Get the free FORECLOSURE FUNDAMENTALS

Show details

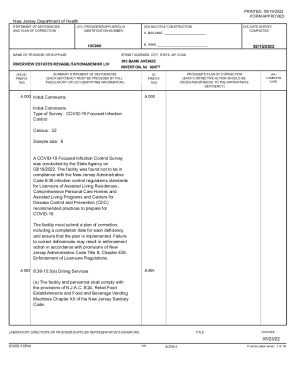

FORECLOSURE FUNDAMENTALS & THE USE OF IMAGED DOCUMENTS By: Robert A. Mathis Newman, Mathis, Brady & Sped ale 212 Veterans Blvd. Metairie, LA 70005 (504) 8379040 Mathis newmanmathis.com2008 Bank Counsel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreclosure fundamentals

Edit your foreclosure fundamentals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreclosure fundamentals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreclosure fundamentals online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreclosure fundamentals. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreclosure fundamentals

How to fill out foreclosure fundamentals

01

Gather all necessary documentation such as mortgage documents, loan statements, and any relevant financial records.

02

Start by reviewing and understanding the foreclosure process and your rights as a homeowner.

03

Communicate with your lender to explore available options and discuss potential alternatives to foreclosure.

04

Complete all required forms and provide accurate information related to your financial situation.

05

Submit the necessary paperwork to your lender or the appropriate authority responsible for handling foreclosures.

06

Follow up with your lender or authority regularly to ensure the process is progressing and to address any additional requirements or inquiries.

07

Seek guidance from a foreclosure counselor or attorney to understand your rights and potential defenses against foreclosure.

08

Consider attending foreclosure prevention workshops or educational programs to gain more knowledge about the subject.

09

Maintain open lines of communication with your lender throughout the process and promptly respond to requests for information or documentation.

10

Keep track of important deadlines and stay organized to avoid delays or potential complications during the foreclosure proceedings.

Who needs foreclosure fundamentals?

01

Homeowners facing the risk of foreclosure due to financial difficulties.

02

Real estate professionals, such as agents or brokers, who want to educate themselves about foreclosure processes to better assist their clients.

03

Legal professionals focusing on real estate law or foreclosure defense.

04

Foreclosure counselors or advisors who provide guidance and support to individuals going through the foreclosure process.

05

Individuals interested in understanding the fundamentals of foreclosure for personal knowledge or academic purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send foreclosure fundamentals for eSignature?

foreclosure fundamentals is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get foreclosure fundamentals?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific foreclosure fundamentals and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit foreclosure fundamentals on an iOS device?

You certainly can. You can quickly edit, distribute, and sign foreclosure fundamentals on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is foreclosure fundamentals?

Foreclosure fundamentals refer to the essential principles and processes involved in the legal procedure through which a lender seeks to reclaim the collateral (usually property) secured by a loan when the borrower defaults on the mortgage.

Who is required to file foreclosure fundamentals?

Typically, lenders, loan servicers, or a legal representative acting on behalf of the lender are required to file foreclosure fundamentals when initiating a foreclosure procedure.

How to fill out foreclosure fundamentals?

Filling out foreclosure fundamentals generally involves completing specific forms provided by state or local authorities, detailing relevant information about the mortgage, borrower, property, and the grounds for foreclosure.

What is the purpose of foreclosure fundamentals?

The purpose of foreclosure fundamentals is to establish a formal record of the foreclosure process, ensure compliance with legal requirements, and provide necessary information to all involved parties.

What information must be reported on foreclosure fundamentals?

Key information that must be reported includes the borrower's information, property details, loan account number, amount owed, foreclosure grounds, and any payment history relevant to the case.

Fill out your foreclosure fundamentals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreclosure Fundamentals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.