Get the free Extended Payment Plan

Show details

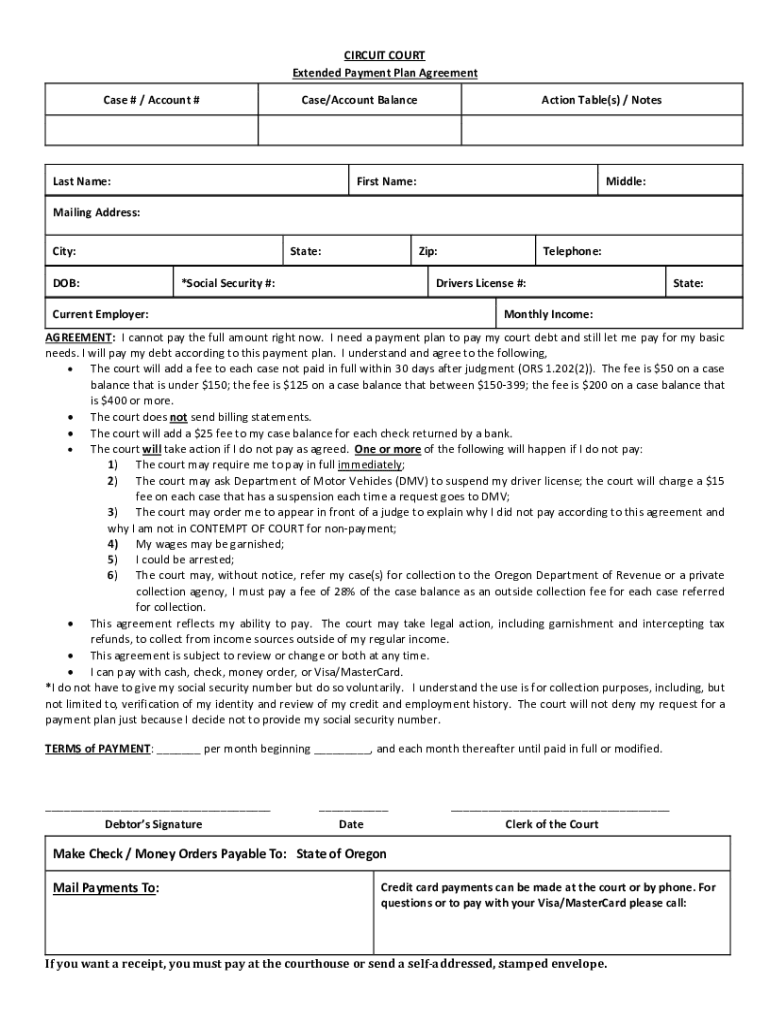

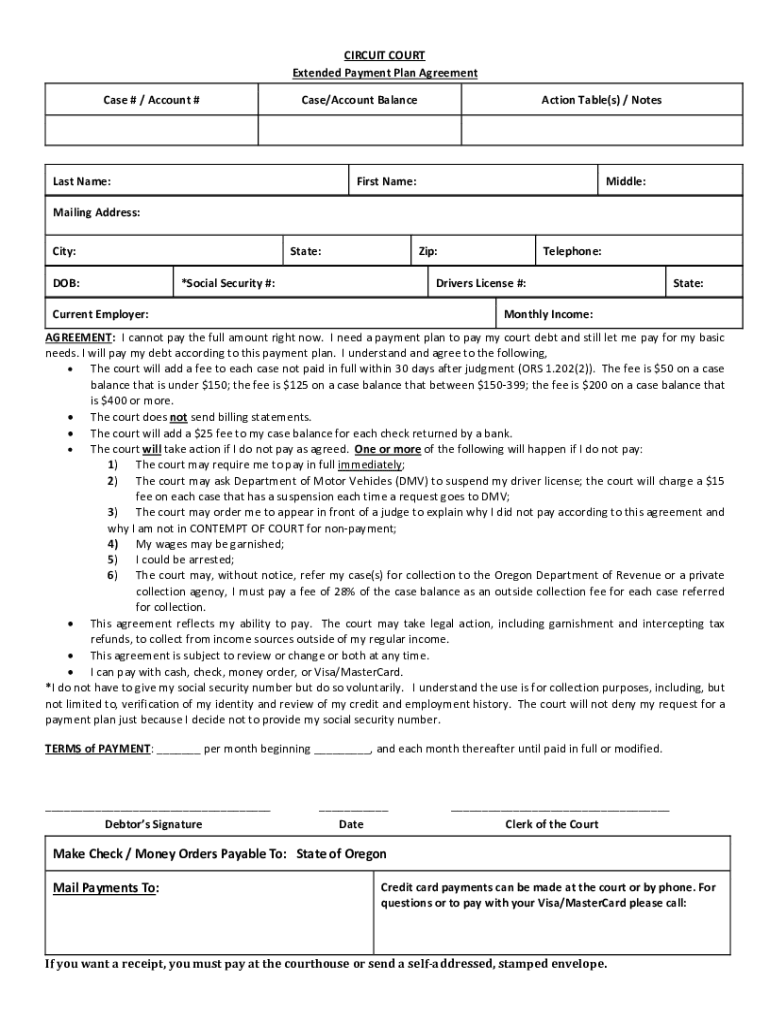

CIRCUITOUS

ExtendedPaymentPlanAgreement

Case#/Account#

Case/AccountBalanceMailingAddress:Actionable(s)/Notes

Hostname:Filename:City:

DOB:

CurrentEmployer:State:Zip:*SocialSecurity#:

Middle:Telephone:DriversLicense#:State:MonthlyIncome:AGREEMENT:Icannotpaythefullamountrightnow

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extended payment plan

Edit your extended payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extended payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing extended payment plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit extended payment plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extended payment plan

How to fill out extended payment plan

01

To fill out extended payment plan, follow these steps:

02

Gather all necessary information about your payment plan, such as the total amount owed, interest rates, and repayment terms.

03

Contact your creditor or service provider to discuss the possibility of setting up an extended payment plan.

04

Provide detailed information about your financial situation, including your income, expenses, and any other relevant factors that may affect your ability to make regular payments.

05

Work with your creditor or service provider to negotiate a reasonable repayment schedule that fits your budget and allows you to pay off your debt over an extended period of time.

06

Carefully review and understand the terms and conditions of the extended payment plan before agreeing to it.

07

Once you have agreed to the extended payment plan, make sure to make your payments on time and in full as per the agreed upon schedule.

08

Keep track of your payment receipts and maintain open communication with your creditor or service provider in case any issues or concerns arise.

09

Monitor your progress and make adjustments to your budget if necessary to ensure successful completion of the extended payment plan.

10

By following these steps, you can effectively fill out an extended payment plan and work towards becoming debt-free.

Who needs extended payment plan?

01

An extended payment plan is beneficial for individuals or businesses who are facing financial difficulties and are unable to pay off their debts in a lump sum or within the original repayment terms.

02

It is especially useful for those who need more time to repay their debts without incurring additional penalties or charges.

03

People who have experienced a decrease in income, unexpected expenses, or other financial setbacks may find an extended payment plan helpful in managing their debt obligations.

04

By opting for an extended payment plan, individuals can avoid defaulting on their debts, maintain a positive credit history, and gradually work towards regaining their financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send extended payment plan to be eSigned by others?

Once your extended payment plan is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute extended payment plan online?

Filling out and eSigning extended payment plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out extended payment plan on an Android device?

Complete extended payment plan and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is extended payment plan?

An extended payment plan is a payment agreement that allows individuals or businesses to spread out their tax liabilities over a longer period, providing them with more time to make payments without incurring heavy penalties.

Who is required to file extended payment plan?

Taxpayers who cannot pay their tax liabilities in full by the due date and wish to avoid penalties and interest may be required to file for an extended payment plan.

How to fill out extended payment plan?

To fill out an extended payment plan, taxpayers typically need to complete the appropriate form provided by the tax agency, include their financial information, proposed payment amounts, and submit the form by the specified deadlines.

What is the purpose of extended payment plan?

The purpose of an extended payment plan is to help taxpayers manage their tax debts more effectively by allowing them to pay in installments, thereby reducing financial strain and the risk of default.

What information must be reported on extended payment plan?

Taxpayers must report their personal and financial information, including income, expenses, and any assets or liabilities, as well as their proposed payment amounts on the extended payment plan.

Fill out your extended payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extended Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.