Get the free Understanding the Closing Disclosure (CD) - Part I ...

Show details

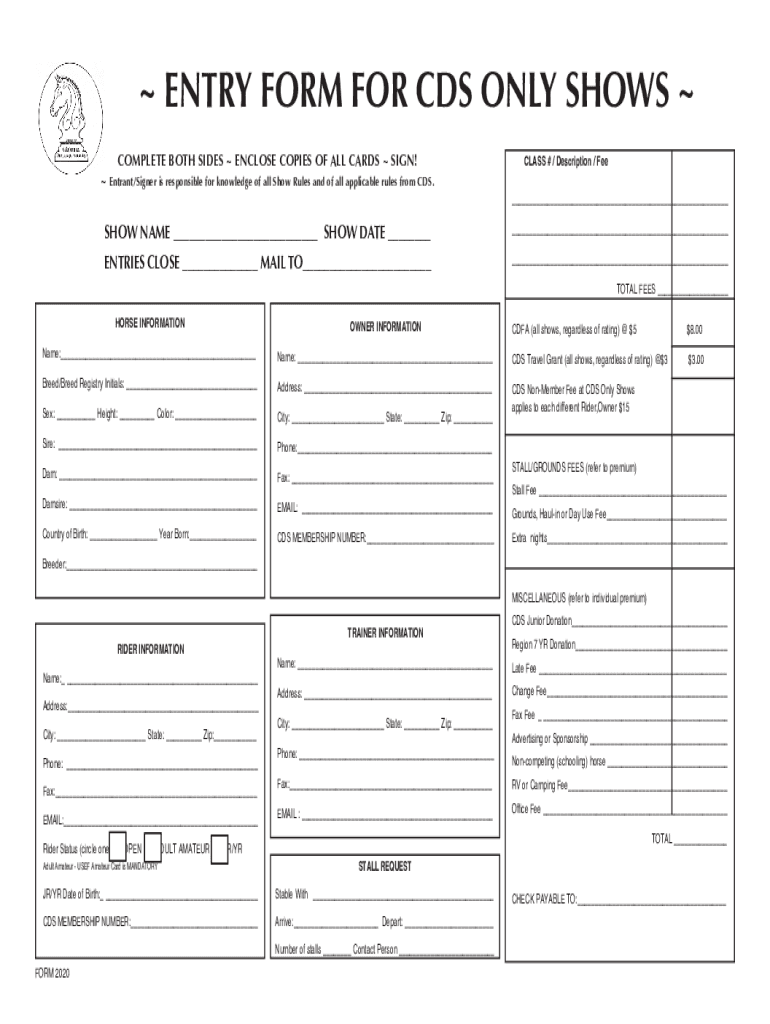

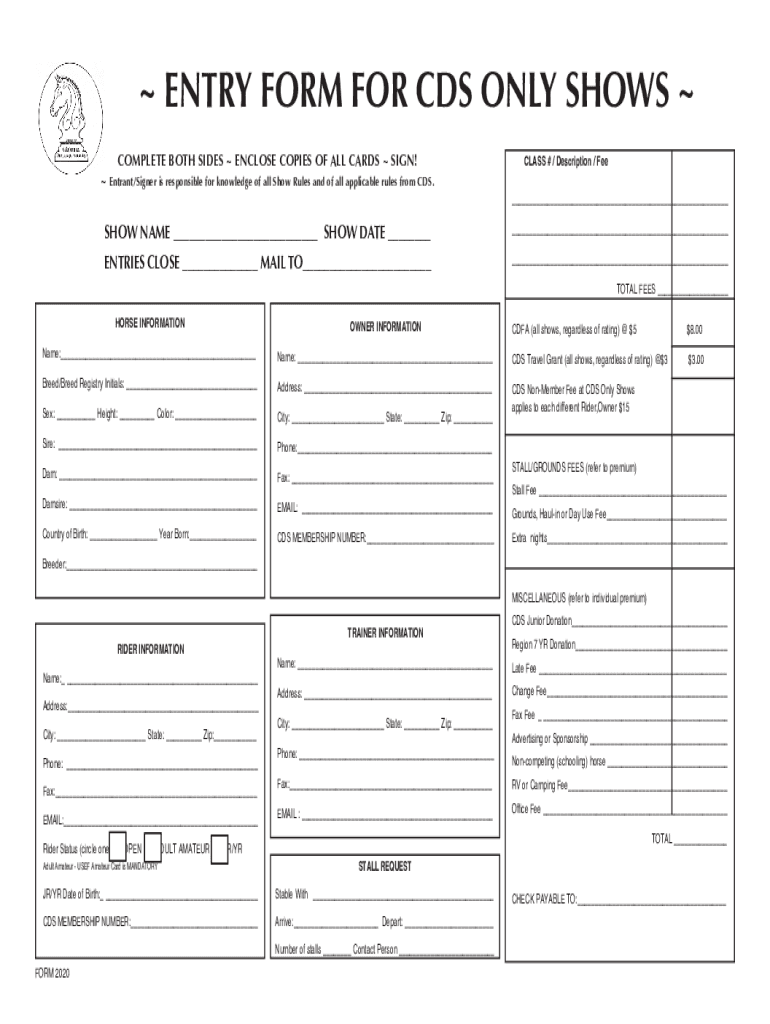

ENTRY FORM FOR CDS ONLY SHOWS COMPLETE BOTH SIDES ENCLOSE COPIES OF ALL CARDS SIGN! Entrant/Signer is responsible for knowledge of all Show Rules and of all applicable rules from CDS.CLASS # / Description

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding form closing disclosure

Edit your understanding form closing disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding form closing disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding form closing disclosure online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding form closing disclosure. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding form closing disclosure

How to fill out understanding form closing disclosure

01

Step 1: Start by reviewing the loan estimate provided by the lender. This document will help you compare the estimated costs and terms with the actual ones mentioned in the closing disclosure.

02

Step 2: Carefully go through each section of the closing disclosure form, which includes loan terms, projected payments, costs at closing, and other important details.

03

Step 3: Make sure to review and compare the closing costs mentioned in the closing disclosure with the loan estimate. If there are any discrepancies, ask the lender for clarifications.

04

Step 4: Pay close attention to the loan terms and conditions, including the interest rate, loan amount, duration, and any potential penalties or fees.

05

Step 5: Take note of any changes made from the loan estimate to the closing disclosure. If there are significant differences, discuss them with the lender before proceeding.

06

Step 6: If you have any questions or concerns about the form, seek assistance from a lawyer, real estate agent, or any other professional who can provide guidance in understanding the closing disclosure.

07

Step 7: Once you fully understand the closing disclosure and are satisfied with the terms, sign the form to acknowledge your acceptance.

Who needs understanding form closing disclosure?

01

Anyone who is applying for a mortgage loan or refinancing a mortgage needs to fill out the understanding form closing disclosure.

02

Both the buyer and the seller in a real estate transaction should review and understand the closing disclosure to ensure transparency and accuracy in the loan terms and closing costs.

03

Real estate professionals, such as loan officers, lenders, and agents, also need to be familiar with the closing disclosure form to assist their clients appropriately.

04

It is important for all parties involved in the mortgage loan process to have a clear understanding of the closing disclosure to avoid any potential legal or financial complications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send understanding form closing disclosure to be eSigned by others?

Once your understanding form closing disclosure is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the understanding form closing disclosure in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your understanding form closing disclosure in minutes.

Can I create an electronic signature for signing my understanding form closing disclosure in Gmail?

Create your eSignature using pdfFiller and then eSign your understanding form closing disclosure immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is understanding form closing disclosure?

The understanding form closing disclosure is a document that outlines the final details of a mortgage loan, including the loan terms, interest rate, monthly payments, and all closing costs associated with the loan.

Who is required to file understanding form closing disclosure?

Lenders are required to provide the closing disclosure to borrowers as part of the loan process, typically three days before closing.

How to fill out understanding form closing disclosure?

To fill out the closing disclosure, lenders need to provide accurate information on loan terms, projected monthly payments, and a breakdown of closing costs, ensuring all details match the loan estimate provided earlier in the process.

What is the purpose of understanding form closing disclosure?

The purpose of the closing disclosure is to inform borrowers about the final costs of the loan, ensuring transparency and helping them understand their financial obligations before finalizing the mortgage.

What information must be reported on understanding form closing disclosure?

The closing disclosure must report loan terms, estimated monthly payments, actual cash to close, and a detailed itemization of closing costs, including fees for appraisal, credit reports, and title insurance.

Fill out your understanding form closing disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Form Closing Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.