is the purpose of 3 in 1 account?

The purpose of a 3 in 1 account is to provide a single platform for managing different types of financial activities, enhancing convenience and helping account holders to maximize their financial management.

What information must be reported on 3 in 1 account?

Information that must be reported includes account balances, transaction details, interest earned, and any fees incurred, along with identification information of the account holder.

Fill out your 3 in 1 account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3 In 1 Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.