Get the free de minimis safe harbor election 2019 printable

Show details

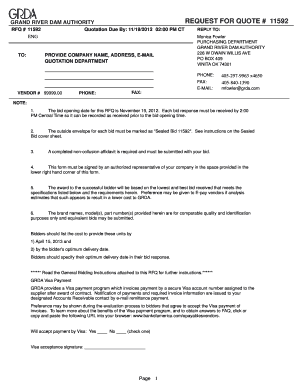

Section 1.263(a)-1(a) DE Minims Safe Harbor Election 2015 I am electing the de minimis safe harbor under Treasury Regulation Section 1.263(a-1(a) for tax year ending December 31, 2015. The amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign de minimis safe harbor

Edit your de minimis safe harbor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de minimis safe harbor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing de minimis safe harbor online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit de minimis safe harbor. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de minimis safe harbor

How to fill out de minimis safe harbor:

01

Begin by gathering all necessary information and documentation relevant to your business transactions. This includes financial records, receipts, and any other supporting documents.

02

Review the de minimis safe harbor rules to ensure that your business meets all the necessary criteria. This includes determining if your business qualifies as a small taxpayer and if your total gross receipts fall below the specified threshold amount.

03

Calculate the total amount of expenses that you wish to allocate using the de minimis safe harbor. This can include tangible property purchases, repairs and improvements, and other eligible expenses.

04

Allocate the expenses appropriately based on the de minimis safe harbor rules. This may involve identifying specific expenses that qualify and determining the proper method of allocation.

05

Complete the required forms or schedules, such as Form 3115 or Form 4562, to report the allocated expenses. Ensure that all information is accurate and properly documented.

06

Attach any necessary supporting documentation to your tax return to substantiate the expenses claimed under the de minimis safe harbor.

07

Review your completed tax return before filing to ensure accuracy and compliance with all applicable tax laws and regulations.

08

Keep copies of all documentation and records related to the de minimis safe harbor for future reference and potential audits.

Who needs de minimis safe harbor:

01

Small business owners who want to simplify the process of allocating and deducting certain expenses on their tax return.

02

Businesses with total gross receipts that fall below the specified threshold amount and qualify as small taxpayers.

03

Taxpayers who want to comply with the IRS regulations and take advantage of the convenient and advantageous de minimis safe harbor rules for the eligible expenses incurred by their business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit de minimis safe harbor from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your de minimis safe harbor into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send de minimis safe harbor for eSignature?

de minimis safe harbor is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out de minimis safe harbor using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign de minimis safe harbor and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is de minimis safe harbor?

De minimis safe harbor is a provision that allows businesses to deduct certain small expenditures for tangible property (like equipment and supplies) without having to capitalize them. It simplifies accounting processes for small purchases.

Who is required to file de minimis safe harbor?

All taxpayers who acquire and use tangible property can use the de minimis safe harbor, but it is particularly relevant for businesses that want to simplify their accounting for small purchases.

How to fill out de minimis safe harbor?

To utilize de minimis safe harbor, a taxpayer must apply it to purchases that do not exceed a specific dollar threshold (often $2,500 per item or invoice), and they must have a consistent accounting policy to treat these amounts as expenses.

What is the purpose of de minimis safe harbor?

The purpose of de minimis safe harbor is to reduce the burden of record-keeping and accounting for small expenditures, allowing businesses to expense low-cost items rather than record them as long-term assets.

What information must be reported on de minimis safe harbor?

Taxpayers must report the amounts spent on tangible property under the de minimis safe harbor, as well as ensure they comply with the threshold limits set by the IRS, along with maintaining a consistent accounting policy.

Fill out your de minimis safe harbor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De Minimis Safe Harbor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.