Get the free Special Purpose Acquisition Companies: An Introduction

Show details

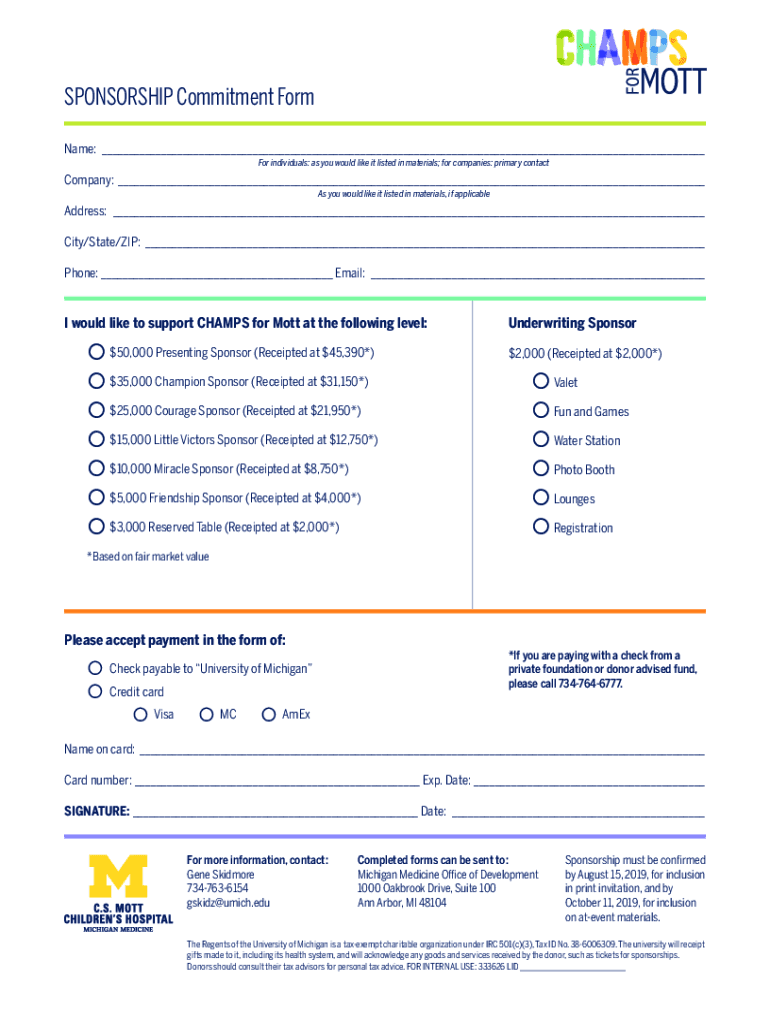

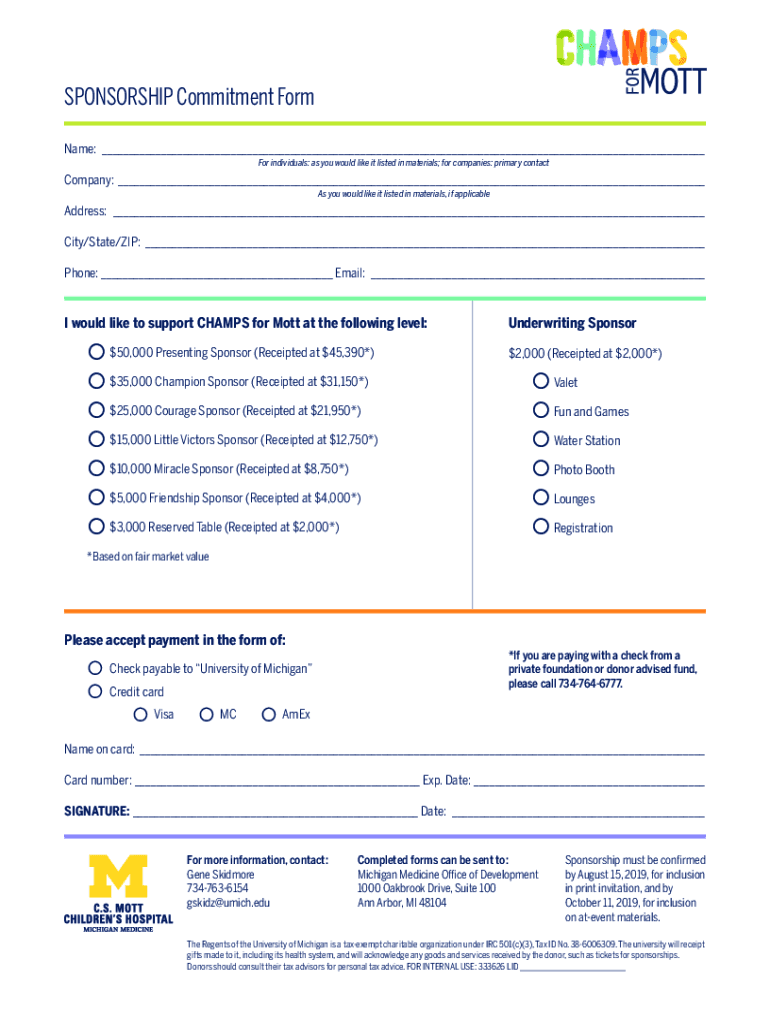

SPONSORSHIP Commitment Form Name: For individuals: as you would like it listed in materials; for companies: primary contactCompany: As you would like it listed in materials, if applicableAddress:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special purpose acquisition companies

Edit your special purpose acquisition companies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special purpose acquisition companies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing special purpose acquisition companies online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit special purpose acquisition companies. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special purpose acquisition companies

How to fill out special purpose acquisition companies

01

Research and familiarize yourself with the process and requirements of filling out special purpose acquisition companies (SPACs).

02

Identify a target company that you wish to acquire through the SPAC.

03

Set up a SPAC by incorporating a new company and raising funds through an initial public offering (IPO).

04

Prepare the necessary documents for the IPO, including a prospectus and financial statements.

05

File the necessary paperwork with the relevant regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States.

06

Carry out a roadshow to attract investors and raise funds for the SPAC.

07

Once the IPO is completed, the funds raised will be held in a trust account until a suitable target company is identified.

08

Conduct due diligence on potential target companies and negotiate the terms of the acquisition.

09

Obtain shareholder approval for the acquisition and any accompanying transactions.

10

Complete the acquisition and merge the target company with the SPAC, thereby forming a publicly traded company.

Who needs special purpose acquisition companies?

01

Entrepreneurs or business owners who wish to take their company public with less regulatory scrutiny and a simpler process.

02

Investors who are interested in investing in a specific industry or sector but don't have the time or expertise to identify and evaluate individual companies.

03

Private equity firms or institutional investors looking for alternative strategies to deploy their capital.

04

Startups or early-stage companies that need access to public markets and additional capital to fuel their growth.

05

Companies that are seeking an exit strategy, such as founders or existing shareholders who want to cash out their investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete special purpose acquisition companies online?

Completing and signing special purpose acquisition companies online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in special purpose acquisition companies without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your special purpose acquisition companies, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the special purpose acquisition companies in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your special purpose acquisition companies and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is special purpose acquisition companies?

Special purpose acquisition companies (SPACs) are shell companies that raise capital through an initial public offering (IPO) to acquire a private company, thereby bringing it public without going through the traditional IPO process.

Who is required to file special purpose acquisition companies?

SPACs and their management teams are required to file various reports with the Securities and Exchange Commission (SEC) throughout the SPAC lifecycle, particularly during the IPO process and after any acquisition.

How to fill out special purpose acquisition companies?

The process of filling out documentation for SPACs involves preparing registration statements, SEC filings, and offering documents that disclose information about the SPAC's structure, operations, and intended acquisition targets.

What is the purpose of special purpose acquisition companies?

The primary purpose of SPACs is to raise funds to acquire a private company, thus allowing that private company to become publicly traded without going through the public IPO route.

What information must be reported on special purpose acquisition companies?

SPACs must report information related to their financial condition, the details of any acquisition, risks involved, management compensation, and disclosures that are customary for public companies.

Fill out your special purpose acquisition companies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Purpose Acquisition Companies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.