SC DoR SC1065 2020 free printable template

Get, Create, Make and Sign sc 1065

How to edit sc 1065 online

Uncompromising security for your PDF editing and eSignature needs

SC DoR SC1065 Form Versions

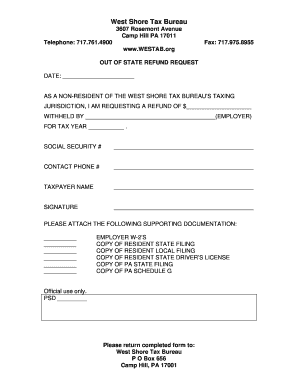

How to fill out sc 1065

How to fill out SC DoR SC1065

Who needs SC DoR SC1065?

Instructions and Help about sc 1065

Hi I'm Priyanka Prakash senior staff writer at fund Ara, and today I'll walk you through how to fill out I RS schedule k-1 pass through entities including s corpse LLC's and partnerships must provide each owner with a schedule k-1 there are different types of schedule k-1 forms depending on which type of business entity you have today we'll look at a common one schedule k-1 for form 1065 which applies to LLC's and partnerships let's get right to it first starters fill out the calendar year or tax year for which you're filling out the form in this case it'll be the calendar year 2018 most business owners watching this will leave these two boxes at the top of the form unchecked you would only check off final k1 if you're winding down your business, and you'd only check off amended k1 if you already sent out your schedule k-1 and are changing or updating some of the information that appeared on that original form in part 1 you'll fill out some basic information about the partnership or LLC starting with the partnerships or LSU's employer identification number which is a nine-digit number will make up a...

People Also Ask about

Where are partnership returns filed?

Who must file South Carolina partnership return?

How do you form a partnership in South Carolina?

Who is responsible for taxes in a general partnership?

What is a composite taxpayer?

How easy is it to form a partnership?

Does South Carolina have a pass through entity tax?

Who is required to file SC tax return?

Who files composite return?

Who is responsible for filing of the partnership return?

How are LLCs taxed in South Carolina?

What is required to form a partnership?

Does South Carolina have a PTE tax?

Who can file a South Carolina composite return?

Who files a partnership return?

Who must file a South Carolina tax return?

What is the passthrough entity tax?

Who must file a SC corporate tax return?

Do seniors have to file taxes in South Carolina?

Which states allow composite returns?

What are the steps of forming partnership?

Do I have to register a partnership?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sc 1065 for eSignature?

How do I complete sc 1065 online?

How can I edit sc 1065 on a smartphone?

What is SC DoR SC1065?

Who is required to file SC DoR SC1065?

How to fill out SC DoR SC1065?

What is the purpose of SC DoR SC1065?

What information must be reported on SC DoR SC1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.